Global markets

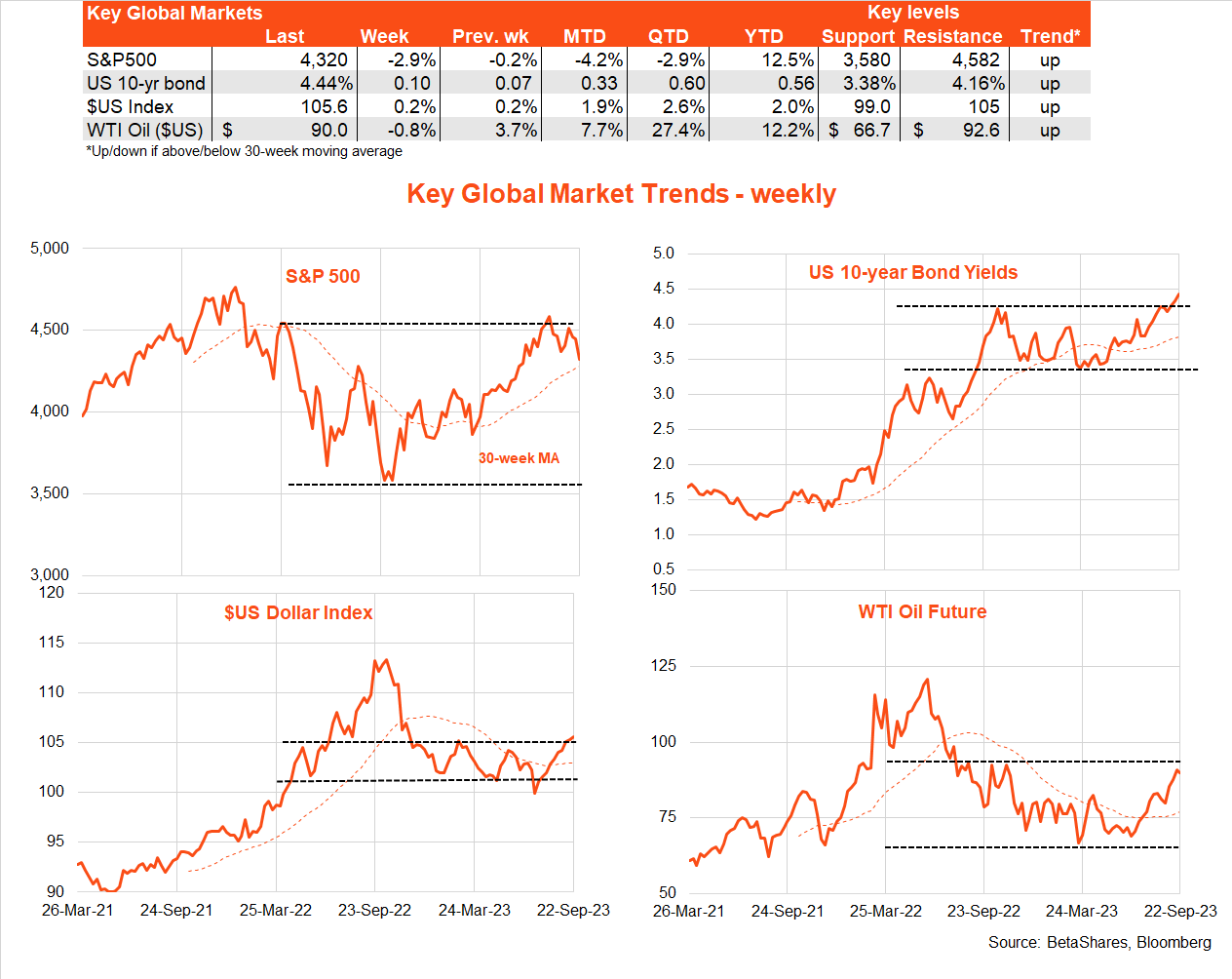

The ‘no-landing’ correction in global equities continued last week, with the S&P 500 (INDEXSP: .INX) down a chunky 2.9% and US 10-year bond yields rising another lazy 0.10% to 4.44%.

The key catalyst, of course, was the Fed meeting. While the Fed kept rates on hold as widely expected, the ‘dot plot’ of Fed policy expectations retained a further rate hike this year – and one less rate cut in 2024.

The ‘higher for longer’ policy outlook pushed up longer-term bond yields.

The S&P is now down 5.7% from its last end-week high on 28 July and last week broke below its recent end-week low on 18 August – confirming the downward correction remains in place. The correction in recent months has coincided with a move higher in US 10-year bond yields to above 4% and above the highs of late last year – indeed, yields have reached levels not seen since 2007.

In turn, this has reflected resilience in US economic growth and reduced expectations for Fed rate cuts in H1’24. The $US has also strengthened in this period.

As regards the equity sell-off, it does not help that US equity valuations relative to bond yields had become very stretched, with the S&P 500 equity risk premium (forward earnings yields less the 10-year bond yield) falling to a skinny 1% – or well below average since the mid-2000s range of 3.5 to 4%.

