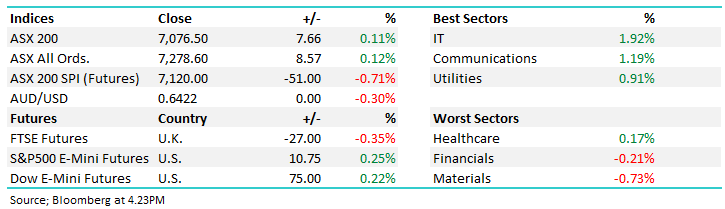

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.11% to 7076.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX saw the worst of it early, down nearly 50 points before another spirited recovery ensued, in quiet trade, impacted by School holidays overlapping with the Rugby World Cup.

Many Fundies no doubt wish they stayed on the desk rather than witness the Wallabies limp out in the pool rounds!

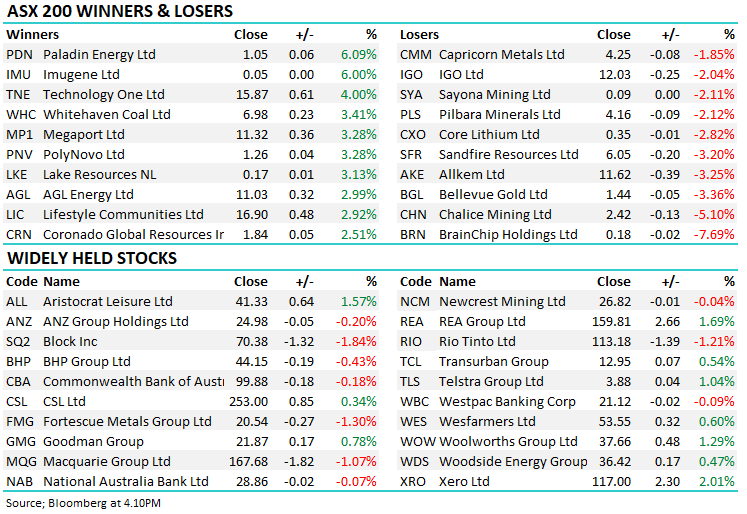

- The ASX 200 finished up +7pts/ +0.11% to 7076 – closing on its highs = bullish

- The IT sector was best on ground (+1.92%) while Communications (+1.19%) & Utilities (+0.91%) played strong supporting roles.

- Materials (-0.73%) & Financials (-0.21%) the only sectors to close in the red.

- Audinate Group Ltd (ASX: AD8) unchanged, had a volatile session, fell 9.7% early on following a downgrade from Jeffries before they bounced back throughout the day to close flat – we own AD8 and remain positive. Big move though – shows why stop losses can be problematic!

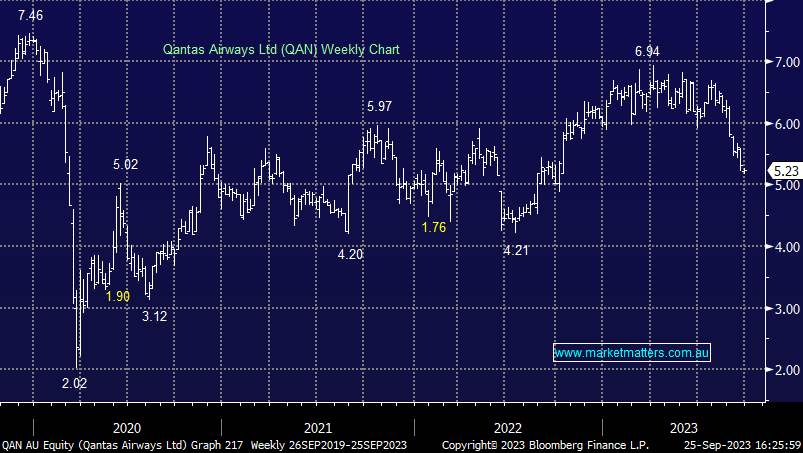

- Qantas Airways Limited (ASX: QAN) -1.51% fell after delivering a market update, fuel prices hurting + they’ll focus more on the customer = a drag on profits. No need to be there.

