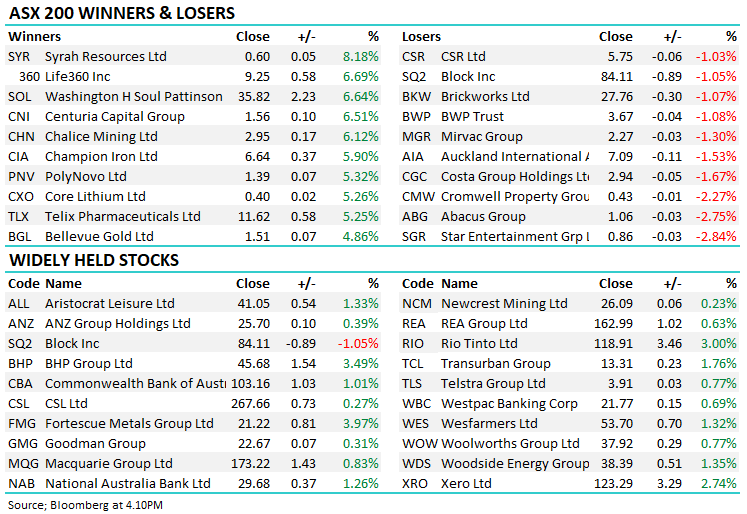

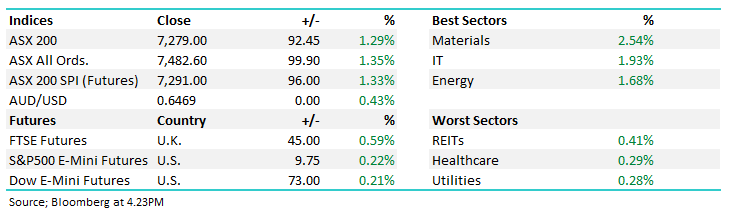

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.29% to 7279.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

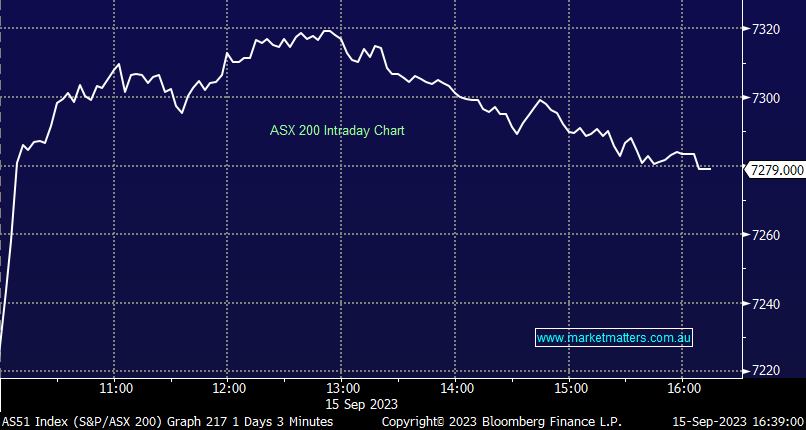

The stars aligned for a strong finish to the week, and the ASX delivered with its best one-day rally in more than 8 weeks today.

All sectors were higher today, led by a resurgent materials sector thanks to strong commodity prices. It was a very broad-based rally today with 80% of the S&P/ASX 200 (INDEXASX: XJO) finishing higher with money keen to pile into the market.

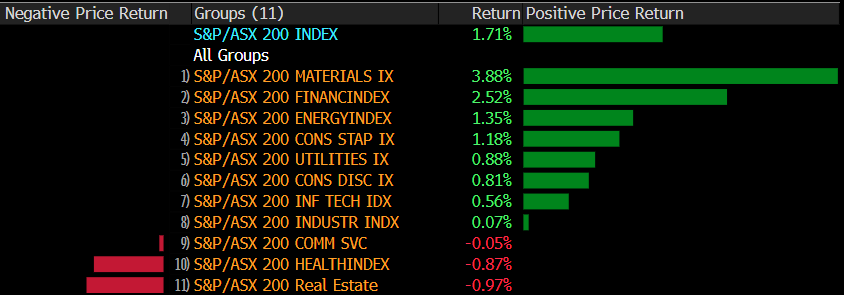

The index posted a gain of 122pts/+1.71% this week, recouping the losses of last week.

- The ASX 200 added +92pts/ +1.29% to 7279.

- The Materials sector was best on ground (+2.54%) while Tech (+1.93%), Energy (+1.68%) & Consumer Discretionary (+1.09%) were also notable gainers.

- While still closing higher today, Utilities (+0.28%) and Healthcare (+0.29%) were the key laggards.

- Data out of China was strong as Industrial production (+4.5% YoY) and Retail Sales (+4.6% YoY) were better than expected, further supporting the rally, particularly in China-facing stocks. The buying followed on from yesterday’s surprise stimulus in the form of a cut to the Reserve Requirement Ratio (RRR)

- Metcash Limited (ASX: MTS) -0.54% hosted their AGM today. Sales YTD were up +6% for food ex-tobacco, +3.2% for Hardware and +1.7% for Liquor. Tobacco sales (-11%) have been impacted by illicit trade while further signs of consumer weakness have been noted despite the growth so far in FY24.

- Novonix Ltd (ASX: NVX) +37.96% continues to surpass targets at their Tennessee battery facility with costs, volumes and sustainability numbers in line with expectations, lifting production capacity targets.

- Qantas Airways Limited (ASX: QAN) +0.36% took another hit, the ACCC rejecting their collaboration with China Eastern today.

- Telco data showed Telstra Group Ltd (ASX: TLS) and TPG Telecom Ltd (ASX: TPG) are losing market share, mostly to Aussie Broadband Ltd (ASX: ABB) and Vocus Group Limited (ASX: VOC).

- Iron Ore rallied a further 1.51% in Asia today taking Rio Tinto Ltd (ASX: RIO) to a one-month high, up 3% in the session.

- Gold was up 0.4% to US$1919 at our close, most gold stocks enjoyed the move.

- Asian stocks were mostly higher, Hong Kong +1%, Japan +1.1% while China was off -0.50%

- US Futures are higher, all by around 0.2%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Clean Seas Seafood Ltd (ASX: CSS) Rated New Buy at PAC Partners

- Monadelphous Group Ltd (ASX: MND) Raised to Overweight at Jarden Securities

- Myer Holdings Ltd (ASX: MYR) Cut to Reduce at CLSA; PT 64 Australian cents

Major Movers Today