Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.078% to 7024.80.

Markets @ Midday

: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

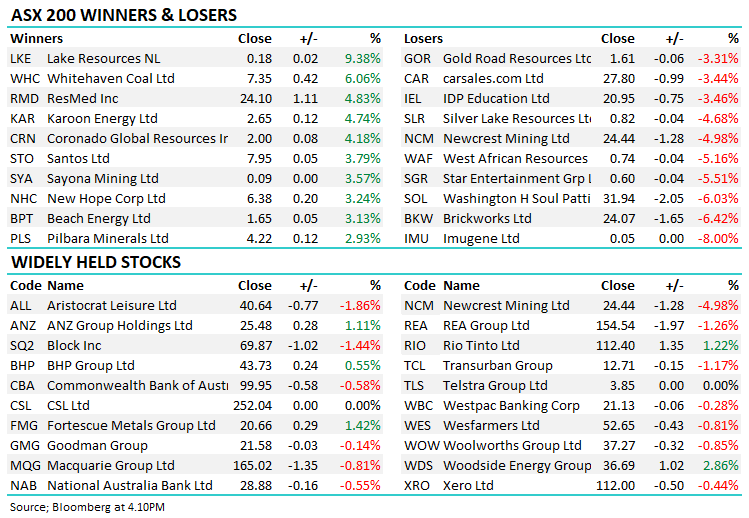

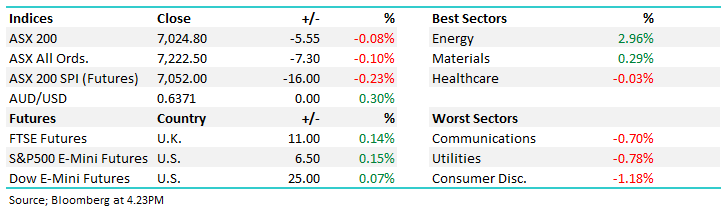

The ASX200 traded ~25pts either side of yesterday’s close today before closing marginally lower in a choppy session.

Resources sectors were the shining light today, Energy and Materials were the only areas of the market to finish higher.

Local 2-year bond yields hit 2-month highs today, one of the reasons the broader market was weaker today.

- The ASX 200 closed down -5pts / -0.08% to 7024

- The Energy Sector +2.96% was best on ground today, Materials (+0.29%) the only other sector in the green

- Staples (-1.18%) was the weakest sector today. 5 other sectors fell by more than 0.5% with utilities (-0.78%) the second biggest decliner in the session.

- Oil cracked 12-month highs again, and the rally continued in Asia today. The latest move came on stockpiles hitting critically low levels at a major US storage hub.

- Domestic Retail Sales data out this morning came in at +0.2% MoM, just shy of expectations at +0.3%, no doubt playing into the weakness in Consumer stocks today though only a small miss.

- Household goods fell -0.4% in the month while Staples were dragged by a -0.3% fall in food retailing. Clothing, footwear & accessories (+1.3%) was the standout in a surprise boost for discretionary spending, though the headline figure missed.

- Job Vacancies also suggested a slowdown in activity, off -8.9% QoQ, though this is a notoriously volatile figure.

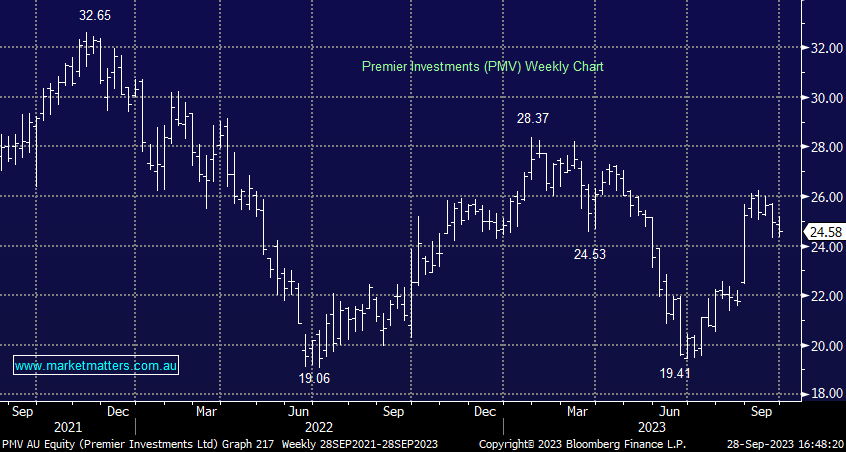

- Premier Investments Limited (ASX: PMV) -0.53% a largely in-line FY23 result today and the company confirmed sales were softer in FY24, largely as expected.

- ANZ Group Holdings Ltd (ASX: ANZ) +1.11% was the only bank to finish higher today thanks to an upgrade by Morgan Stanley. The analyst expects ANZ to grow revenue at the quickest rate in the space over the next 3 years.

- Brickworks Limited (ASX: BKW) -6.42% missed expectations by ~10% on EBIT, mostly on a 65% decline in the Australian Building Materials segment.

- Regal Partners Ltd (ASX: RPL) +6.85% withdrew their proposal to buy Pacific Current Group Ltd (ASX: PAC) after a lack of engagement which seemed to boost shares in the fund manager today.

- Gold fell ~1.5% overnight, but held at that level during the session. Gold stocks struggled today, Newcrest Mining Ltd (ASX: NCM) -4.98% the worst of the majors.

- Iron Ore was up ~0.6% in Asia, continuing to defy the bears and holding $US120/t.

- Stocks across the region suffered, Nikkei 225 (INDEXNIKKEI: NI225) and Hang Seng Index (INDEXHANGSENG: HSI) both down around 1.5%.

- US Futures are up around 0.15%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Premier Investments Limited (ASX: PMV) $24.58

PMV -0.53%: FY23 results out for the retailer today were largely unsurprising given the company provided an update on performance just a few weeks ago.

Sales were up nearly 10% to $1.64b, and retail EBIT was up +6.4% to $356.5m, towards the upper end of recent guidance. Their key brands drove the company’s growth as Peter Alexander sales climbed 11.8% and Smiggle’s up 22.4%.

Premier Investments recently announced it was exploring opportunities to restructure the business, including considerable stakes in Myer Holdings Ltd (ASX: MYR) and Breville Group Ltd

(ASX: BRG).

We expect any move in this direction to unlock more value for shareholders and help the stock higher. Sales for the first 6-weeks of FY24 are down -2% on last year, though this is largely expected.

Premier Investments Limited (ASX: PMV)

Broker Moves

- Allkem Ltd (ASX: AKE) Cut to Market Perform at CICC; PT A$10.80

- Silk Logistics Holdings Ltd (ASX: SLH) Rated New Buy at Moelis & Co (NYSE: MC); PT A$2.75

- Deterra Royalties Ltd (ASX: DRR) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$4.80

- ANZ Group Raised to Overweight at Morgan Stanley; PT A$27

- Champion Iron Ltd (ASX: CIA) Rated New Buy at Jarden Securities; PT A$7.33

- Paladin Energy Ltd (ASX: PDN) Cut to Speculative Hold at Bell Potter; PT A$1.31

- Goodman Group (ASX: GMG) Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$25

Major Movers Today