Happy Thursday!

Thank you so much to the ~1,000 people who took 60 seconds to fill in our research survey from last week. It really helps me out.

(Haven’t taken it? You can still do it by clicking here).

Your support gives me, and the Rask team, so much confidence in what we are building behind the scenes. The final paperwork is being drawn up now, and the tech is being polished off.

So I’ll have an update for you on my what I’m building in coming weeks.

In the meantime…

Survey results

Before we jump into the numbers, a warning: I am no survey expert, so instead of being precisely incorrect with my inferences from this questionnaire, I’ve attempted to make some broad assumptions using the data you volunteered.

Okay, here goes…

The first two data points threw me…

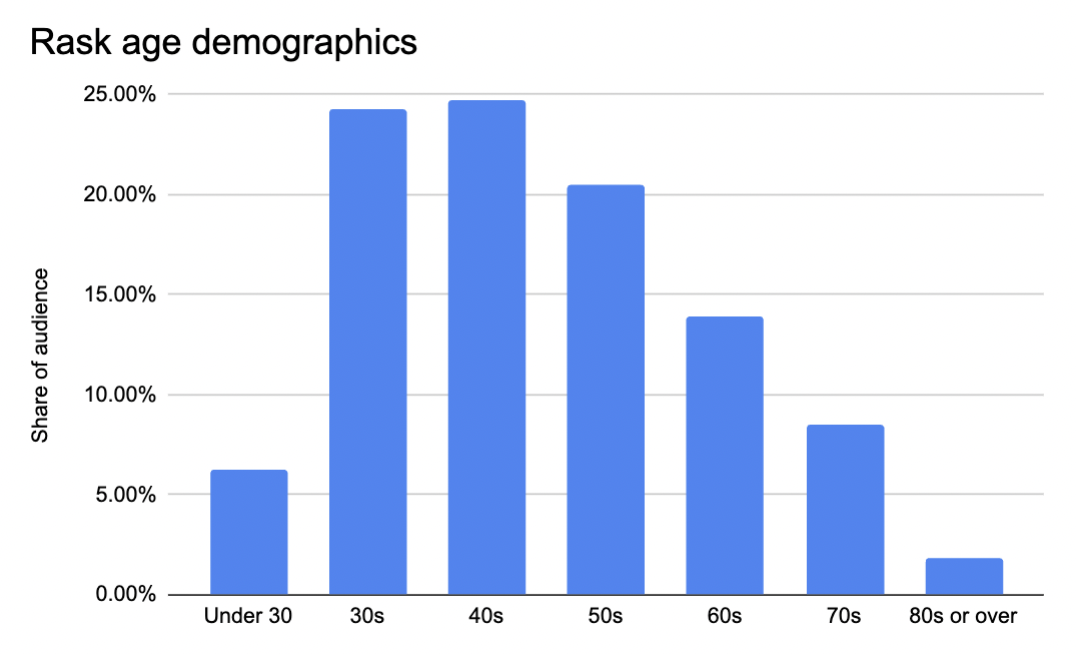

- Rask has more members and readers in the 70s, than 20s!

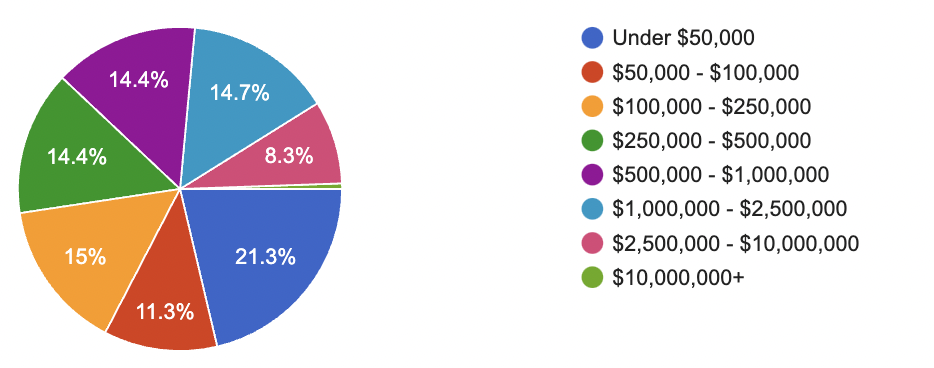

Maybe the young’uns don’t like surveys. Either way, the proportion of 70 and 80+ year olds at Rask is nearly double (10.3%) those under 30 (6.3%). We’ve got our work to do! - The average Raskle has ‘investable’ assets of around $620,000. Technically, this figure should exclude the primary home. It’s a great sign!

- That $620k, is estimated AFTER we exclude the ~0.6% of folks who say they have more than $10 million to invest. A further 8.4% have between $2.5 million and $10 million. These are all big numbers because…

- For every 1,000 Rask investors, the investable assets are a staggering $644 million!

