This week, the Commonwealth Bank of Australia (ASX: CBA) share price jumped after reporting results. But was it really a good result for CBA shareholders? Stock Doctor’s Daniel Ortisi takes a deep look.

The Commonwealth Bank of Australia (ASX: CBA) reported a record profit result of $10.2b for FY23, driven by rising net interest margins as the country’s largest financial institution continues to pass through mortgage hikes at a faster pace than deposit rates.

CBA’s financial report is not just a summary of its financial performance however. The data inside tells us much more about the broader Australian economy, and how its customers are faring. Here are some of our key observations below.

CBA: Higher rates are unevenly felt

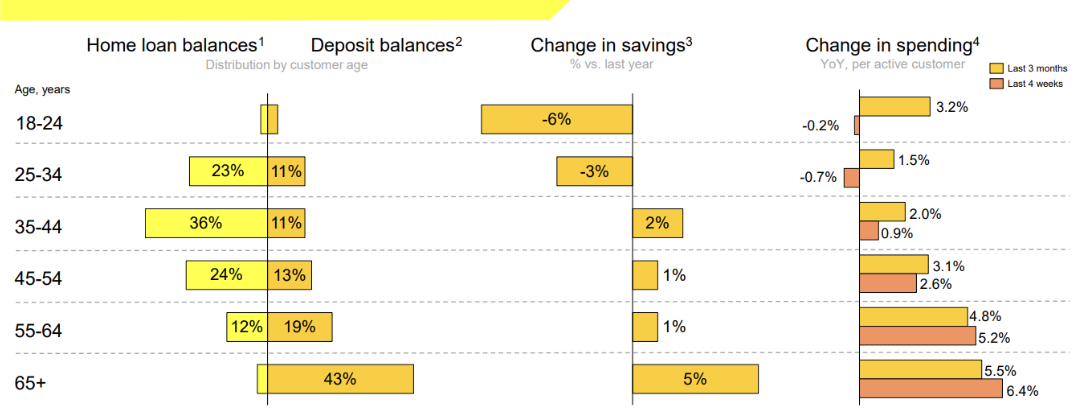

CBA released data that highlights the economic impacts of higher interest rates across the broader economy.

The chart clearly highlights that middle-aged and younger Australians are deeply feeling the impact of higher interest rates, as they typically have larger outstanding mortgage balances.

CBA’s customers aged between 18-34 in fact have a lower savings balance than they did 12 months ago, which demonstrates to us that cost of living pressures are outweighing wage increases experienced in recent years. This could lead to a greater demand for pay increases amongst the younger generation, and potentially stickier than expected services inflation over the medium term.

Additionally, spending appears to have grown at a slower pace than inflation, signalling that consumers across all age groups are likely experiencing lower confidence impacting their propensity to spend. This data point can clearly be backed up by recent profit downgrades by the likes of Myer Holdings

(ASX: MYR), Baby Bunting (ASX: BBN), Dusk Group (ASX: DSK), Universal Store (ASX: UNI) and many other discretionary retailers.

Finally, retirees ages 65+ have allocated a larger portion of their wealth allocated towards deposit balances (which include savings accounts) due to the increase in yields offered by the bank. This is a positive sign for the banking industry, as depositors are the lowest-cost source of funding.

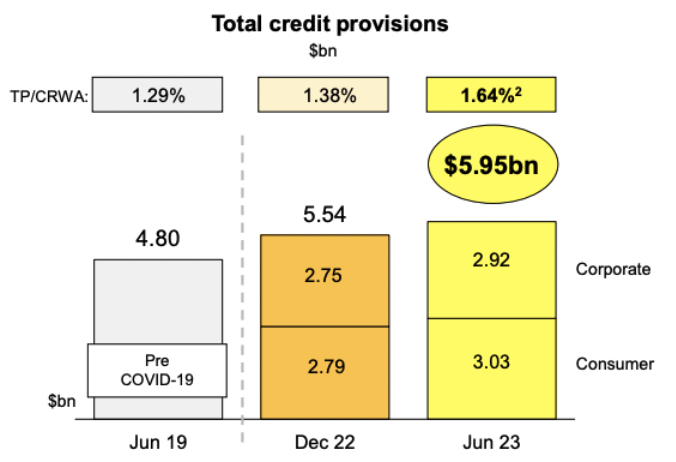

CBA has prepared for a deteriorating economy

CBA has increased its provisioning balances significantly above pre covid levels. The key metric that we look for at Stock Doctor is the provision balance to outstanding credit ratio (TP/CRWA) which rose to 1.64%. This was 27% above the percentage recorded in FY19.

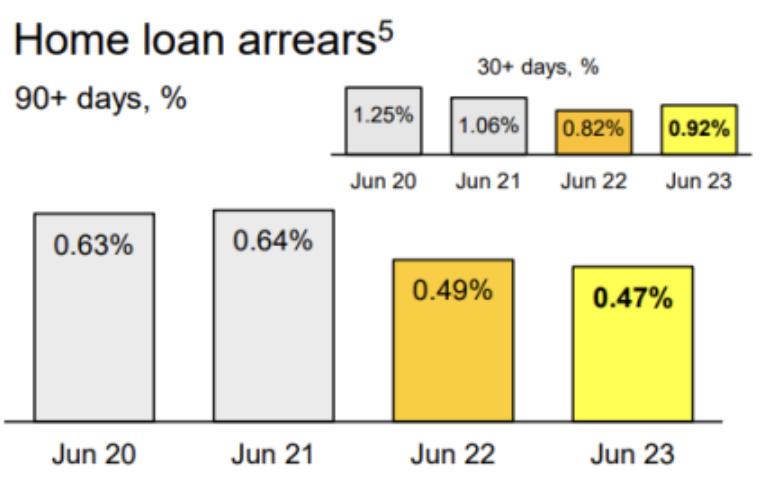

The increase in provisioning has occurred even though the percentage of home loans in 90+ days in arrears decreased year on year. And even despite an increase in the 30+ days percentage, it remains well below levels seen in FY20 and was partially driven by operational issues.

CBA: the Bottom Line

CBA’s record result showed the cost-of-living pressures experienced by middle-aged Australians are yet to result in an increase in distressed customers.

The bank is in a very defensive position, with a provisioning balance 27% higher than pre covid levels and ~$8b in surplus capital sitting on the balance sheet (nearly ~5% of its market cap!).

Due to its large provision balance, we see the potential for capital returns to be above expectations within the next few years if the economy heads toward a soft landing.

As such, we continue to hold CBA as a Star Income stock, despite its lofty valuation premium when compared to peers ANZ Banking Group (ASX: ANZ), National Australia Bank (ASX: NAB) and Westpac Banking (ASX: WBC).

We’ve held the stock in our Income universe since 2012, when we originally purchased shares at $57.