Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.46% to 7186.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

After a muted open, shares were well supported on the local index today.

It seems buyers held back yesterday with the US Inflation data last night, but once that print had passed, it was mostly a one-way street higher. Resources were the main contributors, helped by a strong iron ore price, which continues to defy the bears.

Banks were also well supported, particularly following strong local jobs data.

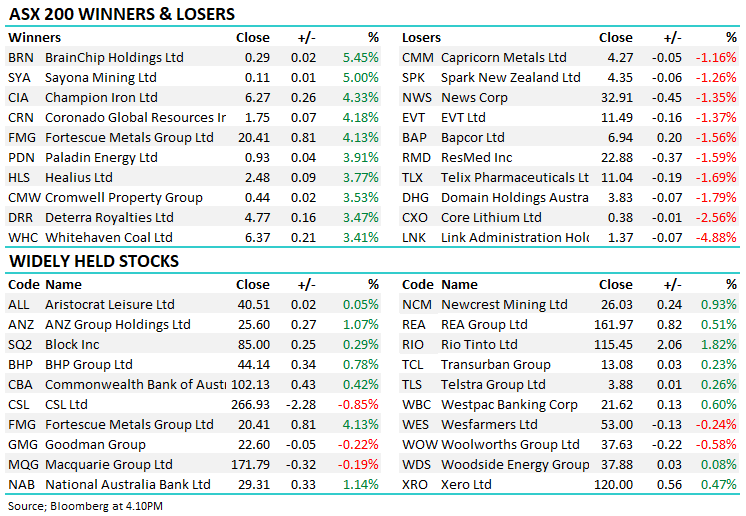

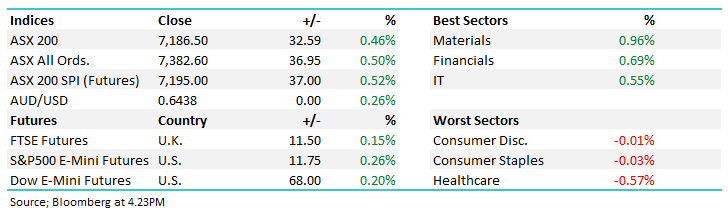

- The ASX 200 added +32pts/ +0.46% to 7186.

- The Materials sector was best on ground (+0.96%) while Financials (+0.55%) & Tech (+0.55%) were also notable gainers.

- Healthcare (-0.57%) was the major laggard today. Both consumer sectors finished lower as well, though only marginally so.

- Employment data at 11.30 AM was strong – Unemployment stayed at 3.7% as expected, although new 65k new jobs were added, a big beat on the 25k expected, which forced the Participation Rate climb to 67%

- Local shares initially sold off on the print given the implications of a strong jobs market means the chance for more hikes (or slower cuts), however, the buyers stepped up. It is close to the perfect print for a soft landing in the economy!

- Uranium stocks stormed higher as the spot price hit the highest level since 2011. Utilities have been drawing down inventory levels, but now have to chase supply. We own Paladin Energy Ltd (ASX: PDN) in two portfolios and Cameco Corp (NYSE: CCJ) in the International Portfolio. Boss Energy Ltd (ASX: BOE) and Deep Yellow Limited (ASX: DYL) were the best in the space today, both up more than 8%.

- The energy sector was well supported, mostly through Coal stocks. Oil has had plenty of support over recent weeks on continued warnings of a lack of a supply.

- Myer Holdings Ltd (ASX: MYR) +1.59% announced FY23 results today which were broadly in line with expectations. More on that below.

- Downer EDI Ltd (ASX: DOW) +1.44% snagged a new contract with the Australian Government, potentially worth up to $750m.

- Sandfire Resources Ltd (ASX: SFR) -0.16% negotiated a $US60m increase to their project financing for Motheo, looking to expand copper production at the mine to 5.2Mtpa.

- Ramelius Resources Ltd (ASX: RMS) flat grew their resource base by 23% in an update today. Its shares lagged gold peers through.

- Iron Ore rallied to over $US120/t, hitting a 6 month high. Fortescue Metals Group Ltd (ASX: FMG) saw the best of the gains, up +4.13%.

- Gold was flat at US$1907 at our close, but most gold stocks were higher today.