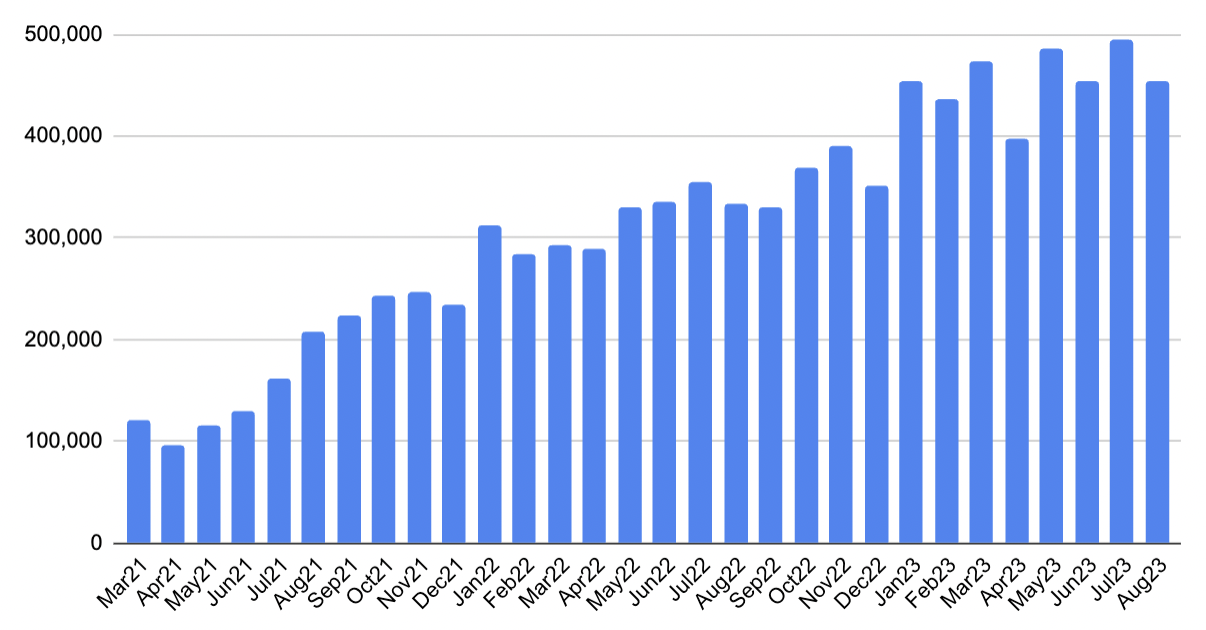

Podcast downloads 👇

- Keep in mind, Rask has over 170,000 unique podcast listeners, plus tens of thousands of newsletter readers, and 23,000 students, and over 4,300 members! You can do the math… (it’s probably around $100 billion)

- The average age of a Rask investor is 48.

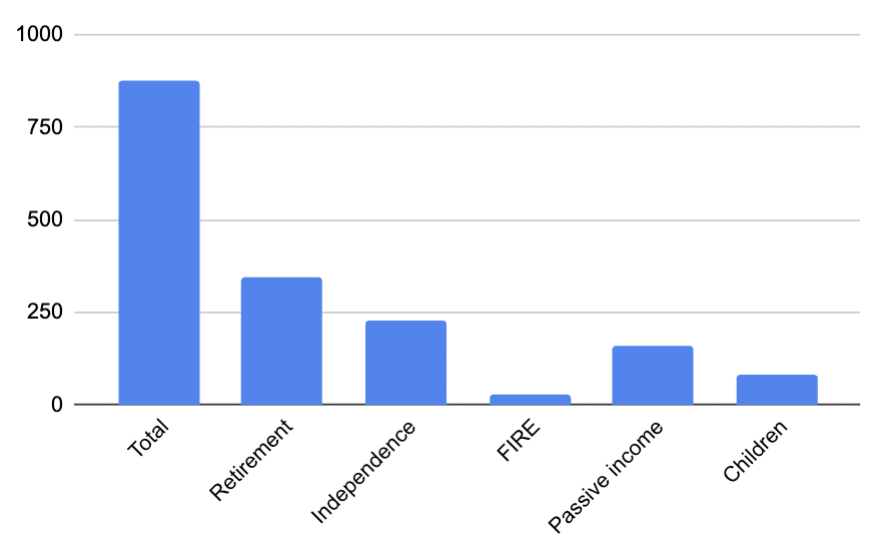

- 39% of Raskles invest principally for “retirement“. While most of these preferences are related, around 26% of folks say some version of “Independence” rather than retirement. Only 2.9% mentioned “FIRE” specifically (Financial Independence Retire Early).

- Passive income is a clear favourite amongst investors, with 18% of respondents making it clear this was their purpose for invsting. Who says Aussies don’t love franking credits!

