The Cochlear Limited (ASX: COH) share price bounced dramatically higher this week following a bumper report. But is the Cochlear share price looking a little expensive? Stock Doctor’s Daniel Ortisi weighs in.

Hearing solutions provider Cochlear Limited (ASX: COH) has bucked the trend of ASX healthcare stocks missing earnings expectations, including Resmed CDI (ASX: RMD), CSL Limited

(ASX: CSL) and Capitol Health

(ASX: CAJ).

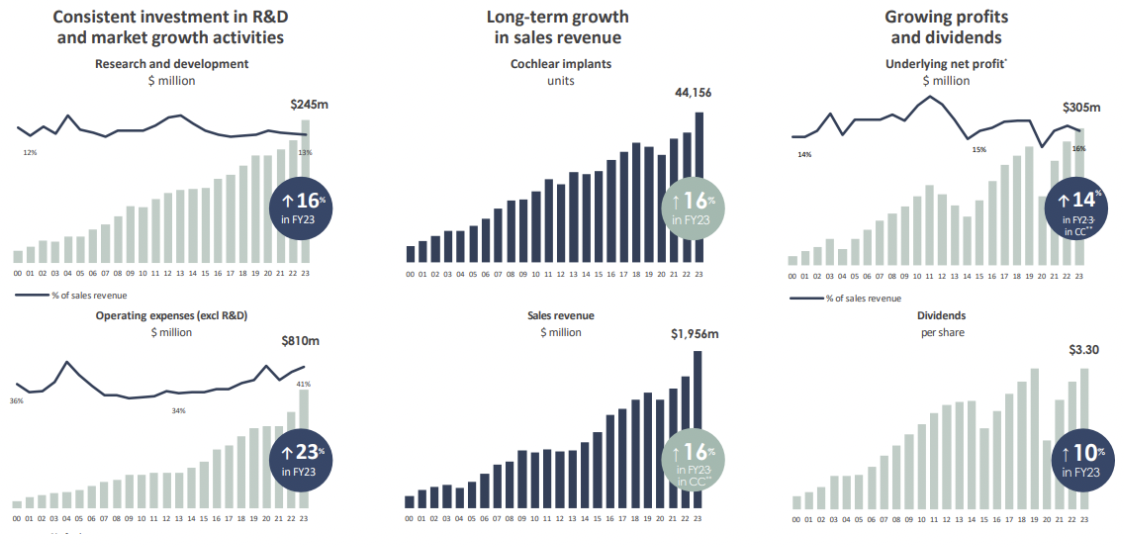

Cochlear reported revenues and profits of $1,956 million and $305 million, respectively, which was in-line with consensus analyst forecasts.

The key highlight of the result however was initial guidance for FY24, which was ~5% above expectations driven by continued revenue growth and improving margins.

Cochlear share price

Cochear’s operational highlights

Cochlear’s strong result was driven by a return to growth in Cochlear’s services division, which reported a 16% improvement in revenue (to $584m), a stark recovery considering growth was flat in 1H23.

Implant sales experienced strong growth also with revenue increasing 21%, mostly driven by volumes, particularly from emerging markets which remain under-penetrated globally.

Our investment thesis

Our team at Stock Doctor believe Cochlear is one of the highest-quality businesses on the ASX. The company developed the first hearing aid which worked by electrically stimulating the cochlear nerve in your ear to provide sound signals directly to your brain.

Its business model is sometimes referred to as the Gillette “Razor and Blades” model whereby Cochlear looks to sell and deliver its implants (the Razor) at a fair price. The device is surgically implanted in the patient’s head (often as a child) which means that they are effectively a customer for life.

Consequently, patients will upgrade the external sound processor (the blade) every four years or so which is an extremely high-margin stream of recurring income, subsidized by insurance providers.

Cochlear share price valuation

The Cochlear share price does look expensive on a forward price-earnings (P/E) ratio of ~45x. However, it is difficult to value this business on a simple earnings capitalisation ratio given the retention of its current customer base, growth in new customers and development of new products.

We have covered Cochlear on and off for over 25 years and one thing we have learned over the period is you rarely want to sell such a high-quality business, especially one that can consistently compound its earnings over the long term.