Oh. My. God. Becky, did you see the RPMGlobal Holdings Ltd (ASX: RUL) share price this month?!? RPM Global is down 7%! What do I do now…

On this extremely boring episode of The Australian Investors Podcast, Chief Investment Officer Owen Rask and financial adviser Drew Meredith, CFP are BACK answering your questions.

Plus! Dr Andrew Deremith, ESQ, joins us LIVE from his New York City junket tour. It’s incredible podcasting.

Your hosts could be anywhere in the world — seriously — and they won’t miss answering your questions on a Saturday morning.

This week, Drew Meredith and Owen Rask cover topics like:

- Different currency hedging strategies – is it time to hedge my USD? Check out our AUD currency hedging chart.

- What the f$%k is up with RPMGlobal (ASX: RUL) – it’s down 7% this month?

- Is Simply Wall Street the poor man’s version of Tikr? What else would you recommend?

- How I saved 1.8% on my mortgage 😱

- Direct Aussie stocks or ETFs?

Plus, we cover results from the latest Rask survey

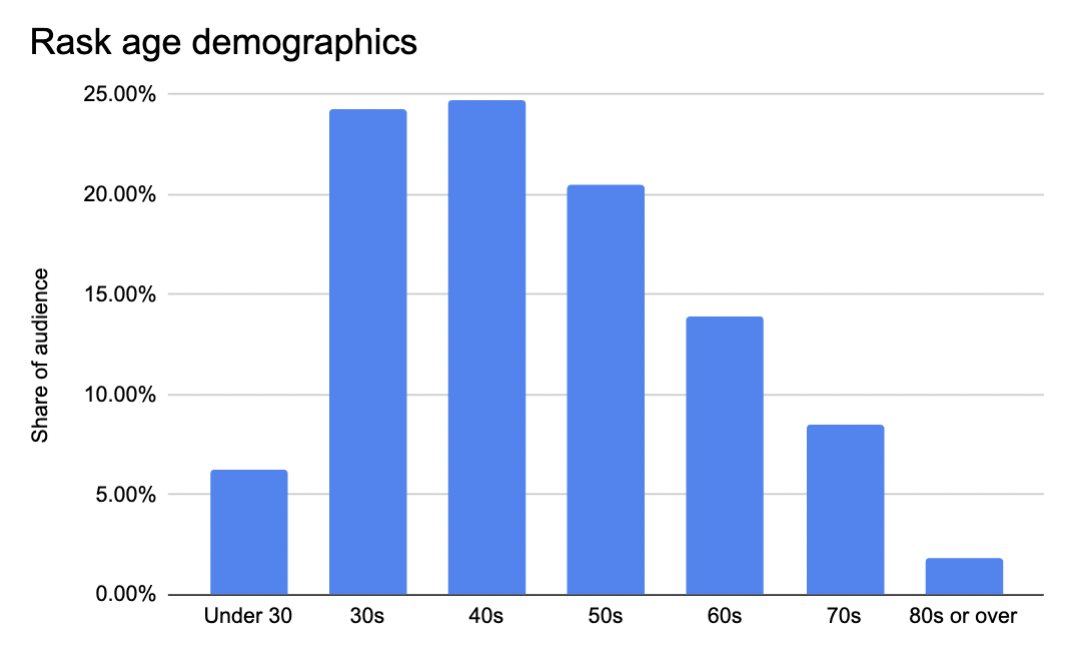

1. Rask has more members and readers in the 70s, than 20s!

Maybe the young’uns don’t like surveys. Either way, the proportion of 70 and 80+ year olds at Rask is nearly double (10.3%) those under 30 (6.3%). We’ve got our work to do!

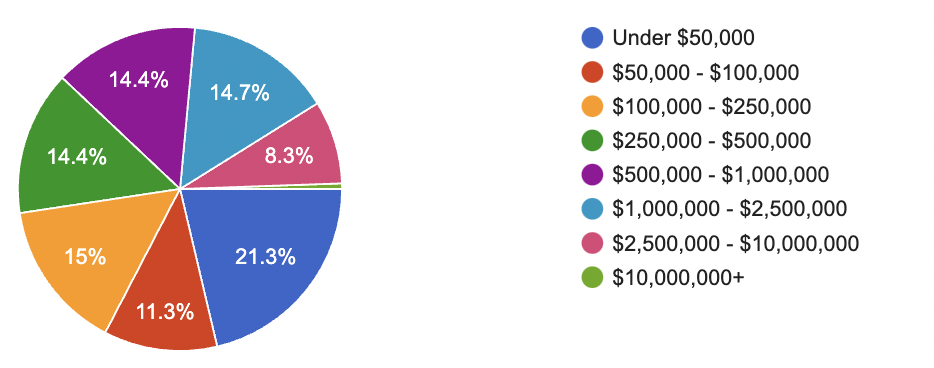

2. The average Raskle has ‘investable’ assets of around $620,000. Technically, this figure should exclude the primary home. It’s a great sign!

