Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.46% to 7163.30.

Markets @ Midday

: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

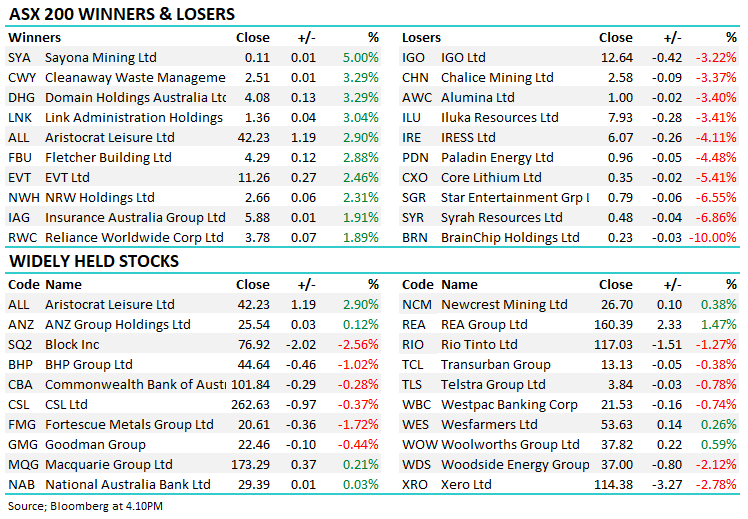

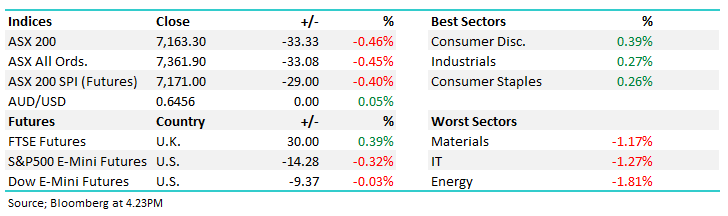

Shares extended their slide to three consecutive days following US markets lower in preparation for tonight’s FOMC meeting.

Commodity-linked sectors of Energy and Materials saw the most pain today while a slight lift in local bond yields also weighed on Tech and Real Estate.

Consumer sectors were surprisingly well supported though, as were Industrials as today’s weakness was not as broad-based as recent days – 40% of the ASX200 managed to close higher despite the index weakness.

- The ASX 200 added -33pts/ -0.46% to 7163.

- The Consumer Discretionary sector was best on ground (+0.39%) while Industrials (+0.27%) and Staples (+0.26%) were solid on a weak day for the market.

- Energy (-1.81%) was the major laggard today, followed by Tech (-1.27%), Materials (-1.17%) and Real Estate (-0.82%)

- Commodity stocks were on the back foot today, particularly energy as oil took a breather from its recent rally. Crude is trading around $US90.50/bbl after trading as high as $US93.50/bbl overnight.

- Uranium fever was also absent today following overnight weakness. Junior uranium stock Alligator Energy Ltd (ASX: AGE) fell -20.59% on its return to normal trade after a $25m capital raise.

- UK Inflation printed a surprise drop in the YoY at our close today, falling from 6.8% to 6.7%. This sparked some late session buying, adding ~10 points to the ASX200.

- The Fed will make their latest US Interest Rate call overnight with a hold priced in. Commentary and the Fed Dot Plot, which shows Fed member’s future rate expectations, following the announcement will be watched closely with Futures suggesting a 30% chance of a hike at the November meeting before cuts start to be priced in from the middle of 2024.

- KMD Brands Ltd (ASX: KMD) -4.55% FY23 results today, hit guidance with record revenue however sales have started slowly in FY24, weighing on shares today.

- Sigma Healthcare Ltd (ASX: SIG) -0.66% 1H numbers were broadly in line with operational improvements lifting earnings. More on that below.

- Qantas Airways Limited (ASX: QAN) -2.2% fell near to 12-month lows the day they announced plans to withhold a portion of departed CEO Alan Joyce’s exit package.

- New Hope Corporation Ltd (ASX: NHC) -2.38% was cut to sell at Citi $5.50 PT following yesterday’s FY23 results – we covered NHC this morning here

- Iron Ore was flat in Asia today, though BHP Group Ltd (ASX: BHP), Fortescue Metals Group Ltd (ASX: FMG) & Rio Tinto Ltd (ASX: RIO) were all more than 1% lower.

- Gold was flat at US$1932/oz at our close, but most gold stocks struggled.

- Asian stocks were down, Hong Kong by -0.35% and Japan by -0.66%.

- US Futures are flat as traders await the Fed.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sigma Healthcare Ltd (ASX: SIG) 75.5c

SIG -0.66%: First-half half results were out from the pharmaceutical goods wholesaler today, coming in broadly in line with expectations though there were positive signs on the cost front.

Revenue for the half was $1.68b, down -8.4% on the back of lower RAT sales and following the sale of their Hospital supply arm.

EBIT rose 315% to $22.4m as solid cost control and operational improvements lifted margins. Despite the strong EBTI result, the company left their FY24 guidance unchanged at $26-31m, despite having covered ~80% in the first half.

The guidance does include one-off costs which the company will have to incur as they prepare to take on the full Chemist Warehouse supply contract from 1 July 2024.

Shares traded in a wide range today as the market looked to price in the near-term impact but longer-term earning potential.

Sigma Healthcare Ltd (ASX: SIG)

Broker Moves

- New Hope Cut to Sell at Citi; PT A$5.50

Major Movers Today