ASX property shares have been crunched over the past 2 years with large caps such as Dexus (ASX: DXS) and Lendlease Group (ASX: LLC) trading at significant discounts to net tangible asset (NTA) values.

The reason for the poor share price performance is due to the market’s concern regarding property valuations, rapidly rising interest costs and low levels of occupancy within their office assets. Simply put, rising interest rates have been a significant headwind for the sector across the board.

The team at Stock Doctor however believe there may be pockets of opportunity within the sector, and Arena REIT No 1’s (ASX: ARF) FY23 result might be the needle in the haystack investors are looking for.

ARF share price

Strong demand for childcare services

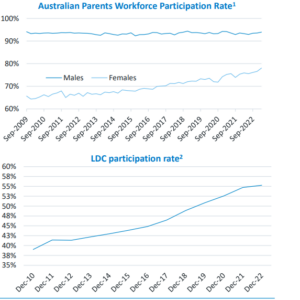

Arena owns and leases 263 childcare properties across the country to leading providers such as Goodstart and Greenleaves Early Learning. What makes childcare property such an attractive space for landlords are the incredibly strong underlying demand drivers, with Australian parents returning to the workforce at record rates, driving increased demand for childcare services.

Source: Company presentation

Property fundamentals are very strong

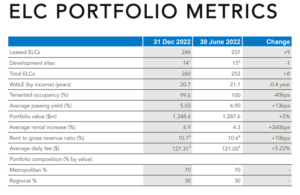

ARF’s portfolio of assets are fully leased, with an occupancy rate of 99.6% and a weighted average lease expiry (WALE) of almost 20 years. Furthermore, ~95% of annual rental escalations increase by the greater of CPI or an agreed fixed figure.

These fundamentals effectively result in long-life assets with CPI-protected cash flows (…sounds like Transurban’s toll roads!) which we view favourably in the current economic climate. A summary of the early learning centre (ELC) portfolio can be viewed below for further details.

Source: Company Presentation

ARF’s counterparties (childcare operators) are able to pass on these cost increases to customers, as the vast majority of childcare services are heavily subsidised by the Government; in fact, the Labor Party are trying to implement further support for childcare services which should support ARF’s near term growth.

FY23 Result

Unlike many of its REIT peers, ARF reported an increase in earnings per share (EPS) to 8.59 cents for the full year. The 8% increase was driven by a 6.45% increase in rental rates and contributions from acquisitions and developments. Dividends grew at a slower pace of 6%, as management allocated some capital towards its development portfolio.

In terms of debt, gearing remains low at 21% of assets and management further increased its debt hedging program to 80% of borrowings (previously 77%). The rapid increase in interest expense has been more than offset by the growing base of rental income.

Bottom Line

The team at Stock Doctor initiated coverage of ARF as a Star Income Stock in 2017 at a share price of $2.18. With a forward yield of ~4.6%, the shares don’t look obviously cheap, but we feel that this is a fair price to pay given the long runway of rental growth ahead.

To uncover more hidden gems within our Star Income universe, and see how our team is positioned this reporting season, why not take a look at the free report below?