It was a sad day yesterday when I learned of the closure of Six Park, which I believe to be one of Australia’s top “robo advice” businesses. This article explains how to transfer shares or ETFs between brokers or robo advisers like Six Park.

Kudos, Six Park

Firstly, to Pat and the team at Six Park. They did an incredible job at seeding and growing a brand so many people trust for long-term wealth creation.

I know many Rask members, listeners and followers are familiar — or invest — with Six Park, so the impact of the company closing down is profound. Thanks for innovating and pushing the world of Australian finance forward!

***

Please note: I have no skin in the game here. But I will reference guides from brokers which are, or have, advertised or had a commercial relationship with Rask (e.g. if we provided educational content, for a fixed fee). What’s more, I am not a registered tax agent. Please refer to the ATO website for more information and speak to your adviser before you do anything you don’t completely understand. Read all guides I reference carefully.

Firstly, it’s vital to understand the difference between a HIN and a custodial broker. Unlike some outfits, for years at Rask we’ve been telling you that it is good practice to choose a broker that offers a HIN (Holder Identification Number). You’re about to find out one of the reasons why.

Our FREE guide on Rask Media dubbed, “Best online trading & share trading accounts in Australia” walks you through the 6-7 most popular brokers in the Rask community, plus which of them offer their customers a HIN and which do not.

Best online share trading accounts in Australia for 2024 (updated)

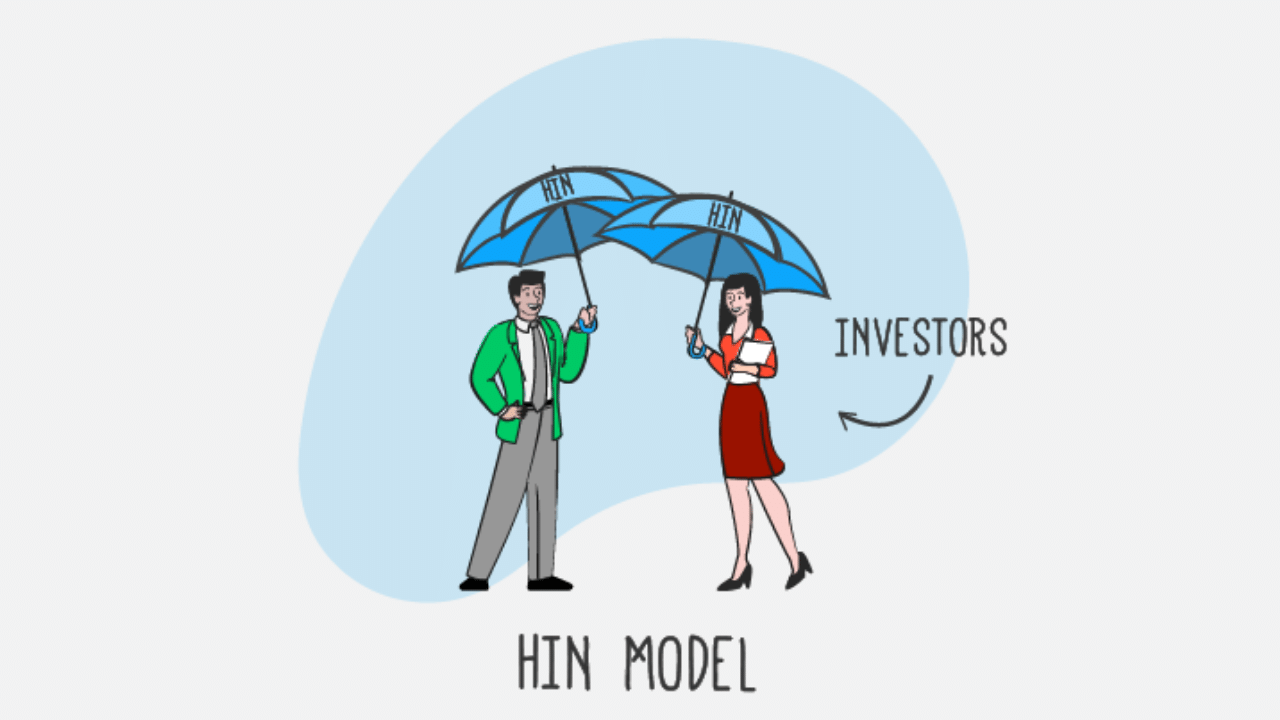

In short, a HIN identifies you exactly as the owner of shares or ETFs. This number can be verified by the ASX. Remember, the ASX controls basically all Australian share trading. A HIN does not apply to US-traded shares (e.g. Apple). A HIN is like having a Tax File Number (TFN) for your shares.

As depicted in the image, above, you hold your own umbrella. It’s your unique finance identity.

In short, a HIN can allow you to transfer shares more easily between brokers. Or, in this case, between a robo adviser (which offers HIN) and a broker (which also offers HIN).

Because you would simply be ‘transferring’ brokers, but not selling your shares/ETFs, this may help you avoid you paying capital gains tax (CGT) to make the swap.