The challenge now is that this risk premium remains skinny – despite the equity sell-off – as bond yields have increased further in recent weeks.

In short, what we’re seeing is an equity valuation crunch in the face of higher bond yields – as while hopes of a ‘soft landing’ have improved, the inflation outlook is not yet good enough to justify the rate cuts the market had been anticipating in 2024.

Higher oil prices – and the likely upward pressure on headline inflation in coming months – only add to the angst.

Something had to give!

All that said, let’s not forget economic resilience is good news and central banks might be prepared to look through a temporary increase in headline inflation if core measures continue to ease

.

We might also hope that Saudi Arabia stems the rise in oil prices at some stage by increasing production again – now that global recession risks (the apparent driver of the production cut in the first place) have dissipated.

Against this backdrop, the August US consumer price deflator on Friday (US time) will be the key global event of the week. As noted above, higher oil prices are expected to result in a bounce back in annual headline inflation from 3.3% to 3.5%, though core annual inflation is expected to ease further from 4.2% to 3.9%.

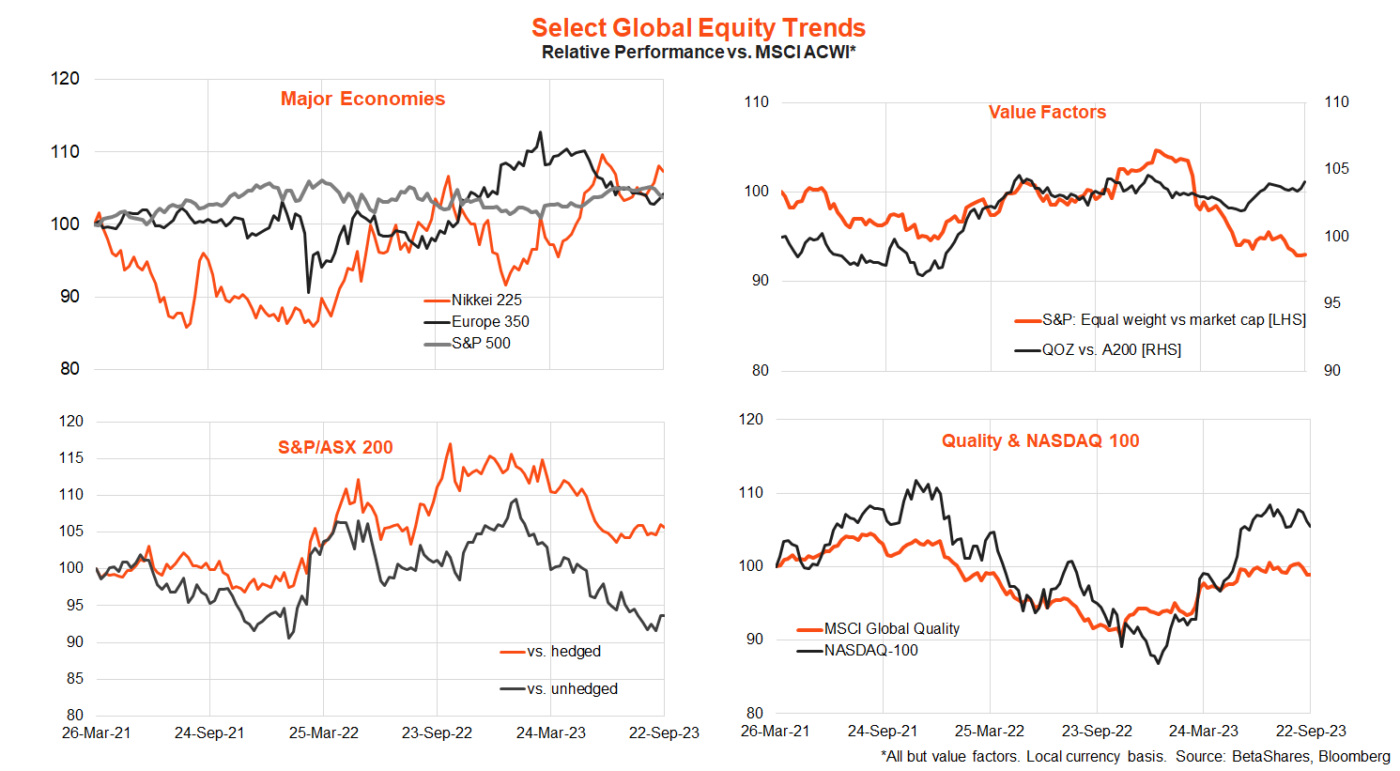

In a mini re-run of last year, the bond-led sell-off in equities has favoured value over growth. The interest-rate-sensitive global technology sector has fared worst, while financials have held up better. Energy is the only sector up since late July, thanks to higher oil prices. Yen weakness, meanwhile, has limited the decline in Japanese equities.

The relative performance of value sectors such as energy and financials has, in turn, also limited the decline in Australian equities – though not by much!

Small caps have also underperformed

, limiting the degree to which the S&P equal-weight index might have outperformed its tech-heavy market-cap counterpart given the heavier declines in technology stocks.