3. That $620k, is estimated AFTER we exclude the ~0.6% of folks who say they have more than $10 million to invest. A further 8.4% have between $2.5 million and $10 million. These are all big numbers because…

4. For every 1,000 Rask investors, the investable assets are a staggering $644 million!

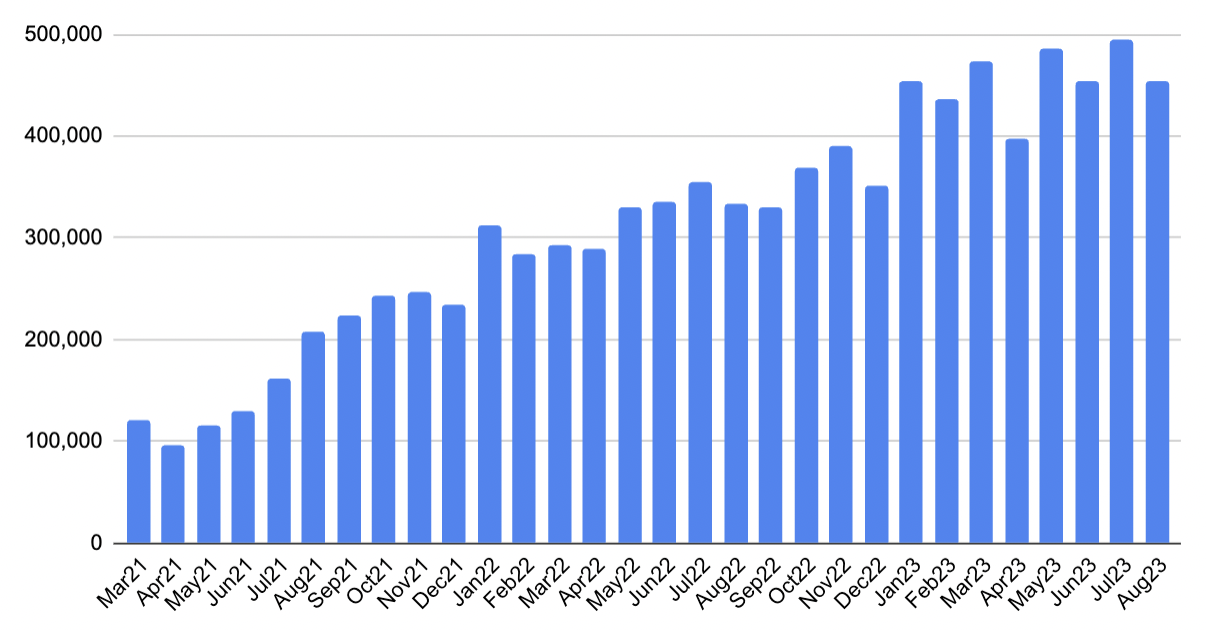

Podcast downloads 👇

5. Keep in mind, Rask has over 170,000 unique podcast listeners, plus tens of thousands of newsletter readers, and 23,000 students, and over 4,300 members! You can do the math… (it’s probably around $100 billion)

6. The average age of a Rask investor is 48.

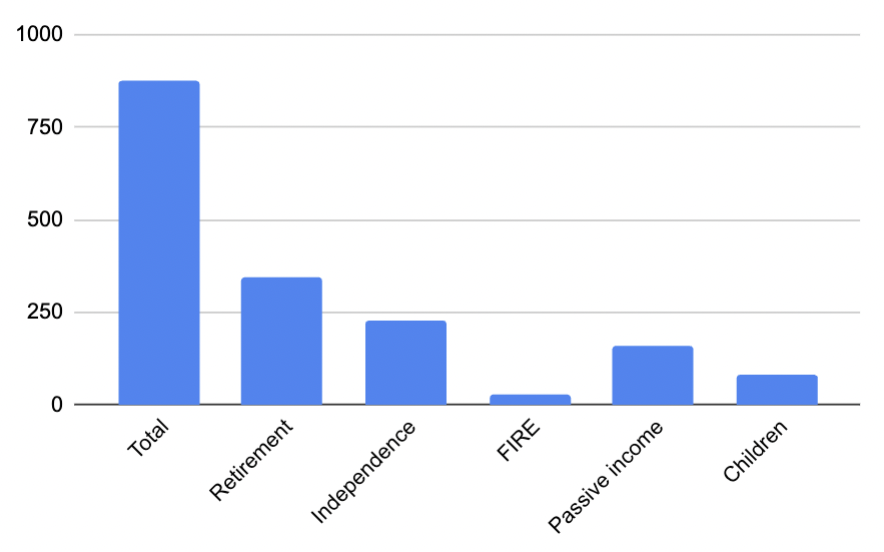

7. 39% of Raskles invest principally for “retirement”. While most of these preferences are related, around 26% of folks say some version of “Independence” rather than retirement. Only 2.9% mentioned “FIRE” specifically (Financial Independence Retire Early).

