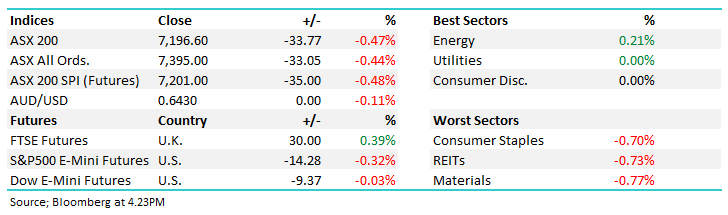

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.47% to 7196.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX is in a holding pattern it seems ahead of a barrage of Central Bank activity headlined by the US Federal Reserve (Wednesday), the Bank of England (Thursday) before Bank of Japan Governor Kazuo Ueda steps up to the plate on Friday.

That saw the ASX open on the back foot this morning and there was no reason to bid up stocks ahead of what are very important decisions on interest rates that will likely have a major impact on how markets trade into the back end of the year.

While it’s easy to conclude that no earth-shattering news will happen, given that’s the consensus call, that in itself (no one expecting a change to the status quo) presents the risk!

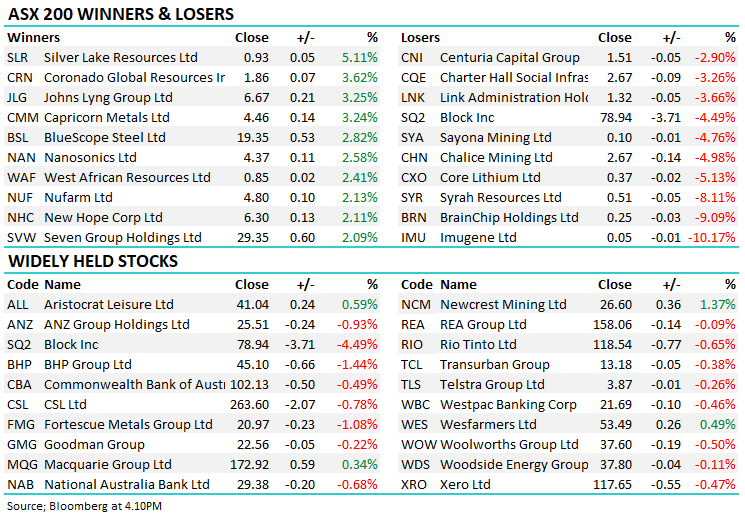

- The ASX 200 fell -33pts/ -0.47% to 7196 – a nothing session really.

- The Energy sector was best on ground (+0.21%) while Utilities & Consumer Discretionary sectors were unchanged

- Materials (-0.77%), Property (-0.73%) & Staples (-0.70%) fought it out for the wooden spoon.

- The RBA minutes from the September meeting were released at 11.30 a.m., a day after new RBA boss Michele Bullock took over. They considered raising rates but held firm based on the observation that interest rates had been increased significantly in a short period and that the effects of tighter monetary policy were yet to be fully realised.

- JPMorgan Chase & Co (NYSE: JPM) for one – and there are multiple others – still expects more tightening, likely in November, to bring down inflation thanks in part to the sharp increase in oil prices.

- Oil prices made fresh 10-month highs overnight – Whitehaven Coal Ltd (WHC) +1.21% & Santos Ltd (ASX: STO) +0.90% higher today, although Woodside Energy Group Ltd (ASX: WDS) lost -0.9% and looks tired.

- Thermal Coal prices out of Newcastle are trading at $US160.75/mt, up from US$130/mt in July, but they’re still less than half what they were at the dizzy heights achieved mid-2022

- New Hope Corporation Ltd (ASX: NHC) +2.11% rallied following impressive FY23 results – a stock we own in the Active Income Portfolio and will cover in more depth in tomorrow’s portfolio positioning report. Profit up 11% and declared a dividend of 30cps fully franked (including a 9cps special).

- Newcrest Mining Ltd (ASX: NCM) +1.37% was higher after Gold prices ticked up + their proposed tie-up with Newmont Corporation (NYSE: NEM) gained FIRB approval. As at the close today, NCM is trading at a 3.8% discount to the implied bid.

- Index changes happened yesterday, we should have covered then: Removed from ASX 200 was Abacus Property Group (ASX: ABP), Abacus Storage King (ABK), Brainchip Holdings Ltd (ASX: BRN), Lake Resources N.L. (ASX: LKE) and Syrah Resources Ltd (ASX: SYR).

- Added to the ASX 200 were Data#3 Limited (ASX: DTL), Genesis Minerals Ltd (ASX: GMD), Neuren Pharmaceuticals Ltd (ASX: NEU), Ramelius Resources Ltd (ASX: RMS) & Weebit Nano Ltd (ASX: WBT).

- Harvey Norman Holdings Limited (ASX: HVN) drops out of the S&P/ASX 100 [XTO] (INDEXASX: XTO), losing its spot to Liontown Resources Ltd (ASX: LTR).

- In the US, grocery retailer Instacart priced its IPO overnight at the top of a marketed range to raise $US660m at $US$30/share, which valued it at $US9.9 bn – their last funding round was done at a $US39 bn valuation back in 2021 – ouch!

- Iron Ore was flat in Asia, still holding around $US120/mt

- Asian stocks were mostly lower, Hong Kong off -0.03%, Japan -0.72% while China fell -0.02%

- US Futures are down, off around 0.2%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

ALS Ltd (ASX: ALQ): ALS Raised to Buy at Jarden Securities; PT A$13.40

Burgundy Diamond Mines Ltd (ASX: BDM): Burgundy Diamond Mines Rated New Buy at Bell Potter

Bannerman Energy Ltd (ASX: BMN): Bannerman Energy Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

Major Movers Today