Australian market

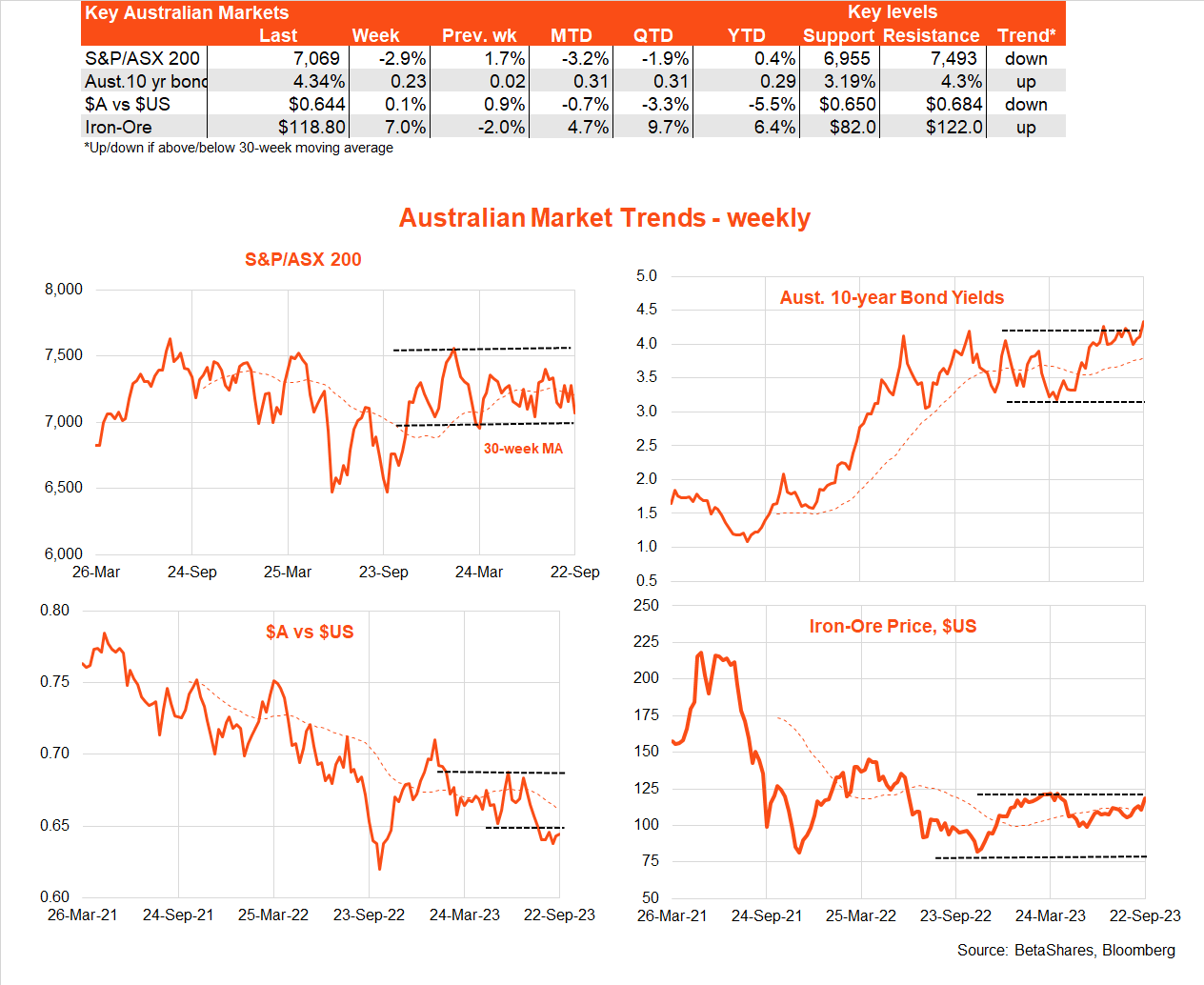

Local equities also lost ground last week in line with global markets.

Local 10-year bond yields moved higher – even more than in the US – and broke above their range highs of around 4.25% seen over the past year.

One local catalyst was the minutes from the RBA September policy meeting, which suggest the Bank did at least contemplate a rate hike – though I suggest not for very long!

In line with a stronger $US globally, the $A remains on the backfoot – despite resilience in iron-ore prices.

Indeed, despite China’s ailing property sector, it appears demand for iron ore remains firm, with China still producing heaps of steel for electric cars, green energy projects and transport infrastructure.

Key Australian events this week include the August monthly CPI report (Wednesday) and retail trade and quarterly job vacancies (Thursday).

As is the case globally, headline monthly CPI inflation is expected to rebound somewhat – from 4.9% to 5.2% – given higher petrol prices. Of interest also, however, will be readings for the underlying inflation measures, such as the trimmed mean and CPI excluding volatile items.

As was the case with employment, August retail spending may also benefit from a ‘Matildas effect’, with stronger spending on sports merchandise, beer and schnitzels.

Given other signs of easing labour demand, the official estimate of Q3 job vacancies should fall somewhat, though exactly how far remains the critical question. As it stands, job vacancies already fell somewhat last quarter though remained at a relatively high level.

Have a great week!