The Resmed CDI (ASX: RMD) share price is down over 30% over the past 12 months as analysts and investors weigh up the long-term impact of GLP-1 treatments on RMD’s obstructive sleep apnea (OSA) market.

Resmed CDI (ASX: RMD)

Stock Doctor’s Senior Analyst Jason Yin has covered the healthcare industry for almost a decade and has summarised his thoughts in a note sent out to our members during the month – which we have provided below for Rask Media readers.

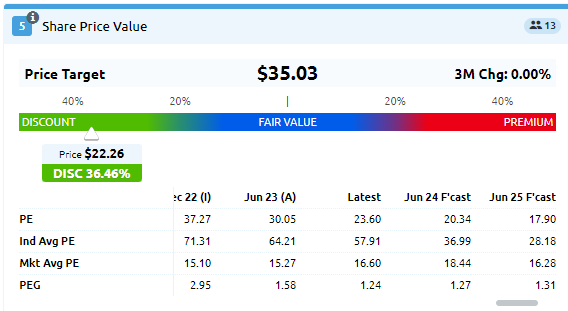

Source: Stock Doctor consensus price target, and forward P/E

Fat chance or silver bullet? Understanding GLP-1 impact on OSA

Resmed’s share price has experienced a significant downturn since its FY23 result. We attribute this sharp decline to rising apprehension surrounding the potential of Glucagon-Like Peptide-1 (GLP-1) treatments.

There has been growing sentiment that such treatments might notably reduce obesity rates. Given that obesity is a primary factor for obstructive sleep apnoea (OSA) diagnoses, the concern is that a decline in obesity might mean fewer OSA cases.

This narrative has generated scepticism regarding the future demand for CPAP machines, a core product for Resmed.

We aim to delve deeper into the intricacies of GLP-1 and determine whether the market’s concerns are well-founded.

Historical context of incretins

Research into incretins, a group of metabolic hormones essential for regulating blood sugar, dates back to the early 20th century.

The two primary incretins are Glucagon-Like Peptide-1 (GLP-1) and Glucose-dependent Insulinotropic Polypeptide (GIP).

The technology behind GLP-1 drugs is not new and was first commercialised by Danish pharmaceutical company, Novo Nordisk A/S (CPH: NOVO-B), in 2012 with the introduction of Ozempic.

Subsequent alternatives have been introduced to the market by American pharmaceutical giant, Eli Lilly And Co (NYSE: LLY).

The role of GLP-1

GLP-1 plays a vital role in post-meal blood sugar management. Its functions include:

- Boosting Insulin Production: After meals, when blood sugar rises, GLP-1 prompts the pancreas to release insulin, aiding sugar absorption by cells.

- Curbing Glucagon Release: GLP-1 helps stabilise sugar levels by modulating the release of glucagon, which increases blood sugar.

- Controlling Digestive Speed: GLP-1 ensures a systematic nutrient release by decelerating digestion, avoiding sudden blood sugar spikes.

- Inducing ‘Fullness’: GLP-1 aids weight management by communicating a sense of ‘fullness’ to the brain, reducing overeating.

GLP-1 analogues, such as Wegovy

and Ozempic, have gained immense attention due to their rapid weight loss effects, making them a popular off-label treatment for swift weight management. These drugs require weekly injections and are priced at around US$1,000 monthly in the U.S.

Alternatives to Wegovy and Ozempic include Trulicity (dulaglutide) and Mounjaro (tirzepatide), both manufactured by Eli Lily. These two drugs are also administered via weekly injections and priced at ~US$1,000 per month in the U.S.

Evaluating GLP-1’s potential influence on CPAP machine demand

Studies have highlighted obesity as a causative factor in about 60% of moderate to severe adult OSA cases.

Theoretically, an uptick in GLP-1 utilisation for diabetes and obesity could decrease OSA diagnoses, potentially affecting CPAP machine demand.

However, several counterpoints exist:

- Weight loss due to GLP-1 treatments is not permanent; many patients regain weight once they stop the GLP-1 regimen.

- The significant monthly costs, paired with possible side effects and resulting insurance challenges, limit GLP-1’s widespread adoption.

The bottom line

Considering the complex relationship between GLP-1 treatments, obesity, and OSA, investors must maintain a balanced perspective.

While GLP-1 treatments may reshape the landscape, they are unlikely to eliminate the demand for CPAP machines materially.

Resmed’s recent share price downturn, in this context, might be more of an impulsive market reaction rather than a reflection of the company’s long-term prospects in the face of evolving medical treatments.

We retain coverage of the company as Star Growth Stock and will continue to assess the risks from GLP-1 going forward.