Sociedad Quimica y Minera de Chile (NYSE: SQM) is the world’s second-largest producer of lithium chemicals. Its 2Q23 report stunned the market by missing analyst profit expectations by ~20%, sending its shares lower.

The miss was driven almost entirely by lower-than-expected realised lithium prices, as the market has experienced a significant level of volatility in recent months.

Aside from the profit result, the presentation included interesting discussion points on the supply and demand dynamics of the sector going forward.

Here are our key takeaways for all lithium investors

Jurisdiction is key

SQM’s report highlights the importance of understanding the impact of jurisdictional risk for equity investors. The company’s flagship projects are located in Chile, which has some of the most onerous royalty laws globally.

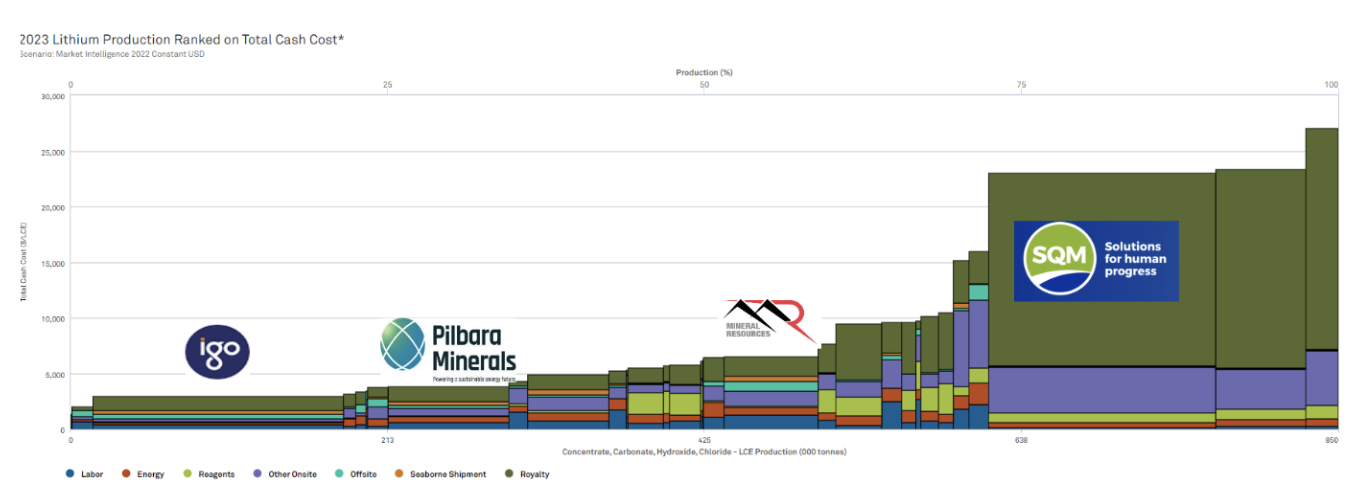

The chart below reflects the forecast cost curve for the lithium industry in 2023 which emphasizes this risk, as royalties represent 74% of the total operating cost.

Local peers IGO Limited (ASX: IGO) and Pilbara Minerals (ASX: PLS) reported cash margins in the same quarter in excess of 80%. Compared to SQM around 50%.

Simply put, the company’s upside is hampered significantly, and this will detract from further investment in the region despite it having one of the largest endowments in the world.

Source: CapIQ

Lithium production is hard

Another key takeaway is that project execution in the space remains highly challenging.

Expansion projects have been delayed a further 6 months, and some have been put on hold entirely. This has been a sector-wide issue, with almost every producer reporting delays in recent years.

Some investors may be familiar with the Mt Holland lithium project which SQM jointly owns with Wesfarmers (ASX: WES).

The company believes it will be producing lithium chemicals jointly in 2025, however, we view this forecast as optimistic given the challenges IGO recently experienced with its hydroxide facility in Kwinana (which is yet to reach commercial scale after almost 12 months of production).

The Bottom Line

Retail investors love the lithium industry (and for good reason), but there are significant risks and challenges in the space.

Investors need to carefully conduct their due diligence to avoid taking on unnecessary risks and incurring losses.

Lessons should be learnt from the challenges of companies such as Core Lithium (ASX: CXO), AVZ Minerals (ASX: AVZ) and Lake Resources (ASX: LKE).