Both uranium equities and the uranium price have been marching higher in recent weeks.

Numerco’s uranium spot price indicator closed at US$58.25 last Friday, up 19.8% so far in 2023.

Meanwhile, bellwether producer Cameco Corp (NYSE: CCJ) closed at CAD46.07, a level not seen since 2007. Cameco accounted for more than 11% of global uranium production in 2022, making it the world’s second largest producer.

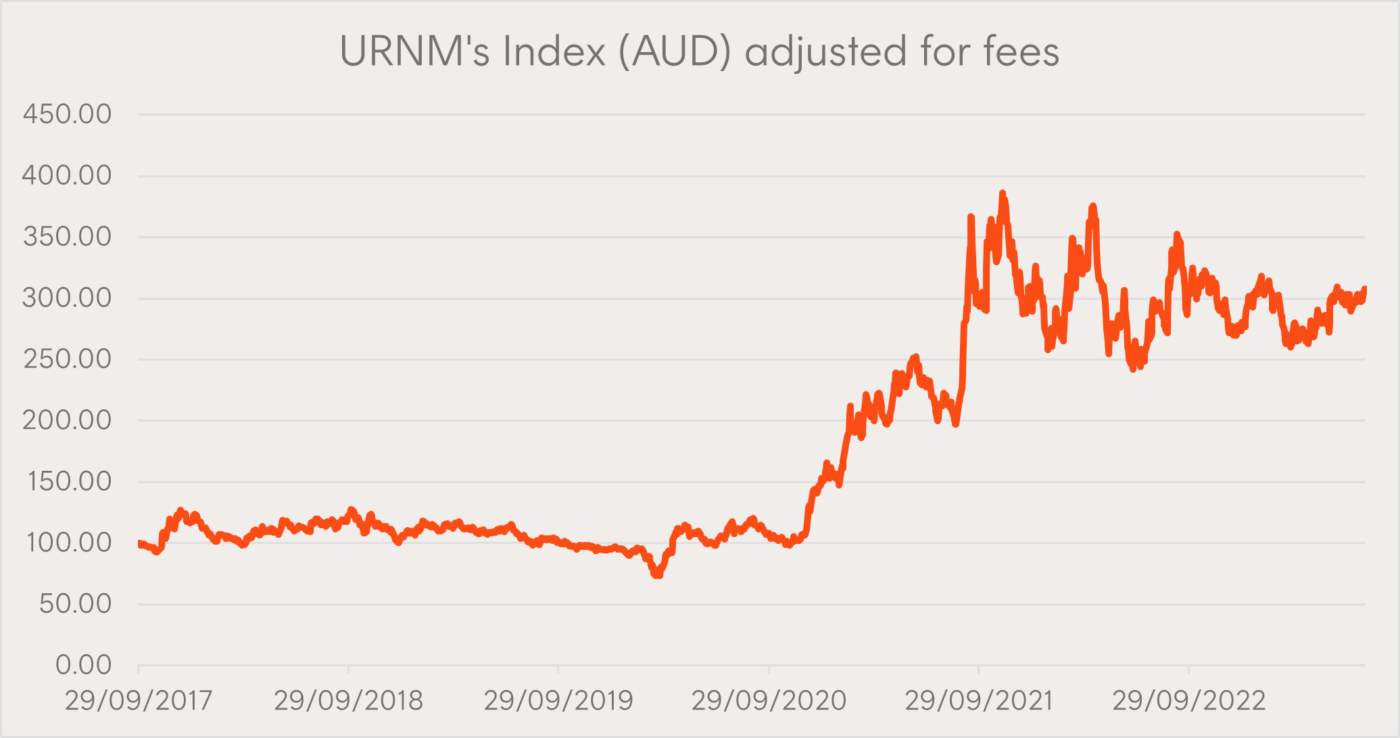

It’s not just been a short-term phenomenon either. The Indxx North Shore Uranium Mining Index, which Betashares Global Uranium ETF (ASX: URNM) seeks to track (before fees and expenses) has returned 21.3% per annum over the last five years, outpacing most major asset classes and equity markets.

