Hello investing heroes,

One of the questions that pops up time and time again when I speak to listeners ready to take the first step, is which brokerage account to use.

We have so many options these days when it comes to choosing a brokerage account, that it can feel impossible to make a fully informed decision – even if we’ve read all the reviews, compared the fees and analysed the advantages and disadvantages.

And more options don’t make us happier.

In fact, psychologist Barry Schwartz argues that a ‘greater variety of choices actually makes us feel worse’. Then, if we do make a decision, we worry about whether we made the right choice. Schwartz calls these ‘decision ghosts’.

So given all the choices we have now, the natural desire to make the ‘right’ decision and the resulting drive to research, research, research, how do we combat analysis paralysis?

Here’s how I would approach choosing a broker.

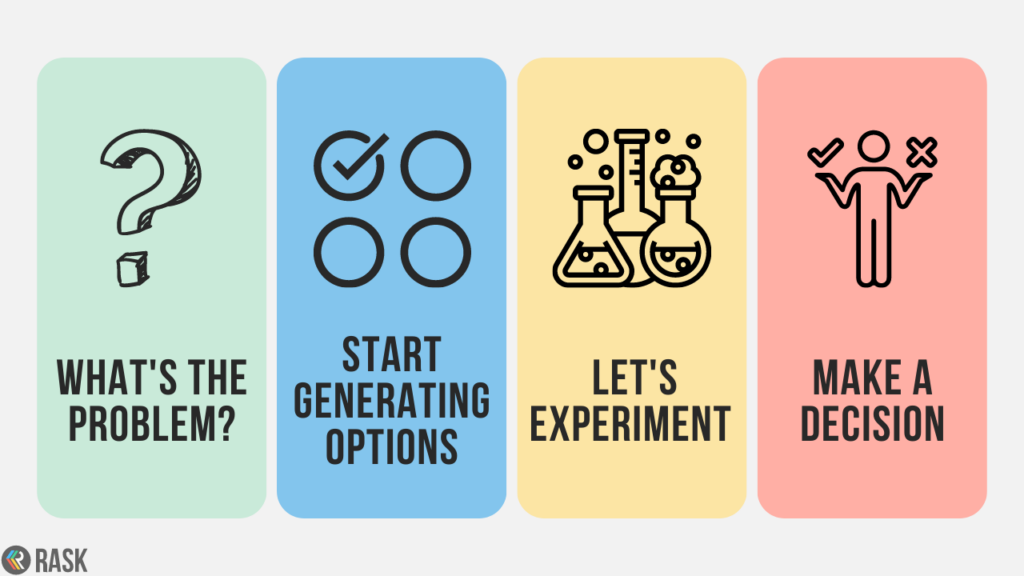

Step 1: What is the problem?

First, you need to identify the problem you’re trying to solve and figure out where you’re stuck. Start by writing down all the pieces of information you feel you need to know before you make a decision. Without doing this, you can get trapped in an endless research quest where you never feel ready to make a choice.

Then use this list to do your research and write down what you discover. This information will form the foundational knowledge you need to make a decision further on in the process.

Step 2: Start generating options

Use this knowledge to generate options. Try to narrow down the choices of brokerage accounts to three suitable options that would fit your personal requirements. Any more than that will start to get overwhelming and reduce the chance that you’ll make a decision.

✅ Some of the most popular choices in the Rask community include CommSec, Pearler*, Stake, Selfwealth* and CMC Markets.

Step 3: Let’s experiment!

Now it’s time to experiment. Give yourself a set time period to open an account with each of your top-three options and try them out. Make notes on what works and what doesn’t, and assess how well each option meets your needs.

Importantly, set yourself a due date to make a decision at the end of that trial period and move forward with your chosen brokerage account (remember, this decision is not set in stone). Even better, find a friend to hold you accountable to this decision-making process.

Step 4: It’s decision-making time

It’s time to make a decision. Using all the information you’ve gathered and the experience you’ve had testing out each brokerage app, make a decision that best suits your problem.

You don’t need a perfect solution, but you do need to make a choice here.

📚 If you’d like to learn more about making financial decisions, you can preorder my upcoming book, Buying Happiness, on Booktopia and Amazon.

Plus, Owen and I recently recorded an episode on how brokerage accounts work — click the image below to tune in!

What is your financial decision-making process?

Let me and the Rask Core 🌏 community know about it by jumping into the Community forum. It’s now only $9.99 per month to be part of Rask Core – cancel anytime! Or send us a DM on Instagram 📨

I might just share your insights in our upcoming Money & Chill episode on The Australian Finance Podcast.

Cheers to our financial futures,

* Please note: Rask has flat-fee partnership arrangements with both Pearler and Selfwealth. However, we are not paid to mention them here.