It’s an age old question,

Is it possible for a person to time the share market?

All the data seems to be pointing very firmly to no. It’s simply too hard to do.

Many investors try to pick the bottom of the share market to take advantage of any following rebound. This approach is referred to as ‘market timing’ and involves making investment decisions based on short-term market movements.

In contrast, a buy-and-hold approach involves buying shares and holding them over the long-term, irrespective of market movements. An overwhelming body of research finds that this passive buy-and-hold, long-term approach to owning shares produces better long-term results.

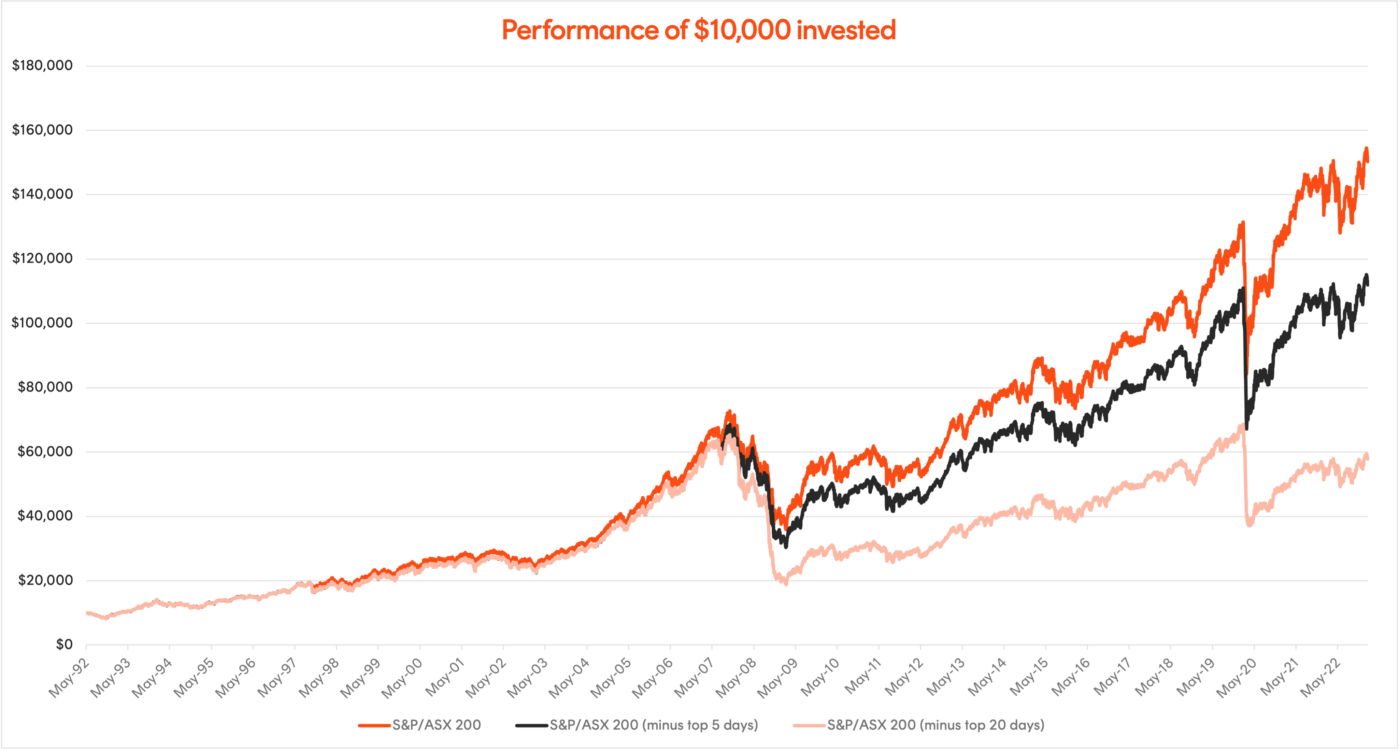

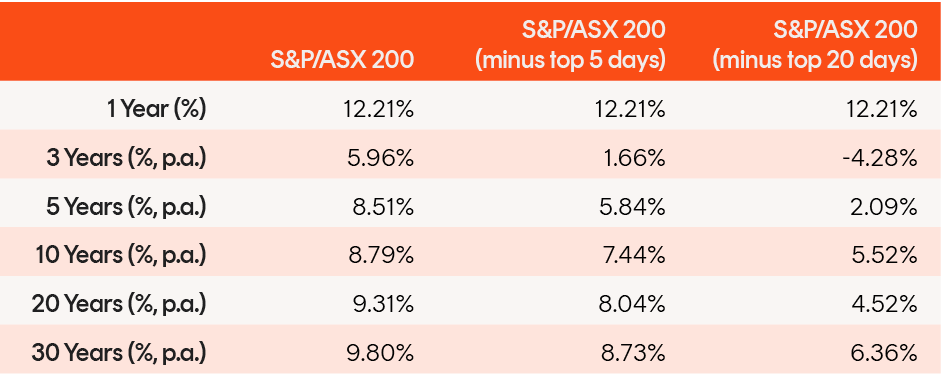

We crunched the numbers using the S&P/ASX 200 (INDEXASX: XJO) benchmark index, and our analysis showed just how big a difference it can make when investors miss out on a handful of the biggest rallies.

