ResMed CDI (ASX: RMD) shares are trading down about -11% in early trade to ~$30 per share after its 4Q23 result came in below consensus expectations.

The company’s 4Q23 gave investors an update on the health of the business and highlights for the full year FY2023.

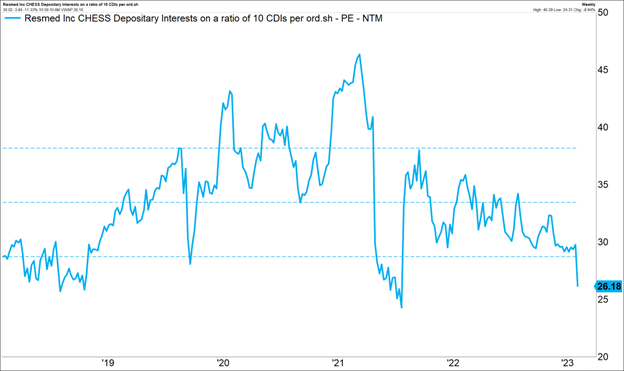

ResMed CDI share price

Result disappoints the market

Year-over-year revenue grew +23% to $1.1b for the quarter, taking full year revenue to $4.2b, +21% in constant currency, in line with consensus.

Gross margins decreased by 210 basis points for the full year to 55.8%, mainly due to unfavourable product mix and higher component and manufacturing costs, partially offset by an increase in average selling prices. Consensus margin expectations for 56.7% suggest that it is taking longer for margins to rebound coming out of Covid and may have investors fearing that margin compression is more permanent than transitory.

Diluted earnings per share of $6.09 and non-GAAP diluted earnings per share of $6.44 were below consensus of $6.52.

RMD’s quarterly dividend increased +9% to $0.48 per share.

Other takeaways

The bigger picture for RMD shares remains on track with the company claiming that it improved over 160 million lives in the last 12 months, well on the way to its goal of helping 250 million lives in 2025.

The result showed signs that cost inflation was not just limited to componentry with SG&A expenses up +26% on a constant currency basis with higher salaries and headcount taken on from the MEDIFOX DAN acquisition.

AI continues to be a hot thematic with RMD CEO Mick Farrell outlining plans to launch artificial intelligence products for patients and doctors with early testing of its new AI products seen as “very positive”.

ResMed also announced the acquisition of Somnoware, a US-based provider of digital sleep and respiratory care diagnostics software for sleep labs and physicians. Financial terms were immaterial and therefore not disclosed.

RMD continues to benefit from the recall of key competitor Phillips’ PHG sleep devices causing outsized sales growth in the US market driven by market share gains.

Limited outlook and guidance also does not help – the lack of forward earnings clarity is never well received by analysts and investors alike.

Is this a buying opportunity for RMD shares?

Like we saw with CSL Limited (ASX: CSL), gross margin recovery seems to be taking longer than expected, with RMD’s higher costs of components only partially offset by higher selling prices.

On a forward P/E of ~26 (after adjusting for today’s sell off), there’s not too much room for error, although RMD now trades over one standard deviation below its historical average P/E range. ResMed’s track record and potential for margin recovery to the peak ~60%+ gross profit margins have the potential to further grow earnings and re-rate shares. I can still see upside at these levels and RMD shares look oversold.