The Australian share market

or ASX index is uniquely known for its high dividend yield. On average, our local market has a yield more than double that of the US S&P 500!

This is, in part, due to our favourable tax system, which allows for the pass-through of franking credits to shareholders. Another reason is that Australian investors often prefer to invest in companies that are delivering an attractive stream of income, which often persuades company Boards to deliver them when there is capacity to.

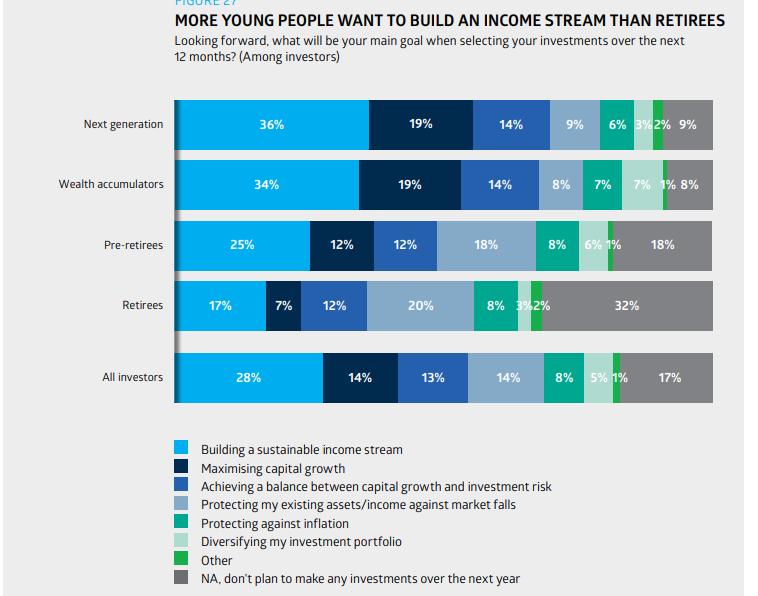

In fact, I was stunned when I read in the recent ASX investor survey that 36% of younger Australians aim to build a sustainable income stream with their investments compared to the overall average of only 28%.

Young Aussies really love income stocks!

Source: ASX

The elephant in the room

In our conversations with clients, we typically find that the average investor focuses on the size of the trailing dividend yield when looking to make an investment in an “income stock”. If only it were that easy.

Stocks with outsized dividend yields are typically those in highly cyclical markets (such as resources, or energy stocks) or those which have expectations of a reduction in dividends in the future.

Think of stocks with severe business risks such as Magellan Financial Group Ltd (ASX: MFG) or Resimac Group Ltd (ASX: RMC). These stocks often come up in conversation due to their outsized yields, but that is primarily a function of their falling share prices (when prices fall, yields rise) and souring market sentiment.

Simply put, the stock market is highly efficient, and if there are companies trading on yields significantly above the market average there is typically a good reason for it.

The issue with cyclicals

As a resources analyst myself, my greatest concern is when investors look at mining companies and think that they are fantastic dividend stocks. This couldn’t be further from the truth.

Mining is a highly cyclical business, with arguably the greatest level of capital intensity out of any industry. This means that mining companies constantly need to invest more and more money into their assets.

If capital is not reinvested into projects, then the assets will eventually be depleted as they are finite resources. To summarise, they cannot typically sustain higher dividends as there are competing priorities for capital.

Other issues can arise too. If a mining company is not adequately investing in its assets, it may be sacrificing operational performance, or even worse, safety. These factors would likely result in lower share prices, making them poor investments for shareholders regardless.

When commodity prices are high, the benefit of operational leverage dictates that returns to shareholders can be outsized, and the team at Stock Doctor often does provide coverage of mining companies as “Star Income Stocks” (Stock Doctor’s designation of our income investment universe).

However, we are very quick to react to changing circumstances as the cure for high commodity prices is… high commodity prices and you ought to be cautious of holding onto cyclical stocks when conditions start to deteriorate.

Take Rio Tinto Ltd (ASX: RIO) as an example. It is one of the world’s best mining companies and has some fantastic assets, but we recently sold the stock out of our income universe despite its large yield.

Poor capital allocation decisions over time and shifting commodity cycles have resulted in its share price effectively going nowhere since its previous peak in 2008.

Sure, ASX investors have received dividends along the way but on a total return basis, the investment would’ve underperformed the boring old S&P/ASX 200 (INDEXASX: XJO) index over that 15-year period.

Ultimately, ASX income investors must pay attention to their portfolio allocations towards cyclical businesses. They can pay above-market yields, but when the cycle turns, those dividends will disappear, and the share price will likely trend lower.

A deep dive into the ASX200’s dividend composition

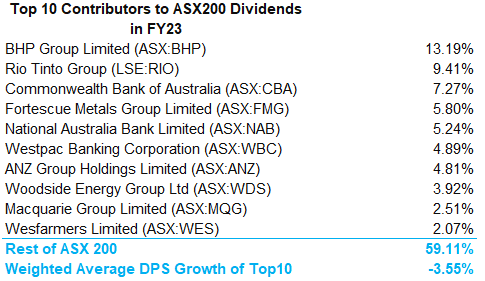

Based on ETF holdings data from Betashares, the top 10 constituents of the ASX200 index account for ~47% of the total holdings. But when we look at dividends in particular … the top 10 contributors account for a whopping 59% of the total income pool.

Clearly, there is a severe level of concentration risk when it comes to investing for income in our local market.

We believe that the average income investor also faces this risk dearly.

When we dug deeper into the data, we found that on a weighted average basis, these top 10 income-contributing stocks will experience a ~3.5% DECLINE in dividends per share when looking one year ahead.

This of course is due to lower expectations for iron ore miners, and some investors may be aware of that – but let’s take it one step further. We found that roughly 4 out of every 10 stocks in the ASX200 will report lower dividends in 12 months’ time, based on analyst forecasts.

Our conclusion is that in times of cost-of-living pressures and high inflation, ASX investors must be cautious when constructing an income stock portfolio or they could be investing in shares that will pay you a lower amount over time than they do today.

An income alternative

Stock Doctor has an entire universe dedicated to income investors. We call this our Star Income Stock

universe.

Our methodology includes both quantitative and qualitative company analysis, which means we don’t just run filters and give investors a list of stocks based purely on a “screen” – we rigorously research the underlying fundamentals and actively manage the portfolio of stocks.

We especially favour ASX companies that can deliver a sustainable yield, and compound that over time in-line with their revenues and profits. At times, we identify special situations whereby we see potential for capital returns or special dividends.

An example in recent times of this playing out for us is Helia Group Ltd (ASX: HLI), Australia’s largest provider of lenders mortgage insurance (LMI). Helia has been carrying a significant amount of excess capital on the balance sheet, well above regulatory requirements, and management called out the potential to deliver this back to shareholders at its interim result last year.

We invested in the stock in March 2022 at $2.81 per share and have since received a total of 67 cents per share in dividends (including 27 cents in specials) which has been a pleasing result.

An added bonus is that the Helia share price is trading higher than our initial investment also.