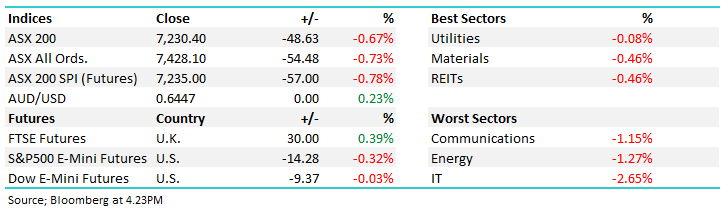

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.67% to 7230.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

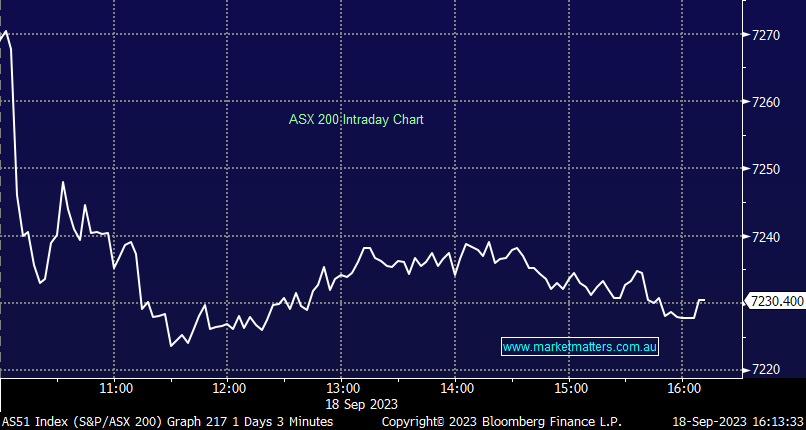

Friday’s rally seems a distant memory with the ASX coming back to earth with a thud, giving back around half the gains made in the prior session as IT stocks keyed off weakness in the US courtesy of higher Treasury yields to lead todays weakness.

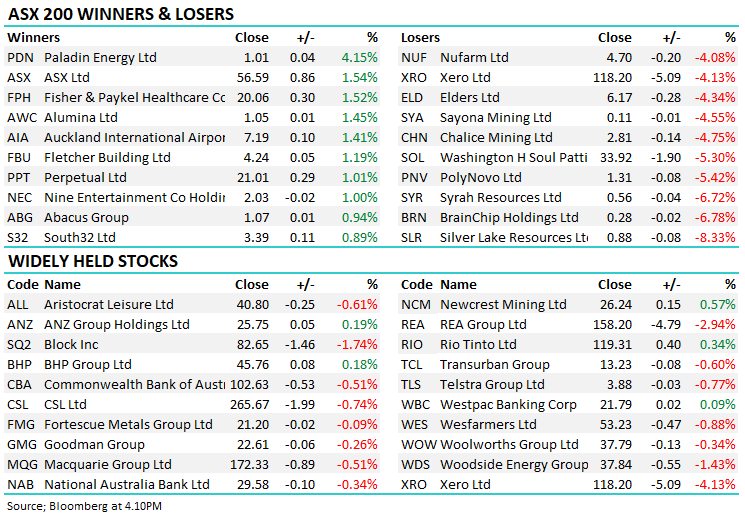

- The ASX 200 fell -48pts/ -0.67% to 7230

- The Utilities sector was the best relative performer (-0.08%) however all sectors on the ASX closed lower with 80% of stocks finishing in the red.

- IT (-2.65%), Energy (-1.27%) & Communications (-1.15%) the weakest links.

- Uranium stocks bucked the trend and continued their run with Paladin Energy Ltd (ASX: PDN) +4.15% to close at $1.01. Click here for our latest thoughts on PDN.

- Worley Ltd (ASX: WOR) -1.45% dipped back under $17 despite a broker upgrade at All Ordinaries (INDEXASX: XAO) to a buy-equivalent and $22 price target.

- Whitehaven Coal Ltd (ASX: WHC) -0.9% confirmed they are in the running to acquire BHP Group Ltd’s (ASX: BHP) major Daunia and Blackwater coal mines in Queensland.

- Costa Group Holdings Ltd (ASX: CGC) -3.4% fell after Paine Schwartz Partners reduced its proposed takeover offer to $3.20, framing it as best and final – they had previously bid $3.50.

- A2 Milk Company Ltd (ASX: A2M) -1.12% was lower after they cancelled its long-running exclusivity deal with supplier Synlait Milk Ltd (ASX: SM1).

