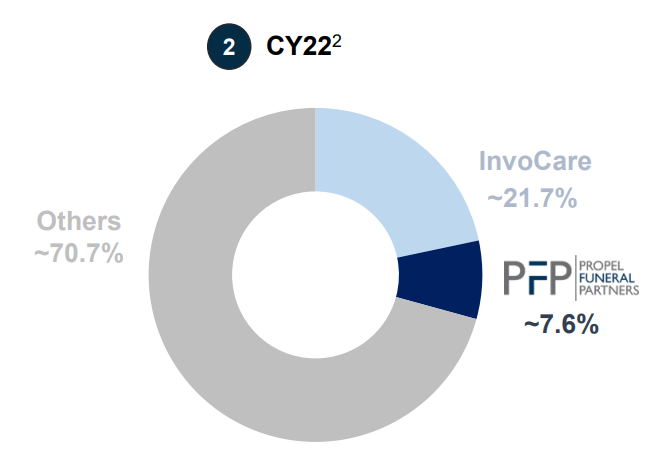

After the recent private equity takeover of funeral home operator InvoCare Limited (ASX: IVC) the team at Stock Doctor takes a closer look at the industry’s second-largest player – Propel Funeral Partners Ltd (ASX: PFP).

PFP share price

What is Propel?

Propel Funeral Partners own funeral homes, cemeteries, crematoria and related assets across Australia and New Zealand, providing a broad range of services and products across the death care industry.

The industry is highly fragmented, and benefits from economies of scale which makes it ripe for further consolidation. Hence, we see a continued pathway of consolidation for PFP.

Why the Propel share price is worth a second look

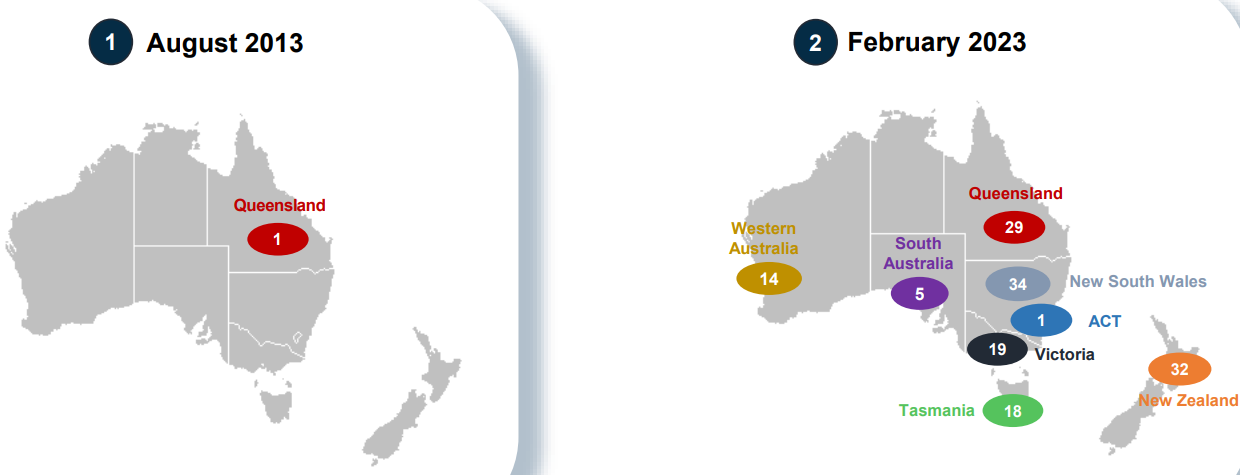

Since its ASX listing in August 2013, Propel has grown from operating one funeral home to ~150 locations.

Source: Company presentation

Source: Company presentation

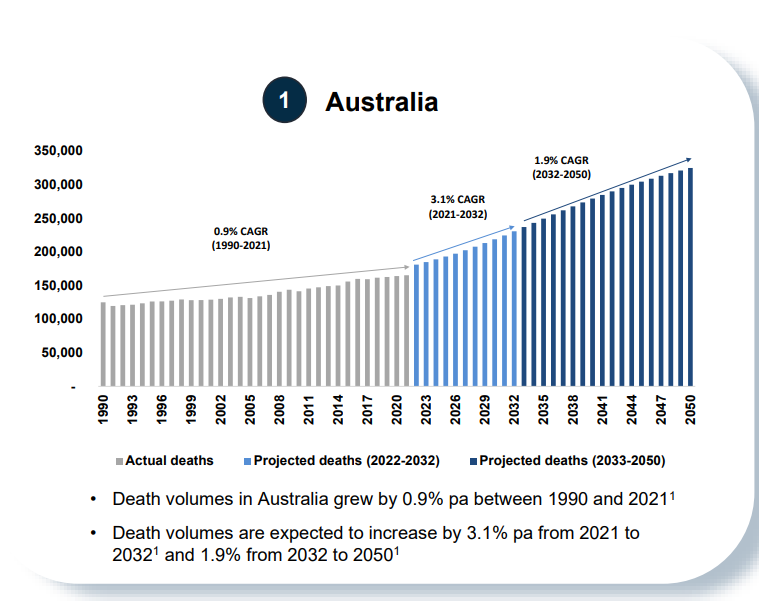

Propel’s revenue is driven primarily by death volumes, which have increased and begun to grow above historical trends. This may be due to changing demographics including an overall aging of our national population.

Long term, the Australian Bureau of Statistics (ABS) forecasts volumes to structurally increase over the next decade due to these demographic shifts.

Source: Company presentation

Source: Company presentation

Aside from favourable organic growth trends, the business has executed on a pipeline of mergers and acquisitions (M&A) in CY23, which Propel will look to bed down over the near term.

As the company continues to scale, this could translate to higher profitability metrics such as return on equity (ROE) and net profit margins, as cost synergies are realised.

ASX investors however need to be cautious of Propel’s rising debt levels, which could place pressure on the company’s balance sheet given the increase in interest rates.

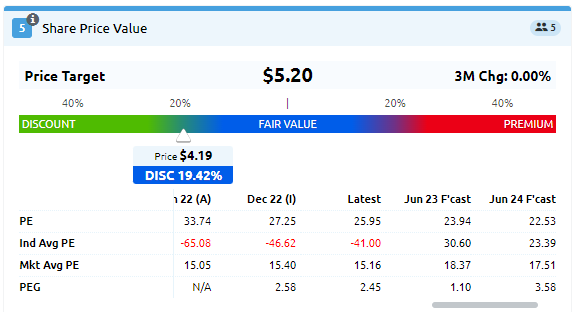

Is the Propel share price undervalued?

With InvoCare being taken off the boards, we think is likely that Propel will attract increasing investor interest.

The company operates in a defensive industry that typically is not sensitive to economic fluctuations. The growth tailwinds mentioned above make it a compelling emerging opportunity for investors who believe its ~23x forward P/E multiple looks attractive.

Propel’s share price is currently trading at a discount to consensus valuations… but we know that valuations can be sensitive to changes in forecast assumptions, so perhaps take this with a grain of salt.

For our team, Propel’s shares are too illiquid for us to make a meaningful investment at present, but we are keeping a close eye on it due to the improving fundamentals.