APA Group (ASX: APA) recently hit 12-month lows, but the question remains, is now the time to buy APA shares?

APA Group (ASX: APA)

What does APA do?

APA owns ~7,000km of gas transmission pipelines which deliver half of Australia’s natural gas usage. Pipelines connect suppliers of natural gas to >1.4m homes and businesses. Spun out of AGL in 2000, its assets are now worth ~$21.5bn.

APA shares enjoy defensive characteristics. It provides essential infrastructure that is predominantly contracted and regulated, with further growth driven from existing customer relationships. Like Transurban Group (ASX: TCL), price increases are linked to inflation, largely insulating APA from persistent inflation present in the Australian economy.

Transurban Group (ASX: TCL)

The energy transition brings uncertainty, but APA’s gas infrastructure should continue to play a crucial role in the Australian economy for many years as a key ‘transition fuel’ that is preferred over emissions-intensive thermal coal to provide baseload power (important when renewables aren’t generating).

Despite the noise around the death of fossil fuels, gas still accounts for 27% of primary energy consumption in Australia and consumption of gas managed to grow at a 2% CAGR from 2011-2021.

If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines.

In the meantime, gas serves as a key ‘transition’ fuel preferred over emissions-intensive thermal coal to provide baseload power (important when renewables aren’t generating).

Acquisition and capital raising

The reason behind the -11% fall in APA share price over the last month has been due to the acquisition of Alinta Energy, the owner of the Western Australian Pilbara region’s remote power assets from a 100% divestment from Alinta’s owner Chow Tai Fook Enterprises.

Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:

- Port Hedland power station (210 megawatts)

- Newman Power Station and associated battery (238 megawatts and 35 megawatts)

- Chichester solar farm (60 megawatts)

- Goldfields gas transmission pipeline, which can transport 203 terajoules a day.

It has a large growth development pipeline, consisting of:

- 900 megawatts worth of renewables and storage products under development

- 1 gigawatt of long-term development opportunity

- 300 kilometres of planned high voltage transmission lines to add to the 200 kilometres it already has.

The acquisition has spurred APA to raise equity at the discounted price of $8.50 in a placement and share purchase plan (SPP) structure.

Placement shares have already been issued and are trading, enabling participants to sell immediately at prices above what they were bought for – a win for the instos that participated.

The good news for existing shareholders is that an SPP is being offered at the same terms as the placement price of $8.50, or a 2% discount to the 5-day VWAP prior to the close date, whichever is lower.

The SPP offer closes at 5pm on 15 September 2023.

The acquisition price of ~$1.8bn in cash is to be funded by an equity raise of $750m (includes $675m placement + $75m SPP) plus $993m of debt.

Alinta Energy Pilbara in FY23 generated revenue of $235 million and EBITDA of $124 million, with an implied EV/EBITDA multiple of 12.9x FY24 estimates. APA trades on 11.7x forward EV/EBITDA, down from a 5-year average of 12.8x, and an undisturbed multiple of 12.65x prior to the deal announcement.

So the deal is not accretive based on the current trading multiple, but management expects the deal to deliver an IRR greater than APA’s weighted average cost of capital, as well as, importantly, being free cash flow accretive.

Dividends

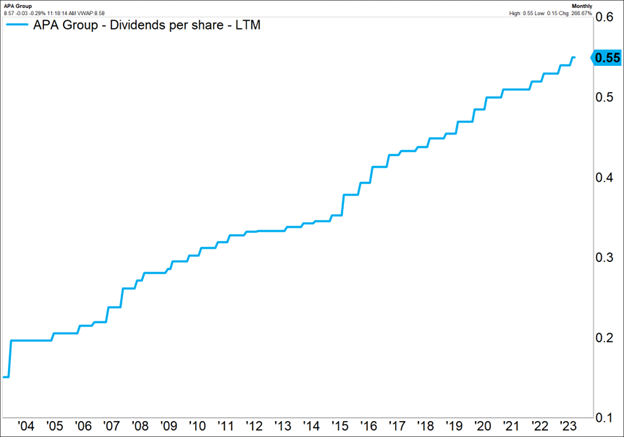

APA typically pays two partially franked dividends per year. APA’s FY24 Distribution Per Security (DPS) guidance of 56 cents per security remains unchanged inclusive of the additional securities on issue as a result of the equity raising.

This implies a dividend yield of 6.59% at the raise price of $8.50, a nice premium to the current 10-year Australian government bond yield of 4.15%.

APA has a stellar record of growing dividends. Only once in 22 years has its dividend payment been reduced.

Are APA shares a buy today?

APA shares look appealing at the raise price with a sustainably high >6% dividend yield underpinned by revenue from strategic infrastructure assets. Although APA has appeared to pay up for the Alinta Pilbara energy assets, most miners working in the Pilbara region rely on the Alinta assets for at least a part of their energy needs.

These assets have good pricing power (inflation linked, like other APA assets) and good incremental returns for new mining assets brought online in the area.

With the minerals-intensive nature of decarbonisation, the assets provide a quasi-hedge against the effects of the energy transition for APA.