- Synlait (SM1) -8.47% fell to an all-time low on the news, although they retained FY23 guidance. They closed today $1.08, down from a Dec 22 high of $3.60.

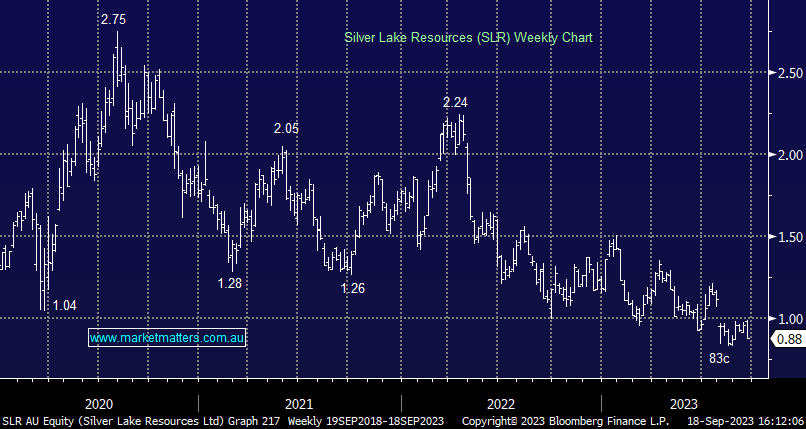

- Silver Lake Resources Ltd (ASX: SLR) -8.33% dropped after disclosing it was the buyer of an $84m trade in Red 5 Limited (ASX: RED) this morning

- David George, CEO at Magellan Financial Group Ltd (ASX: MFG) +0.21% bought 25k shares + invested capital across a selection of their funds in on-market transactions. MFG closed today at $9.49.

- Elders Ltd (ASX: ELD) -4.34% fell away on no news we could see. This is a stock we recently exited for a loss.

- ASX Ltd (ASX: ASX) +1.54% is a stock we’ve kept on the radar even though we’ve removed it from our Income Portfolio Hitlist, the market operator will turn at some point, and downside momentum is showing signs of exhaustion.

- Iron Ore was flat in Asia, still holding above $US120/mt

- Asian stocks were mixed, Hong Kong off -0.91%, Japan -0.63% while China was up +0.25%

- US Futures are lower, off around 0.3%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Whitehaven Coal Ltd (ASX: WHC) $6.61

WHC -0.9%: The coal miner has today confirmed what has been suspected since suspending the share buy-back at their recent results, that they are in the running to acquire BHP’s major Daunia and Blackwater coal mines in Queensland. WHC said it was “participating in the sale process” for the two coking coal mines, and

“The board will make a decision regarding resumption of the share buy-back at the appropriate time”

The mines are worth an estimated ~$5bn so it’s a big deal, although we’d suspect it would be a partnership approach to any transaction.

Whitehaven Coal Ltd (ASX: WHC)

Silver Lake Resources Ltd (ASX: SLR) 88c

SLR -8.33%: the gold miner gave up early gains after disclosing it was the buyer of an $84m position in Red 5 (RED) this morning. The 11% stake traded at 26c, an 18% premium to Friday’s close.

Silver Lake said the purchase was strategic, getting them a seat at the table of the junior gold miner and leaving the door open for a potential takeover.

Red 5 owns the King of the Hills and Darlot mines near Leonora in WA with a total Mineral Resource estimate of 6.2Moz as of June 30.

There have been a number of assets changing hands in the area over the last year, the most recent being Genesis Minerals Ltd (ASX: GMD) buying St Barbara Ltd‘s (ASX: SBM) Gwalia mine last year.

Silver Lake unsuccessfully tried to squeeze their way into that deal, now turning their attention elsewhere, putting some of the $333m cash and bullion available as at 30 June to work.

A deal would make sense here given the company already has significant exposure in the region with the processing capacity at King of the Hills likely the key interest for Silver Lake.

Silver Lake Resources Ltd (ASX: SLR)

Broker Moves

- Fisher & Paykel Healthcare Corporatn Ltd (NZE: FPH): F&P Healthcare Raised to Neutral at Forsyth Barr; PT NZ$21.45

- Super Retail Group Ltd (ASX: SUL): Super Retail Reinstated Equal-Weight at Morgan Stanley

- WOR: Worley Rated New Outperform at RBC; PT A$22

- Seven Group Holdings Ltd (ASX: SVW): Seven Group Rated New Buy at Bell Potter; PT A$33

Major Movers Today