Source: Bloomberg, Betashares. As at 31 January 2023. Past performance is not indicator of future performance. Top five and top 20 days since over the last 30 years have been removed from the respective data sets. None of these days occurred in the past year so one year returns are unaffected.

This might seem like ‘cherry-picking’, but in reality, if you tried market timing, there’s a good chance you’d miss out on some of the biggest rallies.

Humans have a tendency to avoid loss, (called loss-aversion bias) which can cause investors to throw their strategy out the window and sell when markets turn bad.

However, this can be precisely the worst time to sell, as the biggest rallies can happen in the middle of major market falls (see table below).

And the more of those big rallies that you miss out on, the lower your gains over the long term.

The 20 biggest 1-day rallies have occurred during or soon after a major crash

Source: Bloomberg, Betashares. As at 31 January 2023. Past performance is not indicator of future performance.

In contrast, by staying invested in the benchmark share market index, you would automatically capture all market movements, which over time may prove to be advantageous.

Independent research points to the same result

It is not just our research that is coming to this conclusion.

A recent paper from JPMorgan Chase & Co (NYSE: JPM), Is market timing worth it during periods of intense volatility? revealed that timing the market is almost impossible to achieve given that good and bad trading days fall so closely together.

JPMorgan Chase & Co (NYSE: JPM)

As at the end of 2021, seven of the best days in the US had occurred within two weeks of their corresponding worst day; but often the gap between the best and worst days was much shorter.

For example, March 12, 2020 was the second-worst day of the year in US share markets, yet that was immediately followed by the second-best day of the year.

JP Morgan’s study found that the worst days overwhelmingly occurred before the best days: over the last 20 years, six of the seven best days occurred after the worst day.

The close proximity of the best and worst days makes it virtually impossible to buy shares at the bottom before they climb again as most people are not that quick or lucky.

In other words, it is very unlikely that an investor could be lucky enough to consistently miss the worst days while being invested in the market for the best days.

JP Morgan’s final thought is this:

“It is important to remind investors that success is achieved through time in the market, not timing the market. And, to quote Dolly Parton, ‘If you want the rainbow, you gotta put up with the rain’.”

We’d have to agree with that.

The pain of missing out

Separate research from the Schwab Center for Financial Research, Does Market Timing Work? found that even badly timed stock market investments were much better than having no share market investments at all.

That’s because investors who procrastinate and do nothing are likely to miss out on the stock market’s potential growth.

According to their research,

“Procrastination can be worse than bad timing. Long term, it’s almost always better to invest in stocks—even at the worst time each year—than not to invest at all,”

“Given the difficulty of timing the market, the most realistic strategy for the majority of investors would be to invest in stocks immediately.”

If you don’t have a large single sum to invest or like the discipline of investing small amounts regularly, then dollar-cost averaging can assist in mitigating market timing risk and can help you gradually accumulate wealth.

Similar to a regular savings plan, dollar cost averaging involves investing the same amount of money at set intervals over a long period – whether market prices are up or down.

The key takeaway

It is almost impossible to time the market consistently whether it is over a short-term time frame or over the long-term.

Instead, investors should consider having a well-diversified portfolio and holding it over the long-term.

ETFs are well suited to this investment approach by providing a convenient, cost-effective way to get exposure to all the major asset classes. ETFs track benchmark indices for various markets, including Australian and global equities, fixed income, cash and commodities.

You can use ETFs to build the core of your portfolio – investments that will provide your portfolio with a foundation for the long term, through the market’s up and down cycles. For example, the Betashares Australia 200 ETF (ASX: A200) provides exposure to the largest 200 companies on the ASX at an annual management cost of just 0.04% – making it the world’s lowest-cost Australian shares ETF*.

Betashares Australia 200 ETF (ASX: A200)

So you can sit back and enjoy your investment growing over time, without trying to time the market.

*Source: Bloomberg, based on expense ratios of Australian shares ETF based in Australia or on overseas exchanges as at 22 February 2023, Additional fees and costs, such as transactional and operational costs, may apply. Refer to the Product Disclosure Statement for more information.