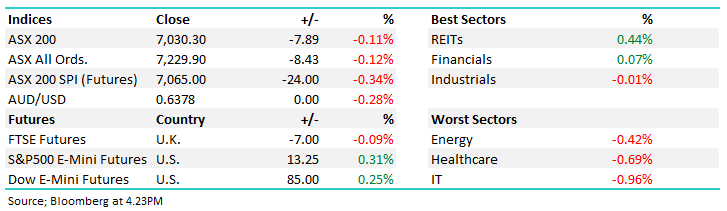

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.11% to 7030.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

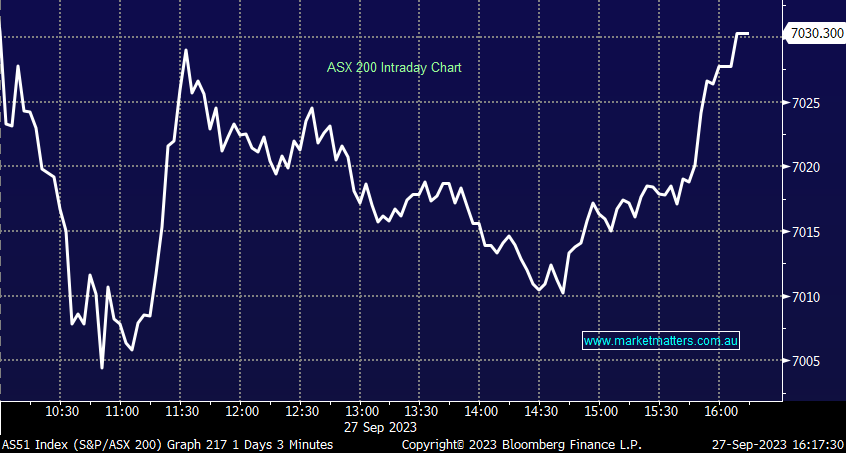

A solid session given the weak leads from the US overnight, inflation came in as expected while we saw some bargain hunting in the property sector with some interesting moves playing out after a tough time.

- The ASX 200 finished down -7pts/ -0.11% to 7030 , up ~40pts from the days low.

- The Property sector was best on ground (+0.44%) while Financials (+0.07%) also edged higher.

- IT (-0.96%), Healthcare (-0.69%) and Energy (-0.42%) the weakest links, although there was some divergent stock performances across Healthcare.

- Thanks to all who attended todays Webinar, looking for opportunities in unloved areas of the market – a timely one we think. A big attendance with a recording of the Webinar going to all subscribers + those who registered.

- The attendance on Market Matters Webinars is growing monthly, and today we had more registrations than spaces available – for future webinars, please get in & register early!

- Inflation data out today landed inline with expectations at 5.2% YoY, up from 4.9% driven largely by a rise in energy costs. While it was the first jump in 4 months, it was not a surprise.

- Cash rate futures locally are now pricing in 20bps of tightening by Feb 24, before interest rate cuts are expected to kick in later in the year. The debate on whether on not the RBA will hike 1 more time is therefore a mute one, the market is already largely there, meaning an extended pause becomes a positive surprise.

- Resmed CDI (ASX: RMD) +4.79% bounced today, a couple of notes yesterday from Macquarie Group Ltd (ASX: MQG) & Goldman Sachs Group Inc (NYSE: GS) calling the rout overdone the likely catalyst. We agree, a huge amount of negativity priced into the stock, and while we think the heady days of a RMD multiple of 34x are done, on 19x it’s simply pricing in too much on the downside. Shorts have risen materially in RMD (particularly in the US) which could drive aggressive counter trend moves.

- We covered our view of Eli Lilly And Co (NYSE: LLY) this morning, the other side of the RMD coin, being a major beneficiary of weight loss treatments – read the note here

- Star Entertainment Group Ltd (ASX: SGR) -8.42% back online post a $565m institutional placement at 60c with another $185m via a non-renounceable rights issue on a 1 for 1.65 basis. We cover SGR below. Stock closed today at 63.5c

- Lots of media recently on ATI bank hybrids following an APRA paper discussing potential changes, our initial thoughts available here

- Sigma Healthcare Ltd (ASX: SIG) -3.68% has a whiff to it, with price action implying some concern around their balance sheet.