- AGL Energy Limited (ASX: AGL) +2.99% had a good session on the back of a Macquarie Group Ltd (ASX: MQG) upgrade to buy. Having hit a ~$12.5 August high, AGL pulled back to ~$10.5 into a nice accumulation level, ready to pop back on the upside in MM’s view. We continue to hold AGL in our Active Income Portfolio. We’ll cover MQG’s positive thesis in a note this week.

- Aussie Broadband Ltd (ASX: ABB) -1.92% was also in the crosshairs at Jeffries, the broker downgrading to hold and $3.75 PT vs. Friday close of $4.16. Like AD8, selling early was not the play here and buyers swarmed on the weakness, hitting a $3.80 low before closing at $4.08. Influential broker moves on mid-cap stocks meeting light holiday volumes = big swings in prices as we’ve seen today.

- Uranium stocks continued to run as prices hit $US65.50 on Friday underpinning strong gains from Paladin Energy Ltd (ASX: PDN) +6.09%, Boss Energy Ltd (ASX: BOE) +5.11% and Deep Yellow Limited (ASX: DYL) +13.15%. We like the sector but now starting to get very hot, probably running ahead of fundamentals in the short term. We’re long PDN and Cameco Corp (NYSE: CCJ).

- Coal stocks also did well, Whitehaven Coal Ltd (ASX: WHC) +3.41% & New Hope Corporation Ltd (ASX: NHC) +1.97% with WHC in particular looking primed for higher levels short term.

- Strandline Resources Ltd (ASX: STA) -12% hit again on the resignation of Luke Graham as MD, this is an example of how things can go wrong when a hopeful flicks the switch into production, be mindful of this when investing in the junior resource space! One of our better sells at 41c in the Emerging Companies Portfolio.

- Last week, APRA released a discussion paper on the suitability of the current structure of AT1 Hybrid Securities in absorbing losses in times of stress – a lot of water to go under the bridge here, however importantly (and this was lost on some who sent in Questions), where any changes are ultimately made to the structure of hybrids in the future, existing hybrids on issue cannot have their terms altered. We will provide more insight here and our thoughts on this in a Morning Report this week.

- Iron Ore was down ~2% in Asia, dragging down Fortescue Metals Group Ltd (ASX: FMG) -1.3%, Rio Tinto Ltd (ASX: RIO) -1.21% & BHP Group Ltd (ASX: BHP) -0.43%.

- Asian stocks were mixed, Hong Kong off -1.6%, Japan up +0.65% while China fell -0.60%

- US Futures are marginally higher, up around 0.2%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Qantas Airways Limited (ASX: QAN) $5.23

QAN -1.51%: the troubles at the flying kangaroo continued today with more money being thrown at upgrading the customer experience and oil prices weighing on earnings.

The airline will spend an additional $80m to address ‘pain points,’ as they put it, on better contact options, better in-flight catering and improving frequent flyer availabilities, just some of the issues that have been underinvested for some time.

Fuel prices are expected to have a $200m impact on the first half for a total cost of $2.8b, while FX will knock another ~$50m off the bottom line.

The announcement looked to soften the blow by saying trading conditions for the first quarter had remained robust, though shares still closed at 11-month lows.

Qantas Airways Limited (ASX: QAN)

Broker Moves

- Bank of Queensland Ltd (ASX: BOQ) Cut to Negative at Evans & Partners Pty Ltd

- Audinate Tumbles After Jefferies Downgrades to Hold

- TechnologyOne Ltd (ASX: TNE) Raised to Buy at Bell Potter; PT A$17.75

- Brambles Limited (ASX: BXB) Raised to Outperform at Macquarie; PT A$15.45

- AGL Energy Raised to Outperform at Macquarie; PT A$11.51

- Westpac Banking Corp (ASX: WBC) Cut to Sell at UBS; PT A$20

- Altium Limited (ASX: ALU) Raised to Positive at Evans & Partners Pty Ltd

- Aussie Broadband Cut to Hold at Jefferies; PT A$3.75

Major Movers Today