PEXA Group Ltd (ASX: PXA) is the monopoly property technology business nobody is talking about.

PEXA Group Ltd (ASX: PXA) is the dominant property conveyancing platform in Australia as a result of an Australian government pledge to digitise their paper-based property settlements system (if only CHESS statements could do the same!).

PEXA Group Ltd (ASX: PXA)

For those of you that have transacted on a property in the last 14 years, one of the many annoying fees you will have no doubt had to pay was to PEXA for their electronic settlement services.

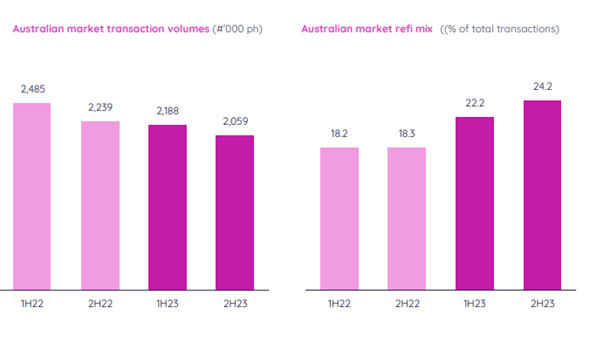

PEXA’s handles 88% of all property transactions in Australia via its electronic conveyancing platform so gets more than its fair share of the $280 million per year industry. PEXA gets an even higher 99% of all re-financings, which are booming thanks to the fixed rate mortgage cliff, where low fixed rate mortgages are rolling off and being refinanced at higher variable rates.

If most property market participants use the platform, it encourages adoption by the remaining minority – a network effect that benefits the market leader, in this case, PEXA. This provides a strong, sustainable moat and makes it difficult for new entrants (like startup Sympli, for example) to compete.

With 400,000 properties changing hands each year in Australia, investors only need to look at REA Group Ltd (ASX: REA) to see how valuable a monopoly position in the lucrative Australian property market can be. As a result of this dominance, REA has seemingly inelastic demand and have been able to increase prices by 13% in FY23 with a further 8% price rise locked in for FY24. We believe PEXA is yet to flex this muscle but can and will in the future.

REA Group Ltd (ASX: REA)

Housing volumes down creates contrarian a buying opportunity

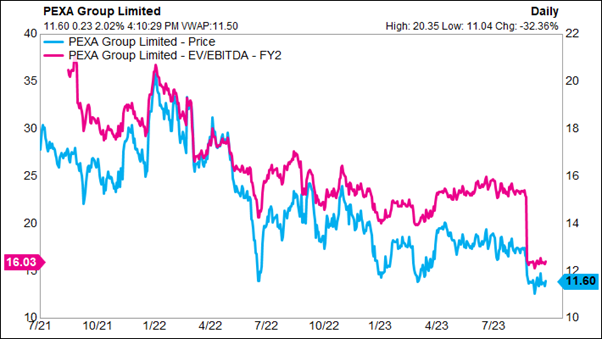

The PXA share price has fallen from over $14 to ~$11.50 today, a far cry from its IPO price of $17.13 in mid-2021.

Housing market conditions have been weak, with higher interest rates affecting the sale volumes which were down -8% year-on-year in FY23, after 48% growth in FY21.

Source: PEXA company presentation

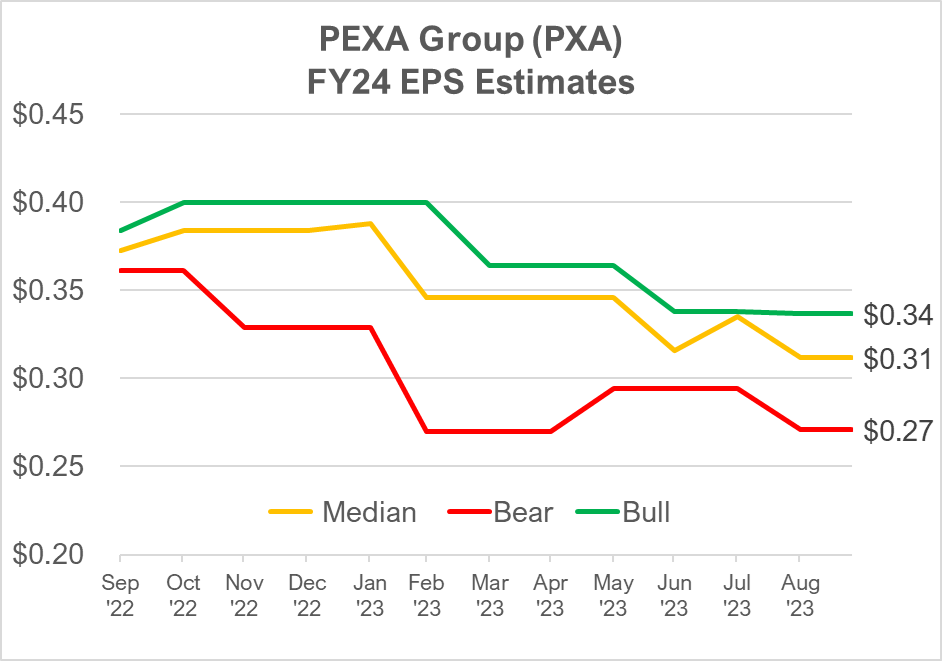

This weakness has seen PXA’s FY24 earnings per share estimates cut from $0.38 earlier this year, to $0.31 currently – an 18% decline.