- Asian stocks were down, Hong Kong off -0.22%, Japan -0.52% while China was off -0.70%

- US Futures are higher. S&P Futures pointing to a 0.3% gain, while tech should start better as the Nasdaq futures are +0.45%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

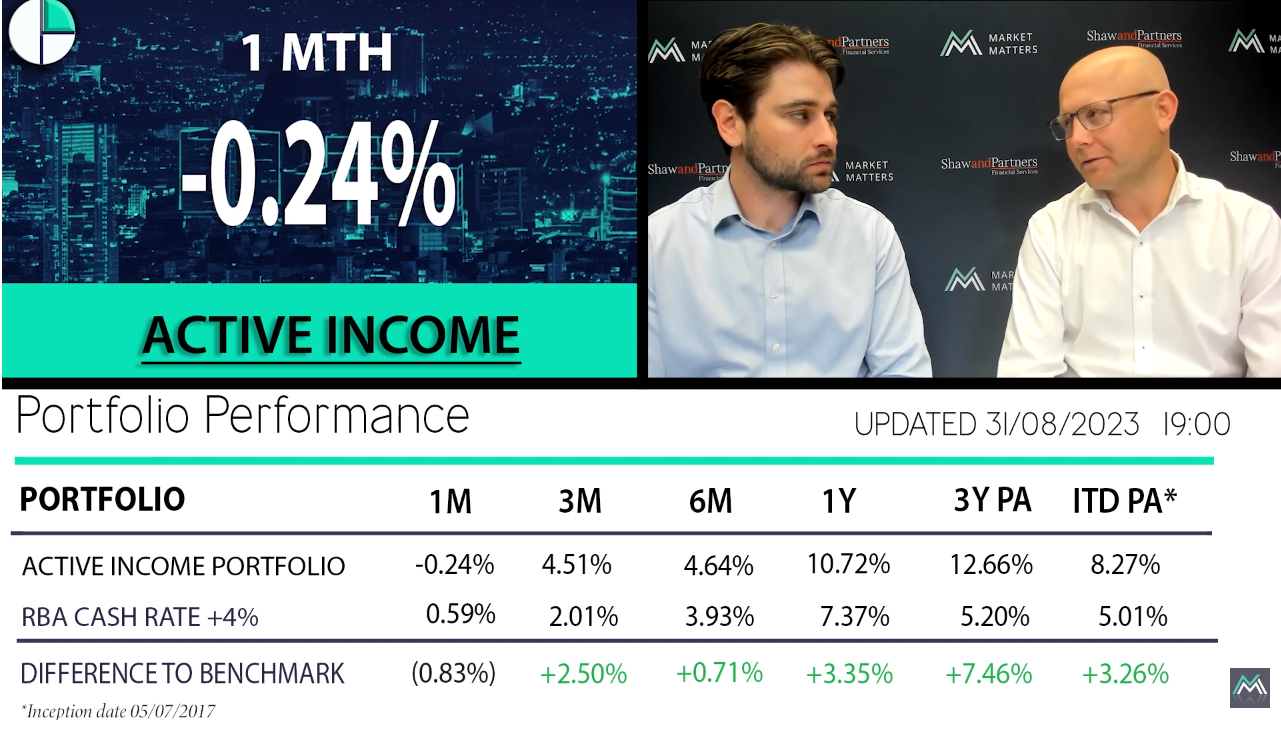

Market Matters video update for August 2023

Portfolio Managers James Gerrish & Harry Watt recap local reporting season, key trends and importantly, how the suite of Market Matters published portfolios performed during the month – a tougher one for most portfolio with 3 of 4 mildly underperforming benchmarks.

Portfolio Managers James Gerrish & Harrison Watt

Myer Holdings Ltd (ASX: MYR) 64c

MYR +1.59%: the department store company was out with FY23 results today given they run to a July year end.

The numbers were broadly in line with expectations as sales jump 12.5% to $3.36b and profit up 18% to $71m, mostly driven by a strong 1H where an improved strategy and strong consumer spending supported earnings.

The result was hindered by some restructuring costs, a soft AUD and theft, though broadly as expected given the company provided a trading update 6 weeks ago.

FY24 has started slowly with comparable sales -1.9% while the company remains “cautious about the macro-economic environment,” continuing the theme we saw throughout the reporting period.

Consensus expects a ~7% drop in revenue and a ~25% fall in profit this year.

Myer Holdings Ltd (ASX: MYR)

Broker Moves

- Select Harvests Ltd (ASX: SHV) Cut to Neutral at UBS; PT A$4.70

- Incitec Pivot Ltd (ASX: IPL) Cut to Sell at Citi; PT A$2.90

- Australian Clinical Labs Ltd (ASX: ACL) Rated New Neutral at Macquarie

Major Movers Today