Here’s today’s The Match Out

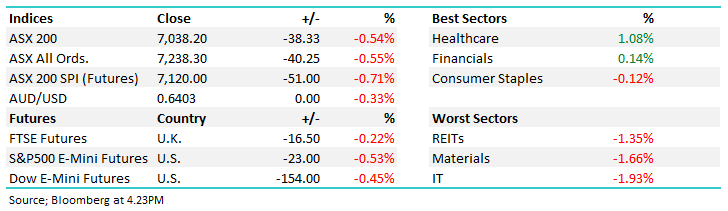

report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.54% to 7038.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX attempted to follow the recovery that played out from weakness over the past two sessions, but it was all too much today, weighed by selling across the IT & Resources sectors as China heads towards a week of national holidays, starting on the 29th.

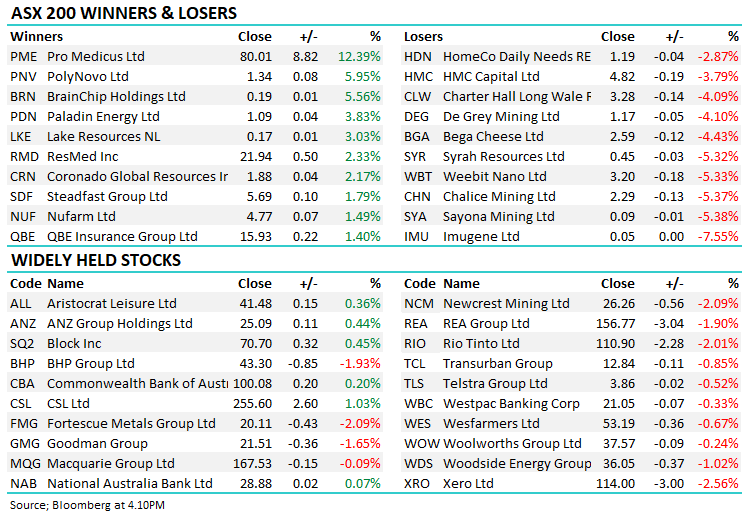

- The ASX 200 finished down -38pts/ -0.54% to 7038.

- The Healthcare sector was best on ground (+1.08%) while Financials (+0.14%) was the only other sector to track higher.

- IT (-1.93%), Materials (-1.66%) & Property (-1.35%) fought it our for the wooden spoon.

- WEBINAR TOMORROW: REGISTER HERE – We are covering Resmed CDI (ASX: RMD) + the other ‘unloved’ areas of the market – @ Midday.

- Qantas Airways Limited (ASX: QAN) -1.34% fell after CLSA became the first major broker to put a “sell” rating on the stock in a year.

- Pro Medicus Limited (ASX: PME) +12.34% put on ~$800m in market cap after winning a $140m contract.

- Gina Rinehart is complicating Albemarle Corporation’s (NYSE: ALB) $6.6bn tilt for Liontown Resources Ltd (ASX: LTR) -1.67%, announcing an increase in her stake to 10.69%/235m shares. LTS dipped below the $3 bid amount today as a result.

- UBS reiterated their key pick in the contractor space today, namely Worley Ltd (ASX: WOR) +0.93%, saying the capex cycle is just beginning. We are backing WOR in this space in our Flagship Growth Portfolio.

- Resmed CDI (ASX: RMD) +2.33% enjoyed a rare green day, both Goldman Sachs Group Inc (NYSE: GS) & Macquarie Group Ltd (ASX: MQG) out with notes saying the share price reaction is well overdone. We will provide our take on RMD in the Webinar tomorrow.

- Uranium stocks continued to run, Paladin Energy Ltd (ASX: PDN) +3.83%%, Boss Energy Ltd (ASX: BOE) +0.43% and Deep Yellow Limited (ASX: DYL) +6.22%. Reiterating comments made yesterday, while we like the sector it is now starting to get very hot. PDN closed $1.085

- Iron Ore was down ~2% in Asia, dragging down Fortescue Metals Group Ltd (ASX: FMG) -2.09%, Rio Tinto Ltd (ASX: RIO) -2.01% & BHP Group Ltd (ASX: BHP) -1.93%.

- Asian stocks were down, Hong Kong off -1.03%, Japan fell -1.23% while China fell -0.30%

- US Futures are lower, down around 0.5%.

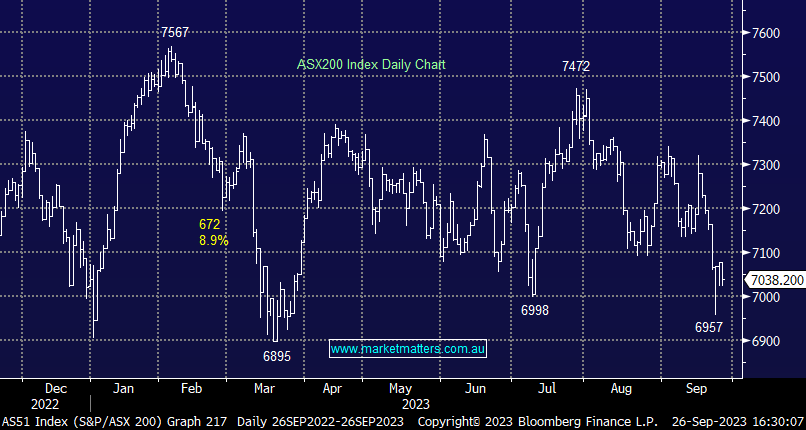

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

WEBINAR TOMORROW: OPPORTUNITIES IN THE UNLOVED SECTORS OF THE MARKET

In this month’s Pulse Check webinar — we’re diving into some of the more unloved parts of the market to discover the stock opportunities hiding in plain sight. We’ll highlight the key stocks that you should be watching, and the ‘buy now’ gains that shouldn’t be ignored.

In what promises to be a highly informative and engaging webinar, join us as we wade through the uncertainty to discover the best value for investors, including the beaten up Healthcare Sector (covering out take on Resmed), Small Caps & Consumer Staples.

Pro Medicus Limited (ASX: PME) $80.01

PME +12.39%: the medical software company jumped to all-time highs today on the back of a nice contract win.

The $140m 10-year deal with Baylor Scott & White Health (BSWH) is the company’s first in Texas where BSWH is the largest not-for-profit healthcare provider with around 500 radiologists.

The full-stack cloud-based offering of Pro Medicus’ Visage 7 will kick off in 1Q24 with the transactional model potentially providing upside from the headline figure.

The company also said their US deal pipeline remains strong, leaving the door open for similar announcements to come, which is the driver of todays outsized move which added ~$800m in market cap!

Pro Medicus Limited (ASX: PME)

Broker Moves

- Allkem Ltd (ASX: AKE) Raised to Add at Morgans Financial Limited; PT A$15.30

- Qantas Cut to Reduce at CLSA; PT A$5.60

- Synlait Milk Ltd (ASX: SM1) Cut to Sell at CLSA; PT NZ$1.19

Major Movers Today