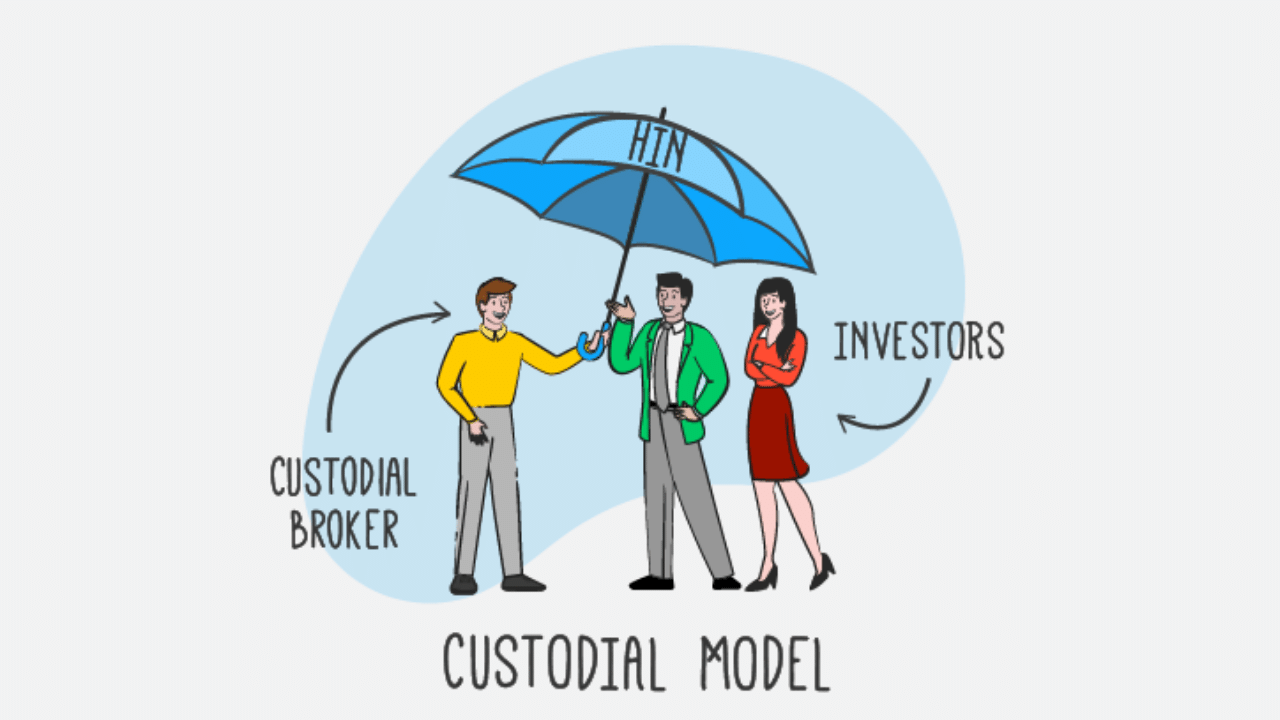

In a custodial model, you don’t have your own “HIN” number registered at the ASX. This is like someone holding the umbrella, and offering one ‘mega HIN’ to hold shares and ETFs on behalf of all investors under the ‘umbrella’. Note: you will have a number called an “SRN” – Shareholder Reference Number.

A custodial model is the most common way to hold shares overseas. But in Australia, you have the added protection of HIN. Transfers from HIN-to-HIN brokers can also be quicker.

Example: transferring VGS

Let’s say a few years ago you purchased $15,000 of the Vanguard MSCI International Shares ETF (ASX: VGS) via your broker or through a robo adviser (which offers HIN).

It is now worth $20,000. Fist pump!

That means you have a capital gain of $5,000 ($20,000 minus $15,000). If you sell the VGS holding (or the current broker does it for you) only to purchase VGS again in a new brokerage account, you will incur capital gains tax (see ATO guide).

Now let’s imagine you simply look into the rules for doing what’s called an ‘in-specie’ transfer, using your HIN.

In a properly done in-specie transfer, the ‘ultimate beneficial owner’ of the shares won’t change — it’s just the middlemen who are shuffling things around for you. Again, if done properly, this shouldn’t incur tax.

Same shares, same investor, different broker.

Make sense?

Good…

How do I transfer?

You can find a step-by-step on exactly how to do the transfer on the Pearler website (view the full guide for SixPark clients), Selfwealth or via Commsec.

Remember: this is NOT a “recommendation”. Speak to your adviser.

