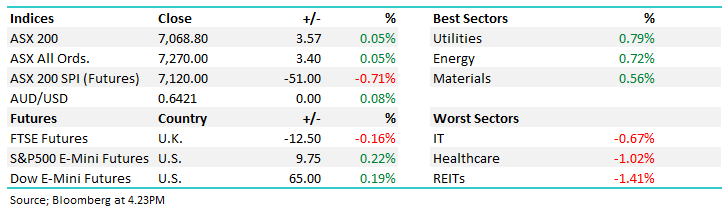

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.051% to 7068.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

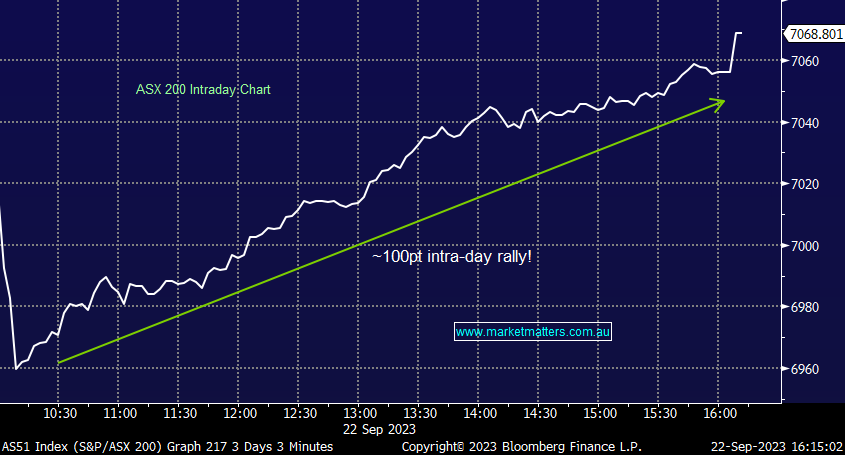

The ASX200 traded below the 7000 level this morning for the first time since March as the risk-off trade continued after the Hawkish update from the Fed yesterday, but a huge intra-day turnaround took hold and the ASX200 ultimately finished marginally higher, rallying +111pts from the morning lows which was simply a phenomenal effort!

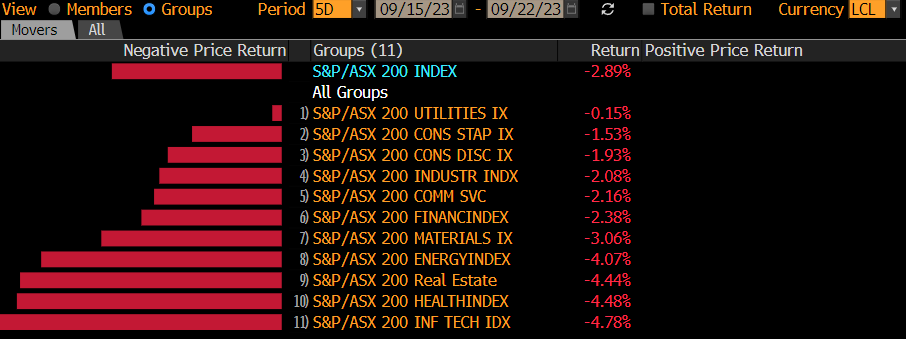

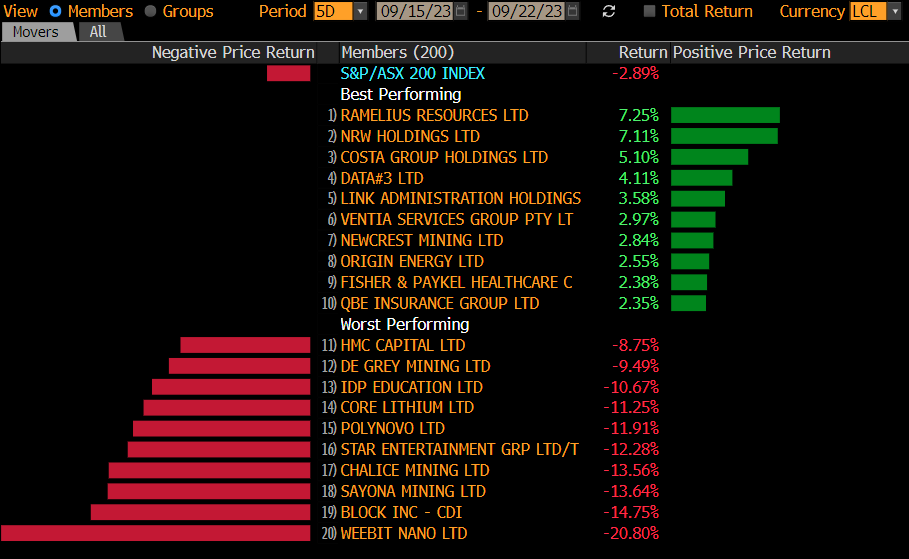

The intra-day buying helped snap a 4-day losing streak, though the index fell by -210pts/-2.89% over the course of a tough week.

