If you do the average thing you’ll get average results.

It turns out that in the sharemarket, doing an “average” job of investing (e.g. following the ASX 200 with an index fund ETF) is a remarkably effective way to invest.

But how do you become a better investor if you are picking individual shares or ETFs?

How do you go from where you are now to becoming confident in finding, researching and valuing shares for yourself?

To do that, you need three things:

- Time. To learn and research. Read articles and listen to podcasts.

- Curiosity. If you want to know how the world of business works, why things happen in politics and make money as you go, you’ve come to the right place. Curiosity, and in particular discovering what makes businesses tick, is what will keep you glued to annual reports, watching interviews and – importantly – help you ‘get back on the horse when an investment inevitably goes bad.

- Behaviour. If you have a cool temperament, do your homework and put aside some time to understand how and why the share market works, you’ll enjoy investing and achieve better results.

So, now that we know the ‘essential ingredients’, how do we do better than average?

In investing, there are three commonly accepted ‘edges’, ‘advantages’ or ways to do better.

1. Informational edge

An informational edge or advantage is all about finding and using better sources of information.<

Remember, if you have access to a company’s annual report in your brokerage account — so does everyone else.

If you have better information than the next investor, you can use it to your advantage.

Choosing the right news sources is essential to investing better:

- Instead of the emotional, fear-heavy and frequent daily news bulletins on most stations, find a source that strips away the emotion and focuses on the facts in the financial space. You don’t want to be making decisions out of fear or based on shallow analysis you hear on the daily news.

- Find great Australian podcasts, fund manager newsletters and communities that will help you think and act better.

Rask tip: Visiting a company’s store, shopping for products on a company’s websites, speaking to industry professionals and suppliers are all great ways to get better information on your company. If you’re analysing a mining company — ask two or three miners what they think about the company.

2. Analytical edge

Most experienced analysts and investors use valuation models and forecasting to improve their understanding of a business, an industry and the way a business runs. But that’s not the only way to get an ‘analytical’ edge.

Refer to Rask’s free valuation courses to learn more about how to analyse financial statements and conduct your own modelling.

The basic principle behind analytical advantage is this: know where your analytical strength lies.

If you have experience in the healthcare industry, chances are, you’ll be able to analyse and research healthcare companies better than most investors. Australia has heaps of great healthcare companies.

If you work in retail, you should focus more of your attention to analysing what consumers/customers are buying and which companies are growing. Smiggle, Peter Alexander, JB Hi-Fi, Woolworths, Bunnings, Lovisa… these businesses are owned by companies on the Australian share market.

Work in creative arts? Adobe Inc (NASDAQ: ADBE) (found on the US stock market) has proven it can produce more than just Photoshop for customers and benefit investors.

Use what you know to your analytical advantage.

Warren Buffett calls this his ‘Circle of Competence’. It’s good to know what is – or isn’t – inside your circle of competence.

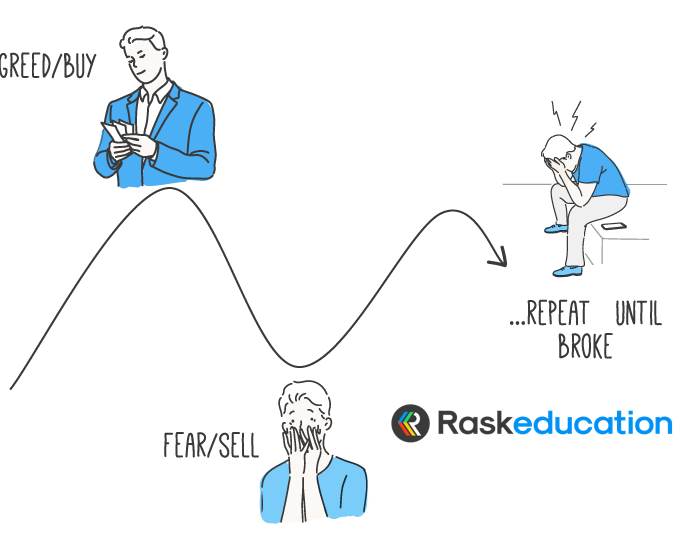

3. Behavioural edge

A behavioural edge is about keeping a lid on your emotions and investing well under pressure (e.g. when your share portfolio is down 10%, 20% or 30%).

The share market can seem like a scary place, but once you’ve done it for a while (e.g. 1-3 years), chances are, you’ll be so passionate and confident in your knowledge that you’ll take it upon yourself to educate others.

Until you reach this point, and make a few mistakes along the way, the share market can seem overwhelming.

Why is that share down 2% today?

Do other investors know something I don’t?

Was that scary thing on the news really important?

The field of behavioural investing and investor psychology are rapidly emerging as some of the most important in finance. The reason is simple:

If you’re in control of your emotions, you’ll make much better decisions. If your emotions are in control of your investing, you can forget about making good decisions.

We say: make your mistakes early, make them small (remember diversification is important) and learn from them.

Here are some of the ways you can learn to act better in the sharemarket:

- Keep learning.

- Find an investing buddy or talk to your partner about investing.

- Use a checklist.

- Learn about your circle of competence.

- Remember that the sharemarket is a long-term (10+ year) wealth creator.

- Take your time making decisions.

- Keep yourself diversified.

- Spend 15 minutes each day reading books or articles and listening to finance podcasts.

- Keep an open mind.

These are just some simple steps to consider. However, if you have to pick three: stay diversified, learn as much as much you can about investing from 3-5 different sources and talk to your partner/friend before making a decision.

You’re about to embark on an exciting, daunting and — over time — potentially profitable journey. Rome wasn’t built in a day. Take your time and learn, the rest takes care of itself.

Warren Buffett famously said,

“The stock market is a device for transferring money from the impatient to the patient.”

Take a look at the free resources below to learn more.