Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.34% to 7048.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Low volumes seen across the bourse to round out the week.

A quiet Friday from the market’s perspective given Melbourne’s public holiday today (and Much of Australia off for Monday). Materials continued to do well, offsetting the Energy sector which gave back some gains after a strong week.

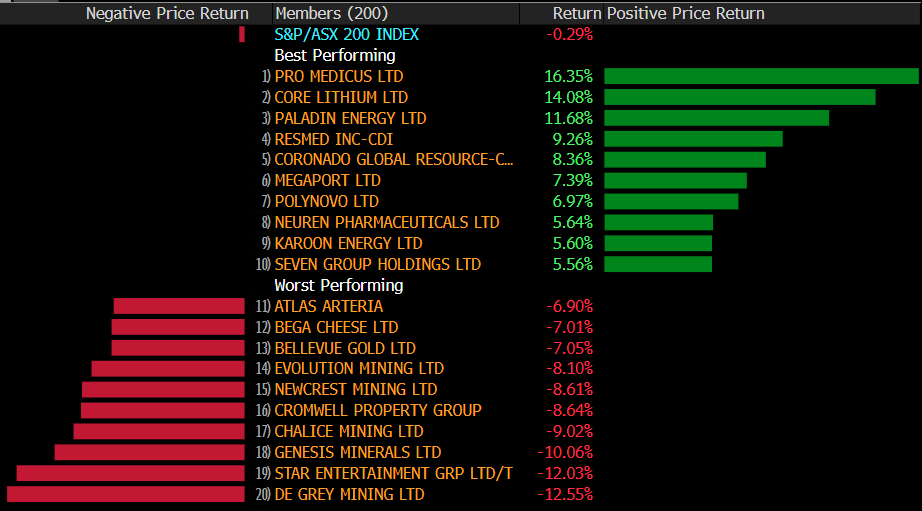

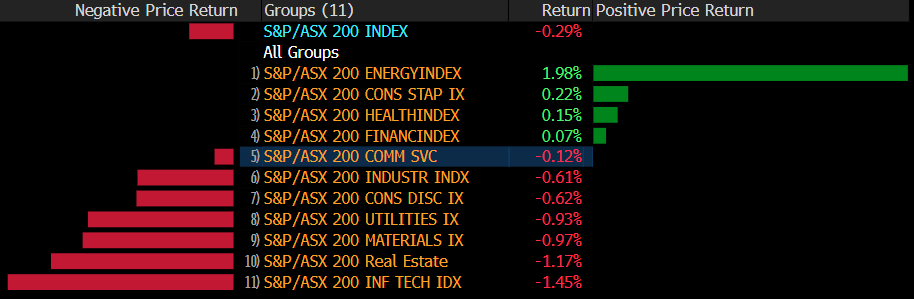

A small decline (-20pts / -0.29%) seen on the ASX200 this week.

- The ASX 200 closed up +23pts / +0.34% to 7048

- The Materials Sector +1.22% was best on ground today, supported by Discretionary (+0.47%) and Financials (+0.33%)

- Energy was the weakest, falling -0.63%, followed by Real Estate (-0.49%) and Utilities (-0.40%).

- Very little news across the listed market today with much of Australia on Holidays

- Bowen Coking Coal Ltd (ASX: BCB) +26.92% rallied after renegotiation their debt deal, offsetting yesterday’s slip and more.

- Gold was up marginally in Asia to $US1868oz, holding its ground following a soft week.

- Iron Ore was up ~0.80% in Asia, supporting 1+% gains for BHP Group Ltd (ASX: BHP), Rio Tinto Ltd (ASX: RIO) and Fortescue Metals Group Ltd (ASX: FMG).

- Stocks across the region were mixed in the weekend – Nikkei flat but Hang Seng added +2.65%.

- US Futures are up around 0.20%.

- No Market Matters Reports on Monday given the NSW Public Holiday

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg