The Rio Tinto Ltd (ASX: RIO) share price has been an excellent performer for investors over the past 5 years, utilising elevated commodity prices to pay down debt and deliver record dividends to shareholders.

In this article, I explain why we exited our position in Rio Tinto shares.

Rio Tinto share price

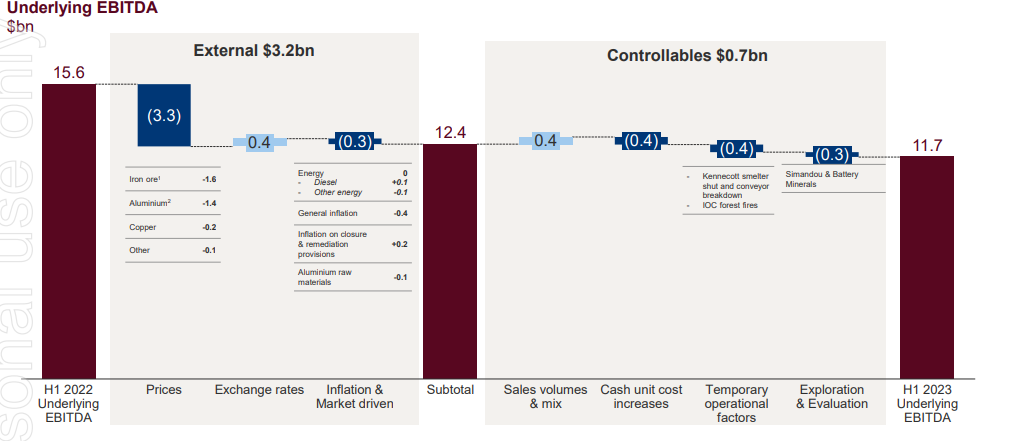

This positive momentum behind Rio Tinto appears to be coming to an end as higher operating and capital costs are coinciding with lower commodity prices. For Rio, this resulted in free cash flow being 46% lower year-on-year in its recent 1H23 report.

Rio: Lower cash flows and dividends; higher reinvestment

Despite recording its third largest first-half dividend over its listed history, Rio Tinto’s US$1.77 per share payout was 34% lower year on year. In-line with its lower earnings due almost entirely to lower commodity prices (85% driven by prices, 15% driven by costs).

Image source: supplied by author, company presentation

Image source: supplied by author, company presentation

Furthermore, Rio’s capital expenditures will increase to $7b for FY23, and $10b in FY24 as it has refocused its ambitions on growth. This is something it has been unable to achieve for quite some time.

Unfocused capital allocation

Our concern is that Rio Tinto appears to have an unfocused approach to investment, trying time and time again to fund and operate some of the most complex mines globally, in difficult operating jurisdictions, including a copper district in the Mongolian desert (Oyu Tolgoi).

Rio is likely to have sunk tens of billions of dollars into this project by the end of the decade, including its purchase of Turquoise Hill Resources (former 33% owner of the project).

Management has also expressed its interest in entering the lithium market. Something that would likely cost billions, in addition to the US$825 million it sunk into purchasing the Rincon lithium project last year (which has already delivered cost overruns and delays).

The bottom line

Whilst mining stocks like Rio or BHP Group Ltd (ASX: BHP) can pay highly attractive dividends during times of high commodity prices, you must always be aware of the impending risks in the resources cycle.

Our view is that record iron ore prices have attracted new investment in supply out of Australia and Brazil, which will likely force downward pressure on pricing in the near term.

In its company presentation, Rio Tinto called out that June was likely an all-time high for combined iron ore shipments out of Australia and Brazil, a fact which makes us nervous.