Want to find the top 10 best ASX shares in Australia? On this episode of The Australian Investors Podcast, Luke Laretive and Owen Rask go head-to-head in the search for multibaggers on the ASX, with some shocking stats.

Luke and Owen go head to head on their top 3 factors to use to search the ASX for big winning stocks, before drilling to some the biggest and best performers on the ASX.

If you like listening to this episode, you’ll LOVE the video version. Watch it on YouTube.

Here’s some of the notes Luke & Owen put together on ASX multibaggers

So why are multi-baggers hard to find?

- Patience: most investors don’t understand compounding – 12% pa for 20 years = 9.65x your money. Focus too much on short term monthly/quarterly/annual earnings/returns and not “earnings power”.

- Resilience: Retail investors focus on price – the main input of a good or bad investment is the current price, relative to the price paid.

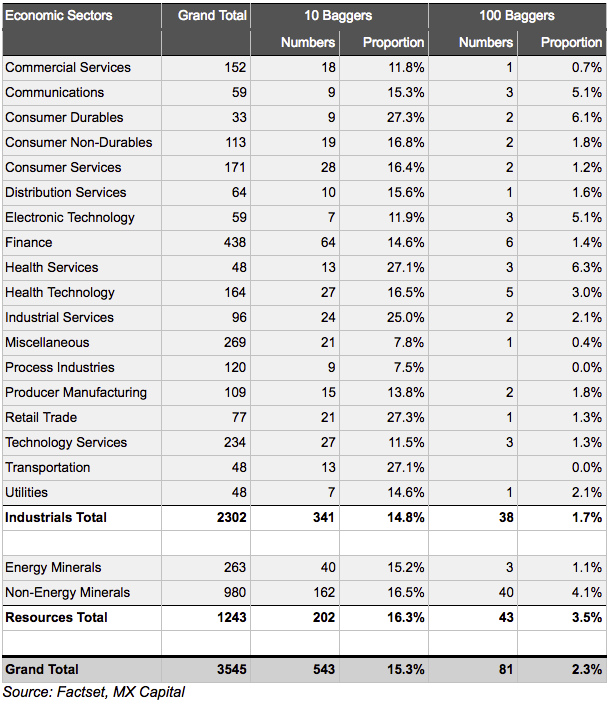

- Rare: 2.3% of companies end up 100 bags, 15% – 10 bags.

To achieve a 100-bagger from real estate business REA Group (ASX: REA) it took 17 years, including GFC when stock declined 50%. Appen was a 10-bagger from $2 to $37, then lost it all back to $2.

The point is:

-

- Need to know what you own, why you own and what information is relevant to the investment thesis.

- And be willing to bet your capital invested against the market, who’s telling you that you are wrong.

- Unlikely to be able to do this if your investment thesis is weak i.e.

- “My mate told me…”

- “I’ve researched hot copper/twitter etc.”

- Use “stop losses”

So, what does an ASX multi-bagger look like in real life?

Simple, consistent revenue and profit growth, without dilution.

We think we have a portfolio of multi-baggers in the Seneca Australian Small Companies Fund.

Profit before tax A$m

| 2018 | 2019 | 2020 | 2021 | 2022 | CAGR | |

| ASX200 | 353.07 | 383.51 | 364.12 | 272.36 | 437.47 | 5.5% |

| Stock #1 | 1.72 | 3.25 | 4.17 | 5.93 | 8.22 | 47.9% |

| Stock #2 | 1.40 | 3.83 | 3.77 | 3.36 | 5.33 | 39.7% |

| Stock #3 | 1.72 | 2.44 | 2.73 | 5.15 | 5.15 | 31.5% |

| Stock #4 | -3.99 | 1.89 | 9.75 | >100% |

What most investors actually say when the talk about multi-baggers is ‘quick wins’ i.e., get rich quick. It’s usually some biotech or mining thing.

What about a boring financial services company….

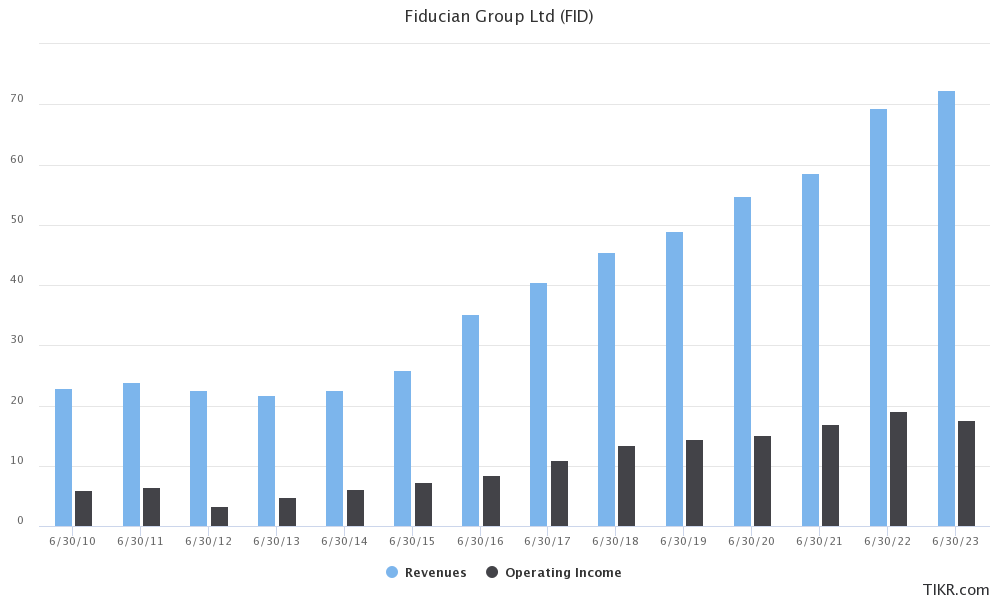

Fiducian (ASX: FID) share price: the stock no-one has heard of

Fiducian is a diversified financials company offering services like funds management, financial planning, platform administration, financial planning software and administration systems. Fiducian’s motto is Integrity, Trust & Expertise.

You can see how Fiducian’s revenue and profit (before taxes and interest costs) have consistently scaled in the chart below.

One for the watchlist perhaps?

Top 10 ASX best stocks

Here are a list of the top 10 ASX best stocks by share price performance over 10 years:

- Pro Medicus Ltd (ASX: PME) – 16,113%

- Bellevue Gold Limited (ASX: BGL) – 6,480%

- Alpha HPA Limited (ASX: A4N) – 6,455%

- Emerald Resources NL (ASX: EMR) – 2,975%

- Capricorn Metals Ltd (ASX: CMM) – 2,829%

- HUB24 Ltd (ASX: HUB) – 2,406%

- Objective Corporation Limited (ASX: OBJ) – 2,282%

- Pinnacle Investment Management Ltd (ASX: PNI) – 2,227%

- De Grey Mining Ltd (ASX: DEG) – 2,208%

- Altium Limited (ASX: ALU) – 1,752%

When it comes to finding the ASX’s best stocks, it’s important to remember that past performance is definitely not indicative of future performance. And these numbers will change, sometimes for the worse. This screen was run using tikr.com, on September 6th, for customers over $US400 million market cap.