Source: Bloomberg, Betashares. As at 31 July 2023. Past performance is not indicative of future performance of any index or ETF. Graph shows performance of the index that Betashares Global Uranium ETF (ASX: URNM) seeks to track, net of URNM’s management fee and cost (0.69% p.a.), and not the performance of URNM. You cannot invest directly in an index.

So what has been driving prices higher? And what are some of the trends that might influence the price in future?

Contracting at decade highs

Nuclear utilities generally buy most of their uranium through long-term contracts, rather than through the spot market.

In recent years, contracting volumes have been low due to a perception of ample supply availability.

However, during the first half of 2023, 118 million pounds (approx. 53,500 tonnes) of long-term contracts were signed.

Based on the current run-rate, Cameco expects 2023 to be the biggest year of contracting in over a decade.

Disruptions to supply

Last month’s coup in the West African nation of Niger may cause disruptions to global uranium supplies. Niger accounted for around 4.1% of global uranium in 2022. It’s unclear at this stage how this might affect exports from the country.

Question marks also remain over supplies from Kazakhstan and Russia, which accounted for 43.4% and 5.1% of global uranium mine production respectively in 2022. The ongoing war in Ukraine has caused many utilities to consider the security of supplies coming from these countries, as Canaccord Genuity Group Inc (TSE: CF) reported last year:

“Even in the absence of sanctions, our discussions with market participants indicate that Western utilities are self-sanctioning and moving to reduce/eliminate their reliance on Russian material.”

Project delays

Operating a mine is a complex business. Building a new mine, or even restarting an idled mine, is even more complex.

For example, Cameco’s Cigar Lake deposit – the highest-grade uranium mine in the world – was discovered in 1981. Construction on the mine finally started in 2005, and was expected to be completed in 2007. After several delays, commercial production was finally achieved in 2015, eight years later than planned.

More recently, Peninsula Energy Ltd (ASX: PEN) announced delays to the restart of its Lance project in Wyoming, USA. A key service provider had terminated their contract with Peninsula, resulting in them needing to build additional infrastructure so that they could complete the processing on-site.

Peninsula Energy Ltd (ASX: PEN)

According to an ASX announcement, Peninsula had “been on the verge of a production restart” at the Lance project, which has now been delayed for an unspecified period as they evaluate the required money, time, and equipment to restart the project.

Global uranium inventories depleting

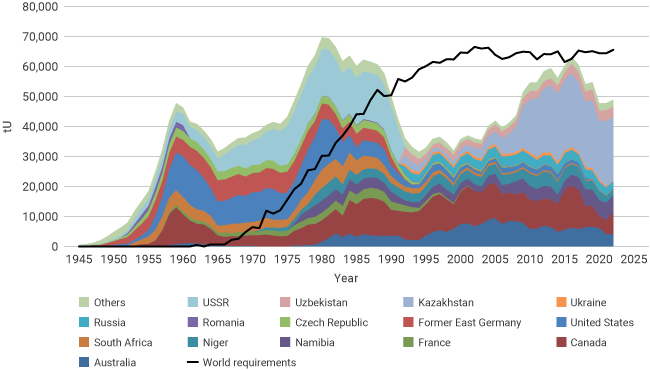

Uranium demand often outstrips mined production.

This might seem impossible, but mine production is not the only source of uranium. Utilities’ inventories can be drawn down, spent fuel can be reprocessed, and enrichment facilities can be ‘underfed’ (which Patrick Poke explained here).

Uranium mined supply versus requirements since 1945

Source: OECD-NEA, IAEA, World Nuclear Association. As at nd-2022.