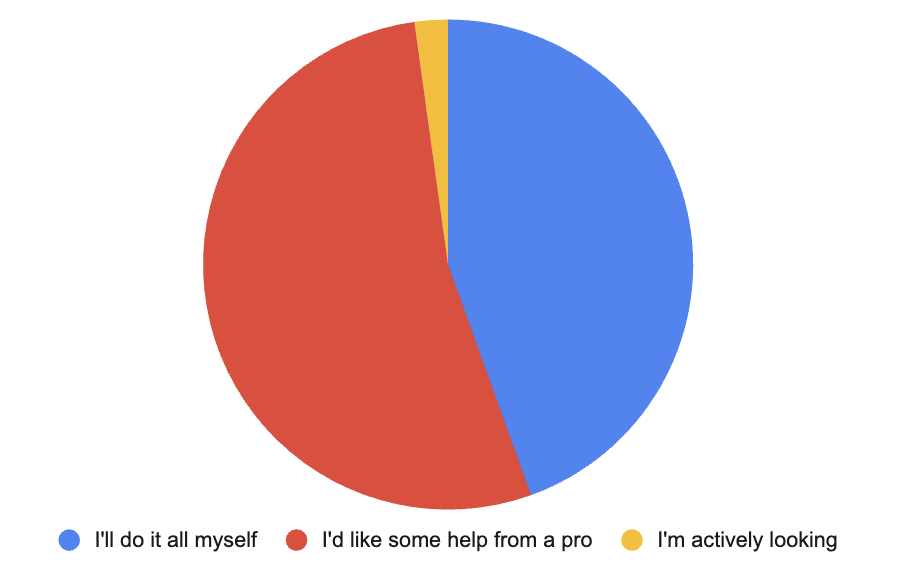

- 44% of the Rask community say they will not use a portfolio professional (investment adviser, planner, broker, etc.). I reckon most will surprise themselves.

- Over half (53%) want some help with their portfolios.

- 2.2% are looking for professional help right now.

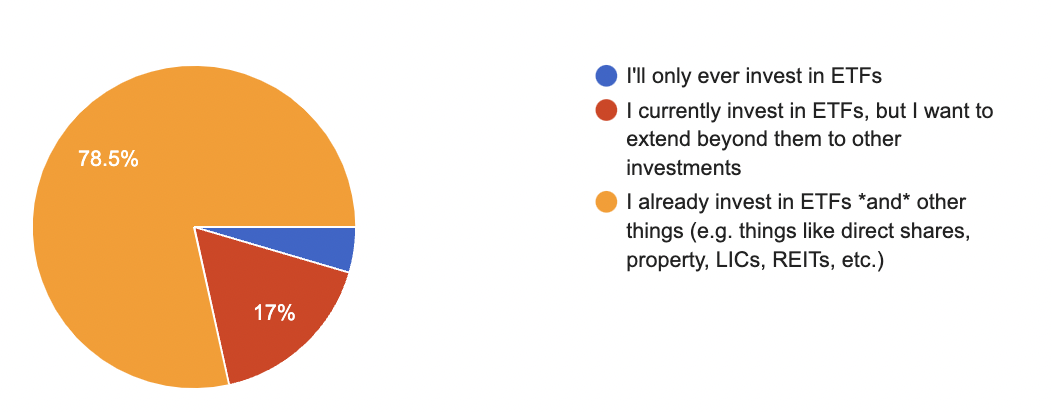

- 78% invest in more than ETFs (direct shares, managed funds, property, LICs, REITs, etc.).

- Finally, of those under 30, around 3.6% have $2.5+ million (mostly through agriculture or inheritance) and 10% have $250,000. That’s fantastic, but also a big responsibility. It’s incredible to see so many in their 20s with meaningful balances ($50k+).

We have heaps more data from over the years. For example, we know around 77% of the Rask audience invest in shares and around 75% own ETFs.

But I’ll leave it here.

Feel free to ask me any questions you want by jumping on next Wednesday’s Rask LIVE (at 12 noon) as I dive into my top 5 ETFs of all time.

Got your Rask Roadshow ticket?

Also, will I be seeing you in Sydney (Oct 3rd), Newcastle or Port Macquarie (next week)?

Please please, bring your family, friend or colleagues along for a fantastic night featuring many of Australia’s biggest and best financial educators and thinkers. Tickets are just $40, or 3-for-2 with coupon code “friends“. Buy them here.

Plus, a one-day-only investor workshop

Finally, here’s a special update — for the first time in 3 years I’m hosting a one-day, intensive value investor session for up to 15 investors. It includes a full day of Q&A with me, plus heaps of extras, like passes to the Value Investor Program (online version, worth $499), 6 months of our membership, free books & merchandise, plus two tickets to the Sydney event!

Serious investors only.

Click here or the image below to get started.