Source: Seneca Financial Solutions, Factset

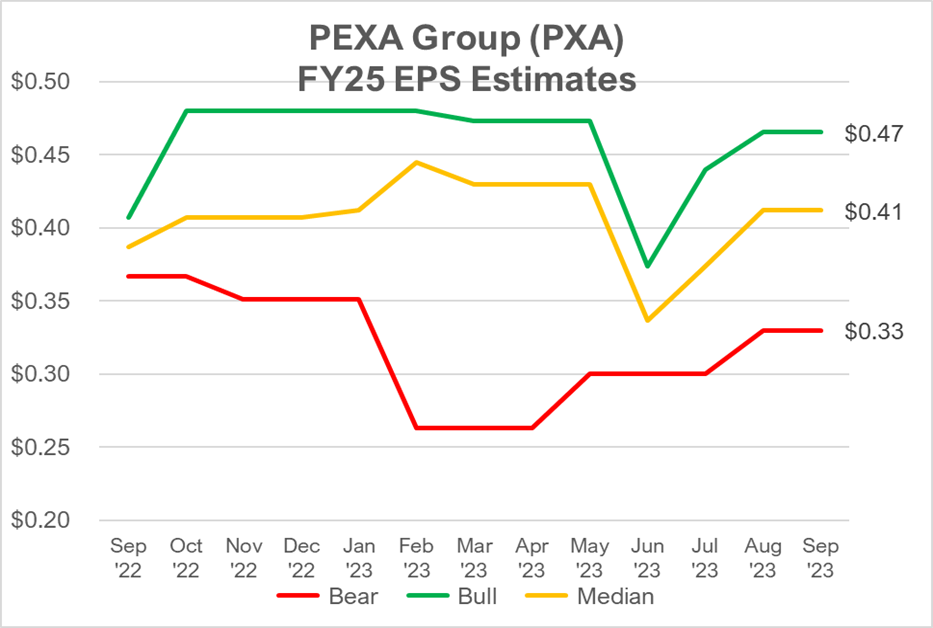

However, when we look through to the FY25 earnings per share estimates we see a different story – analysts are revising their numbers up! In fact, up 20% since July to now sit at $0.41.

We think the market is beginning to look through the short-term impact of lower-than-average housing volumes in Australia and to an environment where PXA Australia is moving forward again.

Source: Seneca Financial Solutions, Factset

UK growth optionality

Outside of its stable and profitable Australian business, PEXA’s growth aspirations have hinged upon its intent to break into the UK market and replicate its successful business model in a larger offshore market.

The UK market represents a $720 million opportunity, ~2.5x the size of Australia’s market. PEXA is attempting to gain significant share in the UK by leveraging its existing technology platform, in a jurisdiction with similar legal and financial processes, that currently operates a paper-based conveyancing system.

If PXA is successful, the contribution to group earnings will be meaningful.

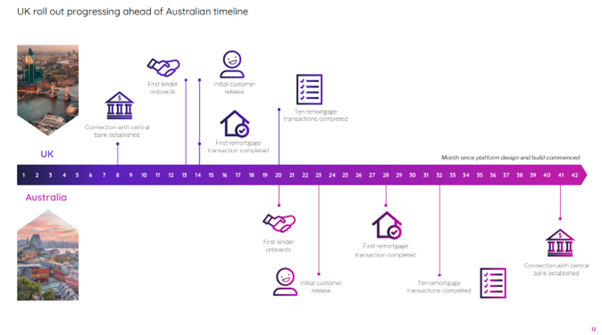

So far, PEXA’s initial inroads into the UK market have been successful – completing its first UK remortgage transaction 14 months after inception vs 28 months in the Australian rollout.

Source: PEXA company presentation

Are PXA shares a buy today?

At current prices, PXA shares have never been cheaper and appear undervalued on 26x FY25e P/E – estimates which only assume a partially success to its UK rollout and continued subdued Australian housing volumes.

We think these assumptions prove overly pessimistic with housing volumes likely to mean-revert and momentum in the UK business.

Source: Seneca Financial Solutions, Factset

If PXA can crack the UK, network effects quickly drive the brand to a near-monopoly market position. This would likely result in a share price that is multiples of the current $11.50.

Worst case scenario is you buy a high-quality Australian growth business that operates on 60% gross margins and trades on a multiple lower than peers like Netwealth Group Ltd (ASX: NWL) and Hub24 Ltd (ASX: HUB) – both of which face more competitive threats and offer lower moats in our opinion.