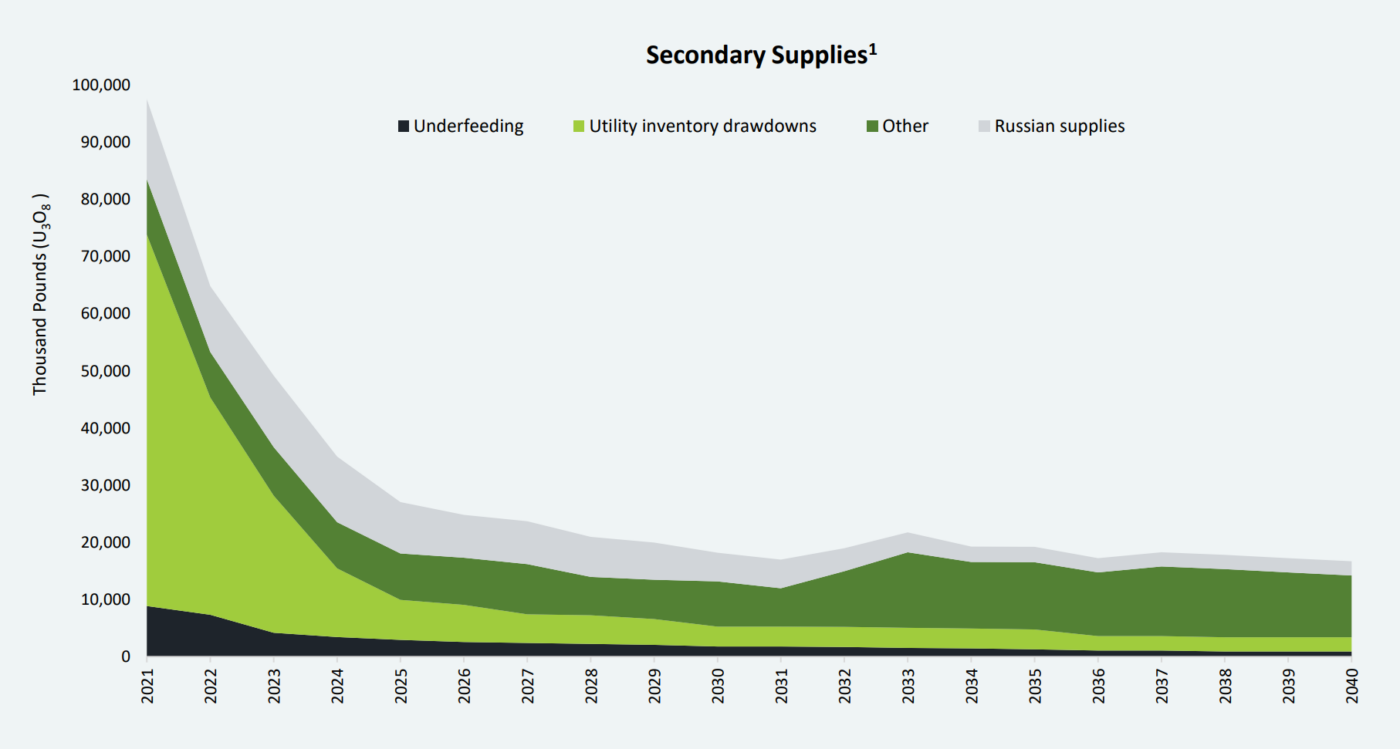

But many of these sources of ‘secondary supply’ are dwindling. With reduced levels of secondary supply available, mined supply will need to fill that gap.

Source: Paladin Energy, UxC Market Outlook, Q2 2023. “Other” includes US Government supplies, MOX and reprocessed fuel.

Decarbonisation

Cars, stoves, and steel production are just a small selection of the processes currently powered by fossil fuels that will need to be electrified if the world is to achieve its climate goals.

This would, of course, increase demand for electricity.

Meanwhile, coal-fired power stations may need to be retired, further complicating the equation.

Nuclear energy faces challenges, including high capital costs, a history of budget blowouts, and challenges in implementing permanent storage solutions for nuclear waste.

However, nuclear energy can provide CO2-free energy, and its ability to produce reliable power over a long lifespan means that it may play an important role in a decarbonised future.

