Global markets

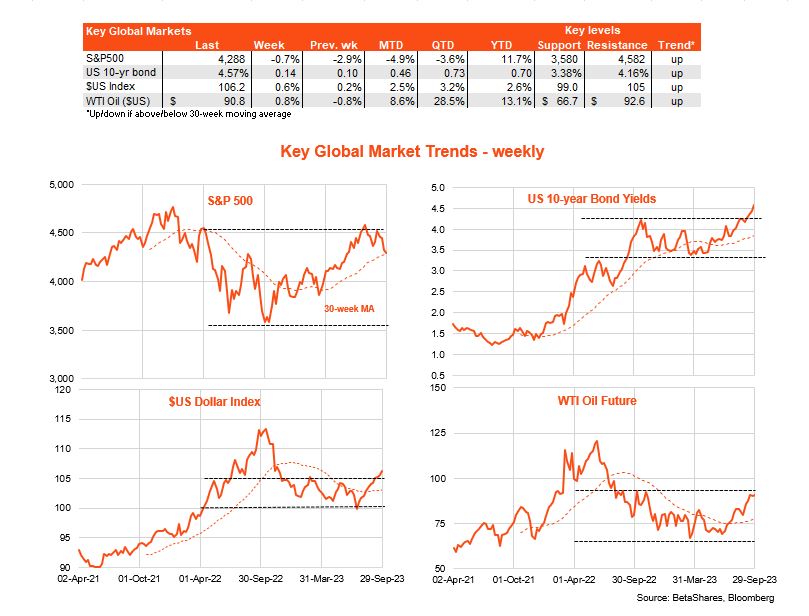

Despite benign US inflation data, the ‘no landing’ correction in global equities continued last week, with the S&P 500 down a further 0.7% and US 10-year bond yields rising 0.13% to 4.57%.

If there was any consolation, US stocks were at least somewhat less sensitive to the further rise in bond yields.

What’s intriguing of late is that the bond sell-off has not reflected anything notably new in the economic data, though appears to reflect concern with rising oil prices and Fed rhetoric discounting the possibility of rate cuts early next year.

Moody’s warning of a potential US credit rating downgrade due to mayhem in Washington did not help the bond market mood, though equity markets at least seemed to shrug it off.

As expected, higher oil prices kept the US headline consumer expenditure price deflator elevated in August, though no more than feared, while core prices were a touch softer than expected.

Headlines prices rose 0.5% in the month, lifting the annual rate a touch to 3.5% from 3.4%. Core prices i.e. excluding food and energy, rose only 0.1%, allowing annual core inflation to ease to 3.9% from 4.3%.

In other key global news, China’s property woes deepened with major property firm China Evergrande Group (HKG: 3333) missing another debt payment.

The key global event this week will be US payrolls on Friday, with another solid employment gain of 160k expected.

Also of interest will be the degree of any further fall in job openings data on Tuesday (US time). It has been declining job openings of late, together with still solid US employment growth, that has raised hopes that excess labour demand and associated high wages growth can ease without a recession.

OPEC also meets mid-week, though hopes are low that the oil producing group will agree to an increase in production.

Australian market

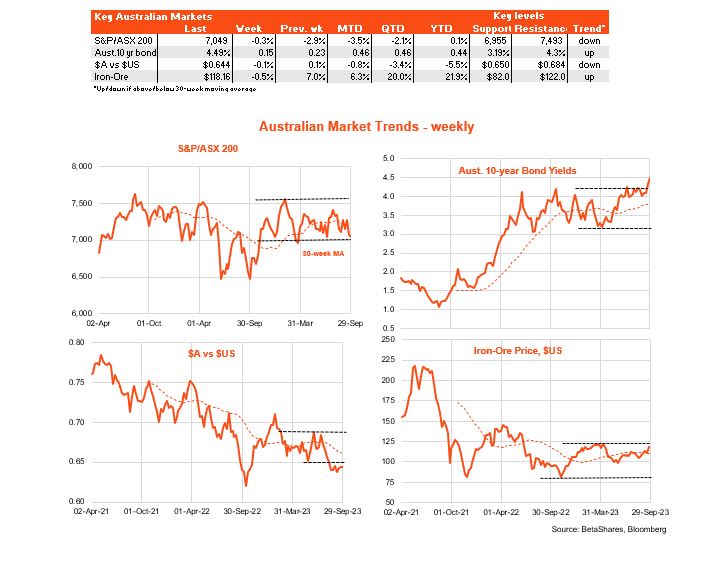

Local equities were down only a little last week – and as evident in the US, local bond yields moved higher despite generally benign local data.

The monthly CPI report was broadly in line with expectations, with a further easing in annual core inflation. Retail sales, meanwhile, were soft – despite Matilda euphoria during August and ongoing strong population growth.

Quarterly job vacancies continued to decline over the three months to August, though still remain at a relatively high level.

The key local event this week will be Tuesday’s RBA Board meeting, though neither economists nor the market sees much risk of a rate hike.

Have a great week!