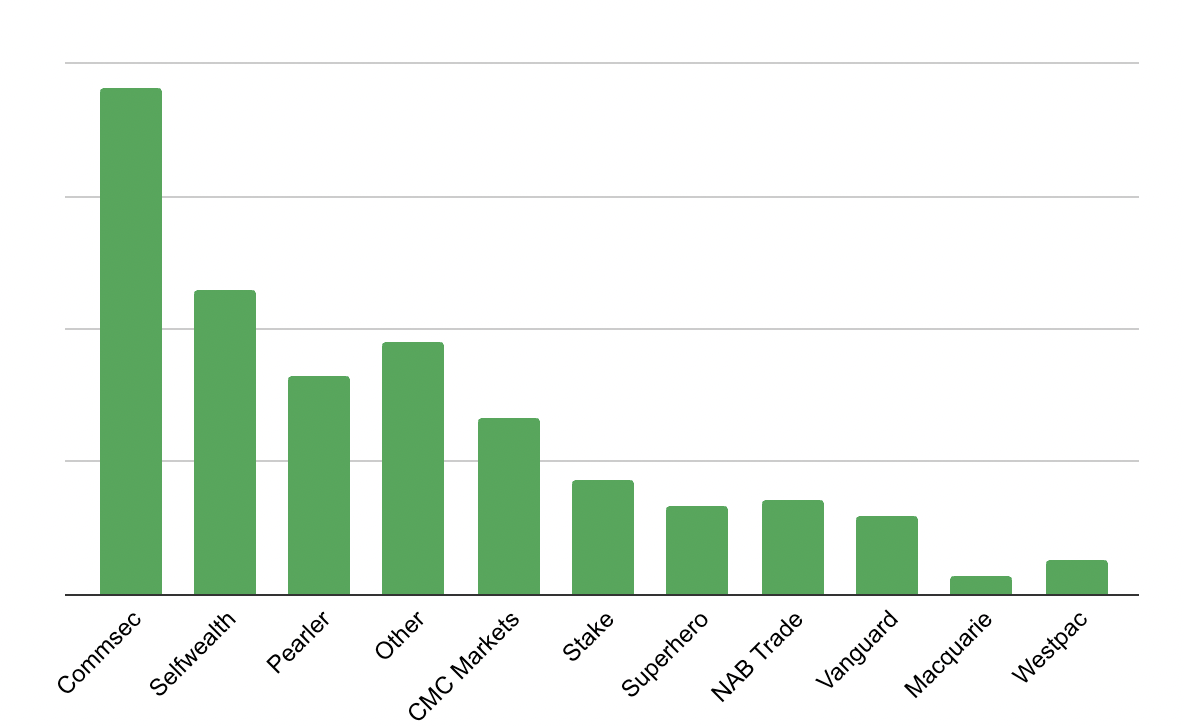

So why did I use these three brokers as my examples?

It’s not because all three of these brokers offer a HIN model (they do). It’s because they are the most popular brokers used by the Rask community, see below.

Note: You should note Pearler is a sponsor of our Australian Finance Podcast and I host the weekly Selfwealth LIVE program.

Transferring to another robo adviser

Update (August 1st):

If you want to have the same ‘style’ of experience as Six Park, you could speak to another robo adviser. For example, following the first release of this article, I just heard from the team at InvestSMART, which manage portfolios for investors in a similar way to Six Park. They also offer free HIN-to-HIN transfers for new clients.

You can click here to access a PDF to learn about Investsmart’s portfolios. And to make things extra easy, you can also click here to book in a free call with Mitchell from Investsmart. Full disclosure: Investsmart is also a long-term advertising sponsor on Rask podcasts.

What else should I keep in mind when changing brokers?

Before you leave a broker it’s vital to read all of the terms & conditions, and make sure it operates under a licence (AFSL) from our regulator (check the ASIC website).

Then do all of your usual checks before settling on a broker. You can even test drive a broker, to check out the features, because you can have more than one broker — and the best brokerage accounts are often free to open.

In case we haven’t made this clear enough on our podcasts, it’s really important to understand that fees should never be your only reason for choosing an investment or a platform.

It’s clear that the Rask community (including yours truly!) LOVES brokerage platforms which can do all the automated investing for us. Many brokers still don’t offer automation 🤦♂️

Also keep in mind that when you transfer brokers you may lose some important info, because things like your transaction history (e.g. buy price and costs paid) might not come across. So keep a record of those before closing the old account.

If you use Sharesight or Navexa to track your portfolio’s tax, you may already have some of that info. Just make sure you update the software with your new brokerage account details and keep a copy of all the old account’s transactions for future tax periods.

Lastly, some of the brokers may charge fees or have really SLOW and complicated processes to transfer to them. It’s not always up to the destination broker (believe it or not, sometimes the old broker gets shitty you’re leaving them). If you’re after an automated or fast transfer, keep this in mind.

I hope this helps.

***

Finally, I’m sad to see the closure of Six Park because I have long admired their transparency, plus the team’s long-term and educational focus.

Pat and the team did a wonderful job at innovating in a highly complex, conflicted and too often broken financial system.

Kudos.

See you in Perth & Adelaide this week! 👗👘

I can’t believe it but the Rask Roadshows kick off in Perth and Adelaide this coming week!

Remember, the theme is party shirts, colourful dresses and bucket hats. The Rask team will be going with a Barbie theme.

It’s going to be a blast.

We’re going national! Get your tickets now!