Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.20% to 7206.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

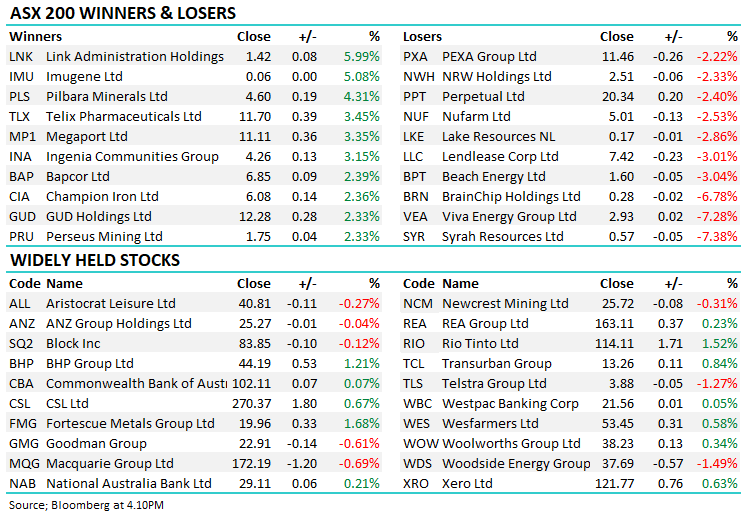

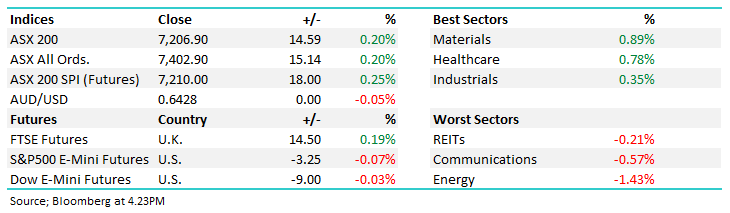

A similar trend to yesterday played out today where weakness in the morning attracted buyers, the ASX200 finishing +50pts up from the session lows to end higher ahead of key US Inflation data due out Wednesday.

- The S&P/ASX 200 put on +14pts/ +0.20% to 7206 – again finishing on the day’s highs + a long way from the lows = bullish

- The Materials sector was best on ground (+0.89%) while Healthcare (+0.78%) finally bounced.

- Energy (-1.43%) the biggest drag while Communications (-0.57%) & Property (-0.21%) fell.

- We’re going to cover Telstra Group Ltd (ASX: TLS) tomorrow morning, specifically why the stock has pulled back ~10% from recent highs and what we intend to do. For our notes on Telstra, click here

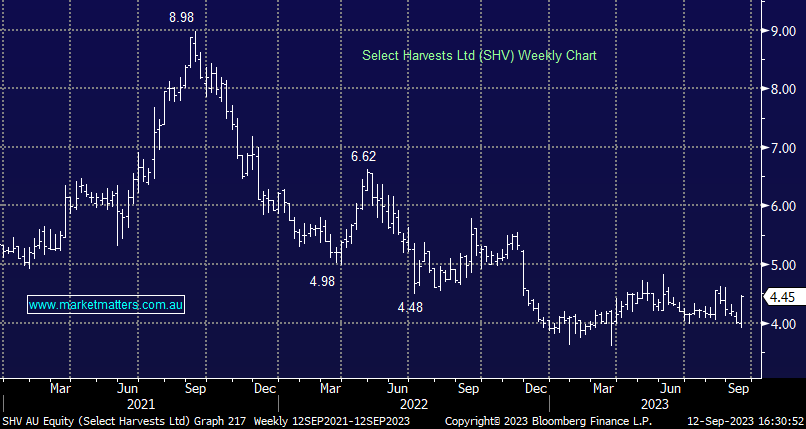

- Select Harvests Ltd (ASX: SHV) +10.42% rallied after the Almond producer talked up their 2024 crop – a trend we’ve seen in the past that often doesn’t materialise – more on this below.

- Viva Energy Group Ltd (ASX: VEA) -7.25% fell on an AFR report saying Vitol is looking to reduce its 40.85% in the fuel retailer/refiner.

- Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) +2.14% rallied as their Sime Darby partnership has shortlisted candidates for the sale of their hospital unit. We own RHC in our Flagship Growth Portfolio and its been a drag of late.

- Gina Rinehart’s Hancock Prospecting confirmed they own 7.72% of Liontown Resources Ltd (ASX: LTR) -0.33%, the share price move implying that she just wants a seat at the table as the Albemarle deal progresses at $3 per share.

- Resmed CDI (ASX: RMD) +1.54% saw a rare day of green as the take up of weight loss drugs, and their potential (positive) impact on sleep apnea continues to split the market.

- Platinum Asset Management Ltd (ASX: PTM) -7.19% fell despite UBS calling time on their SELL Call – it’s been a good one. PTM put through a FUM update on Thursday at 5.49pm….suffice to say it was not a good one.

- Gold was down $US3 trading at US$1922 at our close.

- Asian stocks were mixed, Hong Kong flat, Japan +0.96% while China was off -0.13%

- US Futures are flat, not much doing there!

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Select Harvests Ltd (ASX: SHV) $4.45

SHV +10.2%: a strong day for the almond business, its best session in 4 weeks thanks to the company presenting a more bullish outlook in an update to the market.

They have faced a number of different issues over the last few years with the almond price underperforming expectations, too much rain, not enough rain and issues with the bee population which hindered output.

They spoke to a potential improvement in the crop for the 2024 harvest on the back of El Nino in the update today which caught the eye of the market, saying the dip in 2023 is expected to be a one-off issue and project a 30% increase in yields from there.

Almond prices remain around $6.50/kg and we are unlikely to see a significant increase near term, however, the company is confident of seeing $8/kg+ over the longer term.

Select Harvests Ltd (ASX: SHV)

Broker Moves

- Platinum Asset Raised to Neutral at UBS; PT A$1.25

- Sims Raised to Neutral at Citi; PT A$14.30

- DMP AU Rated New Neutral at Evans & Partners Pty Ltd; PT A$49.10

- CSR Rated New Hold at Morgans Financial Limited; PT A$6.30

Major Movers Today