There is a common perception that when volatility returns to markets, investors should favour active management and stock picking over passive investing.

During the 2020 COVID-19 sell-off, many active managers asserted they were better placed to provide some downside protection, yet, on average, actively managed funds underperformed passive during that episode (further details of which are discussed later in this article).

At the start of 2022, against the backdrop of elevated stock valuations, rampant inflation and a possible recession, we again heard that familiar rhetoric that active management can provide investors with better outcomes through market volatility.

This narrative is intuitively appealing.

In this insights piece, we investigate the extent to which it is supported by the evidence so far (keeping in mind that past performance is not indicative of future performance).

How did active managers fare in 2022 and what longer-term outcomes have they delivered?

In any investment period there will always be some active funds that outperform and some that underperform. The question is, what are the chances of any one active fund outperforming?

The SPIVA (S&P Index vs. Active) Scorecard tracks how actively managed funds all over the world have fared against passive benchmarks.

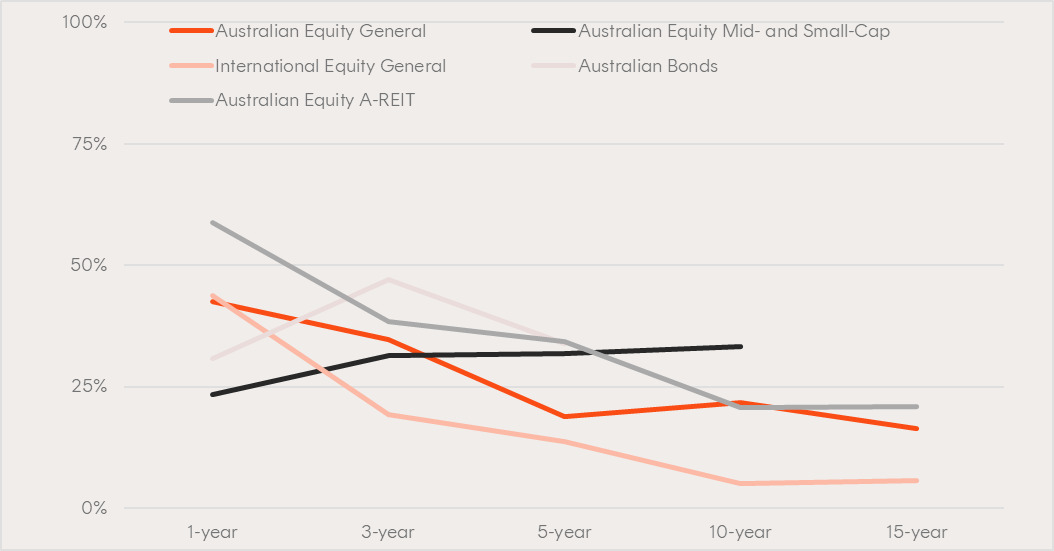

The chart below shows the outcomes over various time frames for Australian-domiciled actively managed funds from the SPIVA Australia Year-End 2022 Scorecard.

For example, the dark orange line shows the proportion of Australian Large Cap Active funds (the ‘Australian Equity General’ category) that beat the S&P/ASX 200 (INDEXASX: XJO) Index over the 1, 3, 5, 10 and 15 year time periods ending 30 December 2022.

SPIVA Australia Year-End 2022 Scorecard:

Proportion of active managers, by fund category, beating benchmark (comparison index) over different return periods

Source: S&P Dow Jones Indices LLC, Morningstar. Data as of Dec. 30, 2022. Chart is provided for illustrative purposes only. Underperformance rates for Australian Bonds and Australian Equity Mid- and Small-Cap categories are reported for time horizons over which the respective benchmark indices were live. All fund categories and comparison indices are defined in the SPIVA Australia Year-End 2022 Scorecard (https://www.spglobal.com/spdji/en/spiva/article/spiva-australia/). You cannot invest directly in an index. Past performance is not indicative of future performance.

The year 2022 was supposed to be the perfect environment for active to beat passive strategies – economic uncertainty, no more easy monetary policy providing a floor for equity valuations, the business models of previous market darlings challenged – a stock picker’s “paradise”.

Yet, for the calendar year, only ~43% of active Australian and International equity large-cap managers (‘Equity General’ categories) actually beat S&P’s comparison indices.

In the Small- and Mid-Cap category, the proportion of active managers beating the comparison index was less than a quarter.

The only category win for active in 2022 came in Australian Real Estate Investment Trusts (A-REITs).

Is this period of market volatility different? What happened in the Covid sell-off in Q1 2020?

SPIVA assessed the performance of Australian-domiciled active funds during Q1 2020 across all the major asset classes.

For the quarter, in all asset class categories except A-REITs, most active funds underperformed their respective benchmarks.

For example, 61% of funds categorised as ‘Australian Equity General’ failed to beat the S&P/ASX 200 Index over the quarter.

The figures were slightly better for Australian equities in the month of March 2020 alone, during the worst of the drawdown, where 51% of Australian Equity General funds underperformed against the comparison index.

However, the ability of these active managers to take a defensive tilt during a bear market appears to have had a muted effect on relative performance. The proportion of active fixed income and global equity funds that underperformed in March 2020 was significantly higher.

Time to reconsider the conventional wisdom?

Unlike actively managed funds, passive ETFs:

- Tend to be much lower cost, more liquid and can offer much better diversification – three desirable characteristics in a market where positive returns are hard to come by.

- Offer full portfolio transparency. Often, getting a handle on why an active fund is underperforming is difficult, whereas all passive ETFs traded on the ASX are obligated to publish all their holdings each trading day, so you can see exactly what is driving performance.

There is a wide range of passive ETFs available on the ASX from Betashares and other ETF issuers.

It might be time to reconsider the conventional wisdom that active management thrives in volatile markets

and have regard to the benefits of low-cost, passive ETFs that could offer a more effective approach to navigating market turbulence and growing wealth over the long term.