National Tyre & Wheel Ltd (ASX: NTD) announced to the market last week that from 2024 onwards, they will have the exclusive wholesale distribution rights to the Dunlop suite of commercial and consumer tyres.

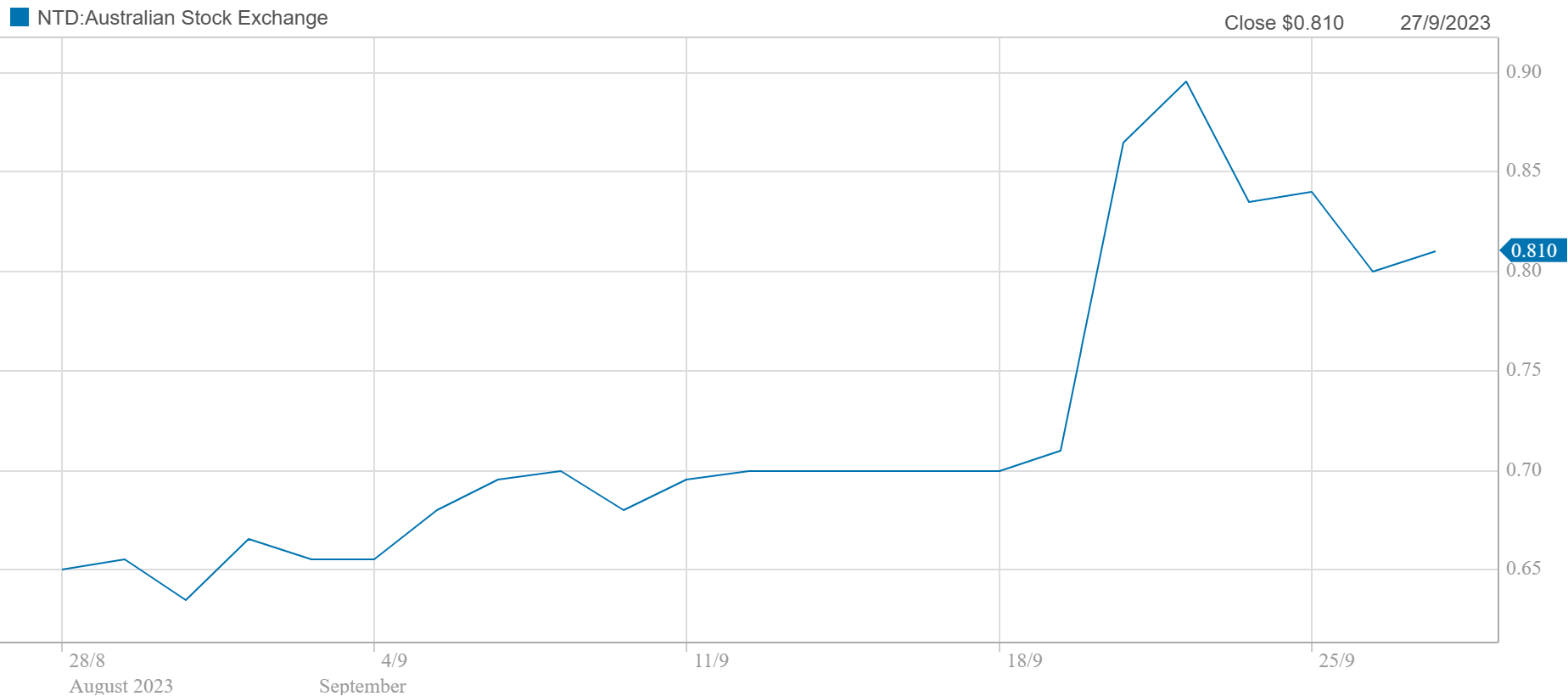

National Tyre & Wheel Ltd (ASX: NTD) share price

The deal is expected to add about $118M in revenue to NTD’s business from 2024 onwards with minimal uptick in expenses.

The share price took off as a result.

Chart 1: National Tyre & Wheel Ltd (ASX: NTD) 5-day share price

Source: Commsec.

In our view, the company was well worthy of a re-rate and the Dunlop deal will add real shareholder value within a realistic timeframe.

Some key take-outs from our perspective are that:

- The transaction expands upon NTD’s multi-brand distribution strategy and gives them better coverage at different pricing points in the market.

- Geographical diversification of supply will be enhanced, thus decreasing potential risks associated with low fill rates in certain jurisdictions.

- Ongoing costs to distribute the Dunlop tyres should be minimal due to work done on warehouse efficiency programs and IT enhancements undertaken in previous periods.

- The stock remains cheap. Trading at ~8-9X 2024 earnings, at less than the book value of its assets and only a 20% premium to its net tangible assets we believe there is a substantial margin of safety at the current share price.

Indeed, we believe the strong founder-led culture, well-aligned management team and diversified business model won’t be overlooked by the market for long and that this is definitely an exciting stock to keep an eye on coming into 2024.

To learn more about the deep value, contrarian and high conviction investment process that has led Collins St Asset Management to ideas such as NTD (back when it was in the mid 20 cent range!) visit: Investment Solutions – Collins St (csvf.com.au)