8. Passive income is a clear favourite amongst investors, with 18% of respondents making it clear this was their purpose for investing. Who says Aussies don’t love franking credits!

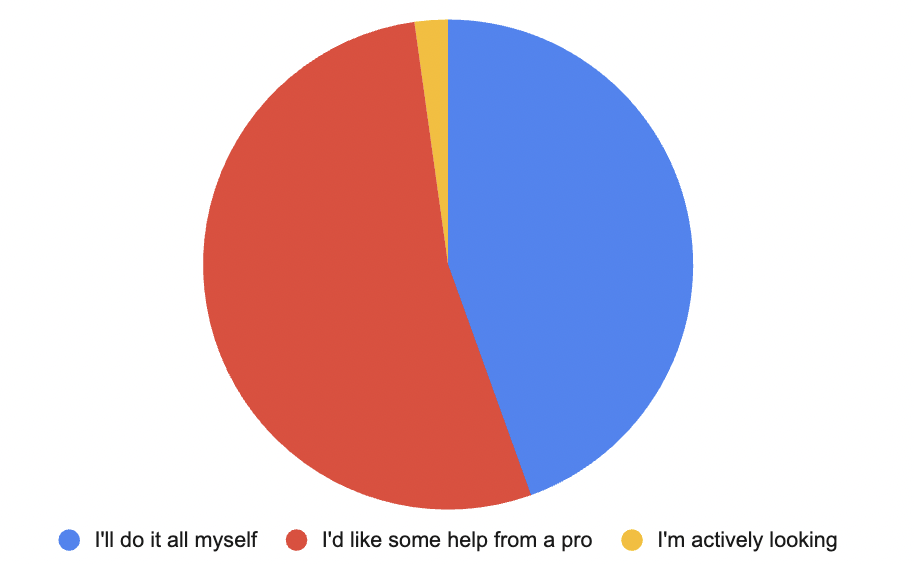

9. 44% of the Rask community say they will not use a portfolio professional (investment adviser, planner, broker, etc.). I reckon most will surprise themselves.

10. Over half (53%) want some help with their portfolios.

11. 2.2% are looking for professional help right now.

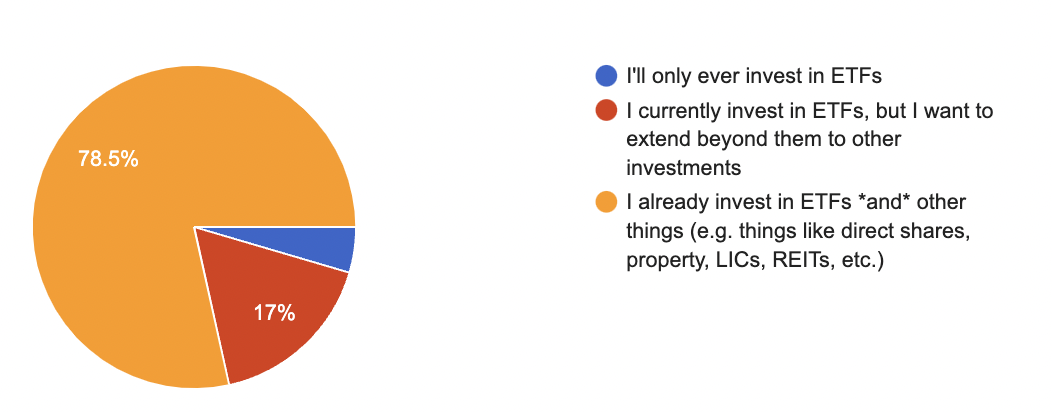

12. 78% invest in more than ETFs (direct shares, managed funds, property, LICs, REITs, etc.).

13. Finally, of those under 30, around 3.6% have $2.5+ million (mostly through agriculture or inheritance) and 10% have $250,000. That’s fantastic, but also a big responsibility. It’s incredible to see so many in their 20s with meaningful balances ($50k+).

We have heaps more data from over the years. For example, we know around 77% of the Rask audience invest in shares and around 75% own ETFs.