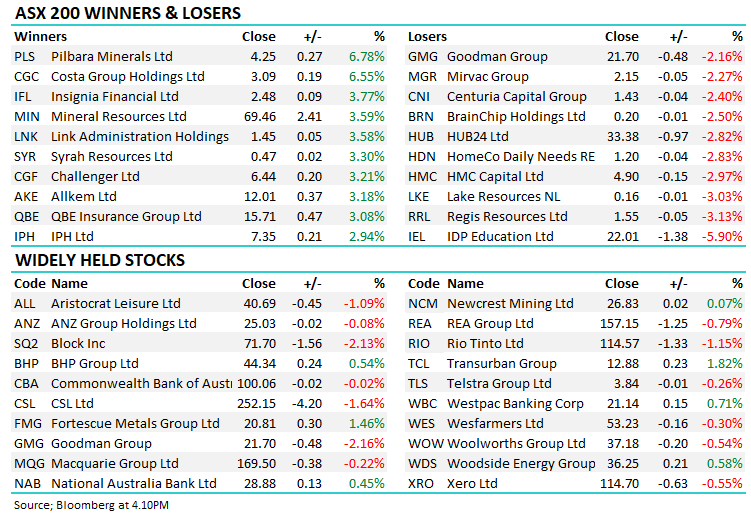

- The ASX 200 eventually closed up +3pts / +0.05% to 7068

- The Utilities sector +0.79% was best on ground today, supported by Energy (+0.72%) and Materials (0.56%)

- Interest rate leveraged sectors of Real Estate (-1.41%), Healthcare (-1.02%) and Tech (-0.67%) found it the toughest.

- There was clearly aggressive buying sub-7000 which is a very positive sign and implies a strong level of support at the bottom end of the trading range.

- We’ve written a lot about respecting the range on the ASX200 in recent months, which sits between 7000-7500 and while it’s been equally restrictive on the upside, the downside support was very obvious today.

- Most stocks opened smack on their lows and rallied hard throughout the session – a day that paid dividends to those who bought the open.

- The Bank of Japan continues to hold out on rate hikes, sticking with the -0.1% interest rate, still targeting 0% for Government 10-year bonds and maintaining a dovish stance.

- Costa Group Holdings Ltd (ASX: CGC) +6.55% rallied as the board of the fruit and veg producer unanimously accepted the bid from Paine Schwartz at $3.20/sh, down from $3.50/sh.

-

News Corporation Class B Voting CDI (ASX: NWS) +2.24% was higher after Rupert Murdoch announced he was handing over the reins to his son Lachlan. At 92 years young, it’s been a good innings from Rupert!

- Lithium stocks held up well in the face of a softer market, prices for Spodumene were up overnight which flowed through to the Chemical producers today, notably Pilbara Minerals Ltd (ASX: PLS) which added +6.78% after opening lower – a huge turnaround!

- Healius Limited (ASX: HLS) and Australian Clinical Labs Ltd (ASX: ACL) were both largely unchanged following the ACCC’s request for more information on the planned tie-up of two of Australia’s largest pathology companies.

- Gold was up 0.25% in Asia to $US1925/oz. For the most part, gold stocks were marginally higher today.

- Iron Ore was up ~0.6% in Asia, supporting a ~4.5% rally for Fortescue Metals Group Ltd (ASX: FMG) off its early lows.

- Stocks across the region also rallied from lows with the Hang Seng the star, up +1.15%.

- US Futures are up around 0.25%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Stocks this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

online pharmacy buy prograf without prescription with best prices today in the USA

- Bank of Queensland Ltd (ASX: BOQ) Cut to Underperform at Macquarie Group Ltd (ASX: MQG); PT A$5.25

- Bendigo and Adelaide Bank Ltd (ASX: BEN) Cut to Underperform at Macquarie; PT A$8.75

- Santos Ltd (ASX: STO) Cut to Neutral at Jarden Securities; PT A$8.05

- Mesoblast Ltd (ASX: MSB) Raised to Speculative Buy at Bell Potter

- Transurban Group (ASX: TCL) Raised to Buy at Jefferies; PT A$14.08

Major Movers Today