Over the past 5 days, the GUD Holdings Limited (ASX: GUD) share price has jumped 12.5%. But that’s no surprise to the team at Stock Doctor. Analyst Daniel Ortisi explains why this week’s news means for GUD shareholders.

When GUD Holdings Limited’s (ASX: GUD) management announced the sale of Davey Water, we noted in our article published on Rask Media (just last week!) that there were two key positive comments made by management that were good for shareholders.

- The net proceeds would be used to reduce debt, which remains elevated after its acquisition of AutoPacific Group (APG) in 2021; and

- Targeted net debt to earnings (leverage) would be ~2.0x for the FY23 period, which alluded to the fact that earnings would likely arrive in line with consensus expectations.

GUD Holdings Ltd share price

GUD FY23 Results: better than expected

The release of its financial accounts saw the GUD share price trade more than 15% higher during the day, as earnings came in ~3% above expectations.

Revenue grew 25% year on year to $1,037 million whilst underlying profits rose 27% to $191 million, driven mostly by a full-year contribution for the APG acquisition.

The cash flow statement was likely the driver of the market’s positive reaction, however, with operating cash flows more than double the previous period. This was well received, as the market has been concerned with GUD’s elevated inventory and debt position.

GUD FY24 outlook

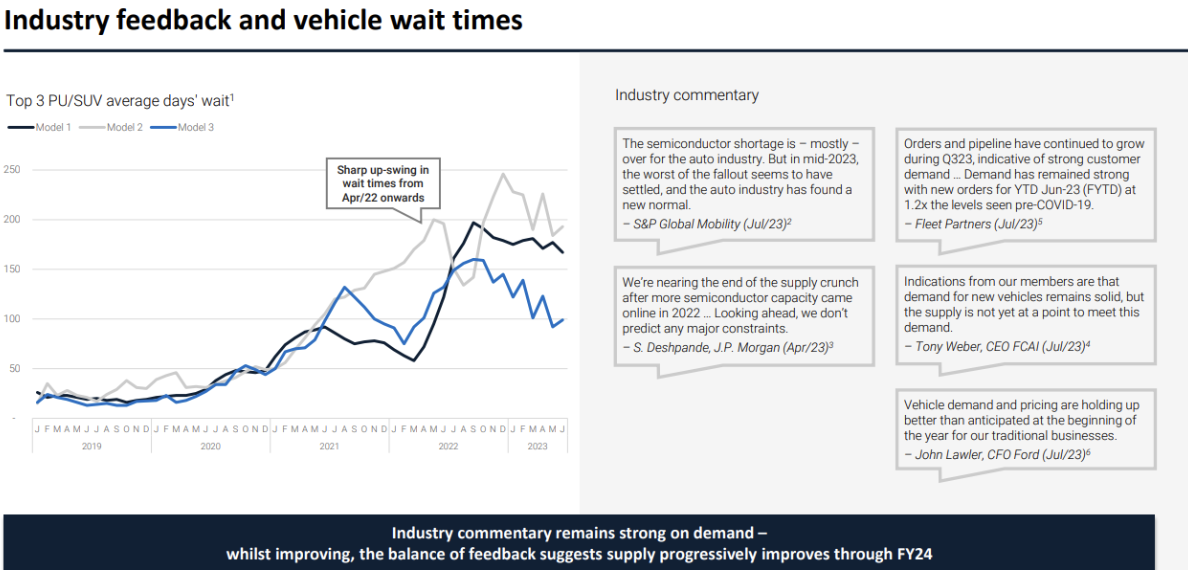

GUD’s management was positive on the supply chain improving for new vehicles inbound into the country. This appears to be consistent with recent comments made by salary sacrifice organisation Smartgroup Corporation (ASX: SIQ) and car dealership owner AP Eagers (ASX: APE).

The supply of new vehicles will drive an improvement in sales of 4WD accessories for the APG brand (towbars, roof racks, trays etc.), as there remains a level of pent-up demand due to delays experienced over the past two years.

Source: Presentation

GUD share price: the bottom Line

GUD’s share price has rerated, soaring ~30% over the past year as fears over the company’s balance sheet alleviate.

As such, we view the shares as fair value at Stock Doctor and will continue to hold the stock within our Star Income universe, as we anticipate dividend payouts to accelerate once leverage falls within management’s target range.