The nuclear energy renaissance

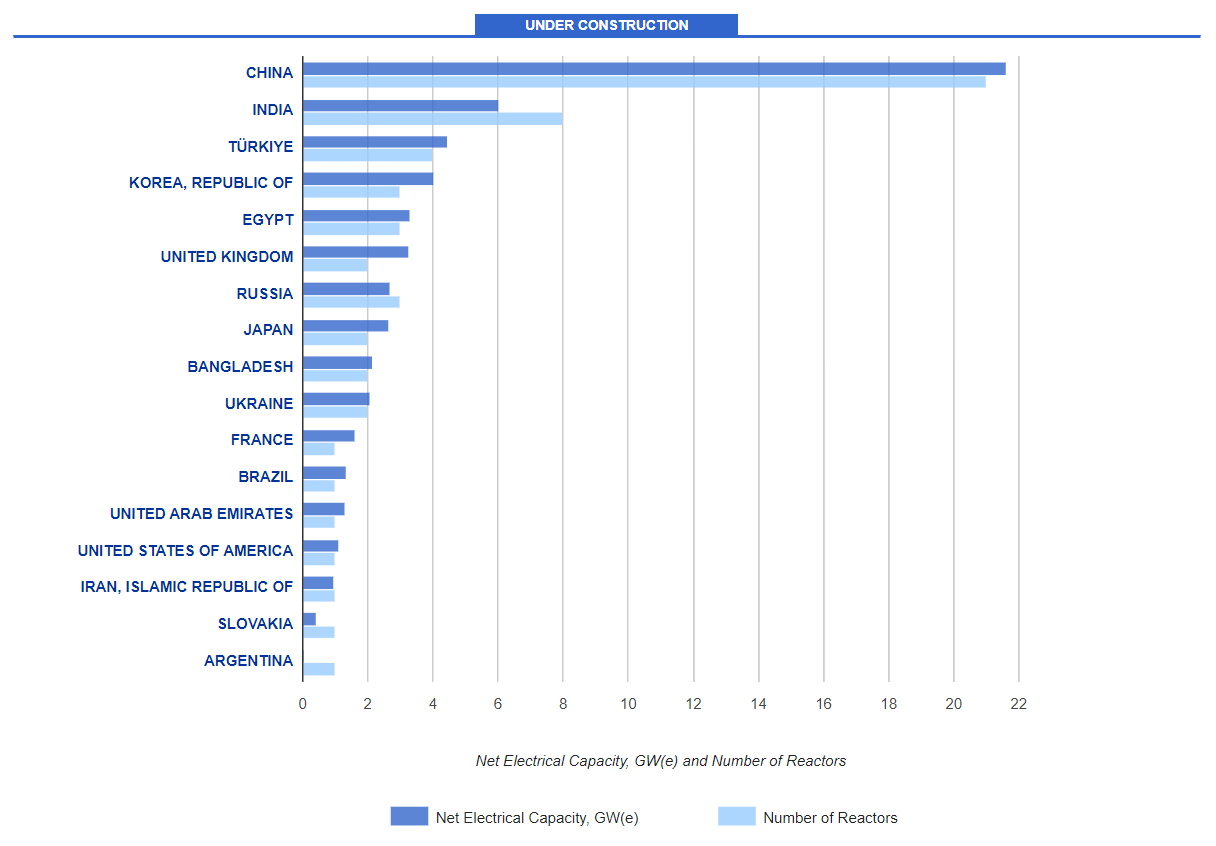

According to the International Atomic Energy Agency, there are currently 57 reactors under construction across 17 nations.

The countries with the most reactors under construction are China (21), India (8), and Türkiye (4).

Source: IAEA. As at 21 August 2023

For comparison, there are around 440 reactors currently operating around the world.

Of these 57, seven are expected to be completed in 2023, and another 11 in 2024.

It’s not just new reactors being built though.

Some reactors have seen increases in power generation capacity, and many have seen extensions to their original planned lifespan.

With more reactors, higher capacity, and extended lifespans, this could result in a higher demand for uranium.