- Property stocks have had an awful time of late, but some interesting price action today, particularly Dexus (ASX: DXS) +2.79% which bounced hard from morning lows, while it’s not often we see Charter Hall Long WALE REIT (ASX: CLW) +2.13% in a session.

- Bank of Queensland Ltd (ASX: BOQ) -0.87% fell on a broker downgrade, Goldmans calling it a sell and $5.60 PT

- We had Danny Younis on 3 years ago for a webinar (here) covering the future of retail. Lots of press on Danny this week as he offloads 2/3rds of his phenomenal wine collection at Auction. One of the largest wine collections ever to be auctioned in Australia, 5000 bottles with some fetching 30k (a bottle!) Interesting reading for the wine buffs – The Danny Younis Collection – the wines have aged better than a couple of the stock calls!

- Iron Ore was marginally higher in Asia, up ~0.5%, Fortescue Metals Group Ltd (ASX: FMG) +1.29% bounced.

- Gold has been on the nose thanks to $US strength, the Dollar Index 106.25 pushing Gold back below US$1900/oz today. Gold stocks felt the heat, Northern Star Resources Ltd (ASX: NST) -2.42% is starting to hurt!

- Asian stocks were higher, Hong Kong up +0.74%, Japan up +0.19% while China added +0.38%

- US Futures are higher, up around 0.25%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Star Entertainment Group Ltd (ASX: SGR) 63.5c

SGR -8.43%: the casino operator was back trading today after completing the bulk of a recapitalization raise that will vastly improve the balance sheet.

Shareholders are able to buy 1 new share at 60c for every 1.65 held with the Institutional component of the entitlement offer raising $565m on 67% of rights taken up. The retail component will raise a further $185m, while Barclays and Westpac Banking Corp (ASX: WBC) will offer a $450m debt facility to add flexibility to the balance sheet.

The end result will see Star pay down all existing debt, clearing the slate as it looks to regain its earnings mojo. There are still concerns from an investment standpoint, an AUSTRAC fine hanging over the company’s head, as well as issues with Queens Wharf, their new Brisbane asset.

However, the company said trading conditions have stabilized and the monthly revenue run rate was up 4% in July and August vs June quarter.

Star Entertainment Group Ltd (ASX: SGR)

Broker Moves

- Pro Medicus Limited (ASX: PME) Cut to Market-Weight at Wilsons; PT A$81.20

- Challenger Ltd (ASX: CGF) Raised to Buy at Goldman; PT A$6.89

- Pro Medicus Raised to Accumulate at CLSA; PT A$88.80

- Bank of Queensland Cut to Sell at Goldman; PT A$5.60

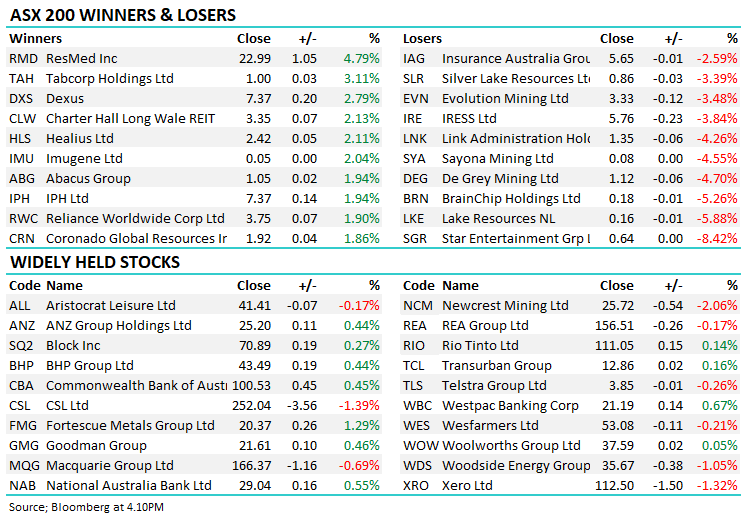

Major Movers Today