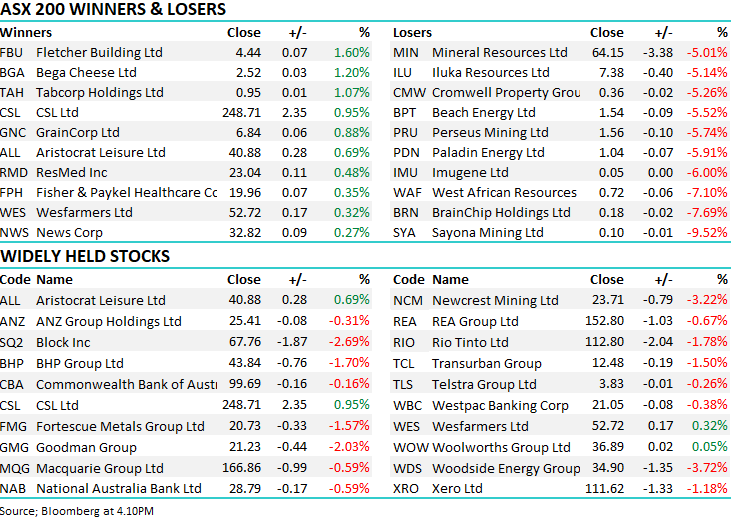

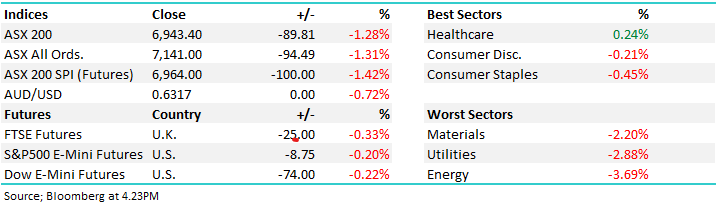

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down +1.28% to 6943.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Quite a bizarre day for stocks with the market lower overall, although there were some decent intraday-rallies met with some decent intraday selling; ultimately a very choppy session on low school holiday volumes that saw the ASX 200 track back and test the bottom of its recent trading range – chalking up a 6-month low in the process.

- The ASX 200 finished down -89pts/ -1.28% to 6943 – the lowest close in 6 months.

- The Healthcare sector was best on ground (+0.24%) while Consumer Discretionary (-0.21%) & Consumer Staples (-0.45%) outperformed weakness.

- Energy (-3.69%), Utilities (-2.88%) and Materials (-2.20%) the weakest links.

- The RBA left the cash rate unchanged at 4.10%, in line with market expectations at the first meeting for new RBA Governor Bullock

- Computershare Ltd (ASX: CPU) +0.04% edged higher on an asset sale.

- Energy stocks felt the brunt, Uranium in the cross hairs on commentary around rising supply to meet growing demand, a natural phenomenon with higher prices incentivising a supply response.

- Iron ore actually held up okay during a risk off session – China on holidays probably helped, Iron Ore off 0.9% to $US117.15 a tonne with BHP Group Ltd (ASX: BHP) -1.7%, Rio Tinto Ltd (ASX: RIO) -1.78% and Fortescue Metals Group Ltd (ASX: FMG) -1.57%.

- We had UBS Bank Analyst John Story in today, reiterating ANZ Group Holdings Ltd (ASX: ANZ) as his key buy in the banking sector while he talked to their recent downgrade of Westpac Banking Corp (ASX: WBC) to sell – we’ll look to cover this in the AM tomorrow.

- Gold has been on the nose thanks to $US strength, the Dollar Index 107 pushing Gold back towards US$1820/oz today. Gold stocks felt the heat, Northern Star Resources Ltd (ASX: NST) -4.29% and Newcrest Mining Ltd (ASX: NCM) -3.22%

- Asian stocks were lower, Hong Kong off -2.88%, Japan down -2.07% while China was closed

- US Futures are down ~0.20%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

RBA leaves rates unchanged

The RBA left the cash rate unchanged at 4.10%, in line with market expectations at the first meeting for new RBA Governor Bullock.

In terms of changes to the statement, they noted economic growth in 1H23 was stronger than expected, but below trend while they highlighted the impact of fuel prices (Automotive fuel rose 13.9% year-on-year in the August inflation data).

Ultimately Goods inflation appears to be easing, but services inflation is staying persistent.

Futures are now pricing rates to peak at 4.24% in 2023 (in December), implying a 56% chance of one rate hike by the end of 2023.

The market is pricing in a peak of 4.36% in April 2024, and a rate of 4.25% in December 2024 (very similar to December 2023 level).

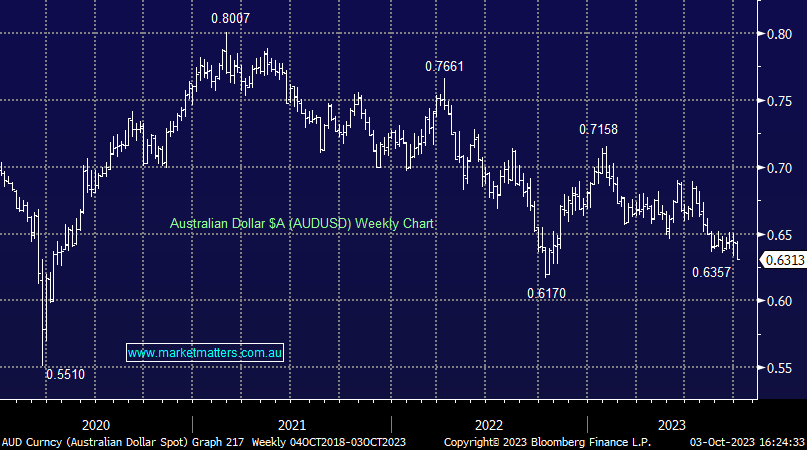

- The AUD is back testing US63c

Australian vs. US dollar

Computershare Ltd (ASX: CPU) $25.82

CPU +0.04%: the share registry and employee services company announced the sale of their US Mortgage Services business following a strategic review.

US-based asset manager Rithm Capital Corp (NYSE: RITM) is expected to pay $US720m for the book which is in line with their tangible asset value and with market expectations for the sale.

While Computershare expects the deal to complete in around 6 months’ time barring any regulatory issues, they have stuck to guidance for FY24. They decided to sell the unit to focus more on the core business, noting the US Mortgage Services arm has come in below margin and return on capital targets, been more capital intensive and faces greater regulatory risk. The CEO even went as far as saying it was “a bit too macro,” referring to the external factors it faces.

Computershare will bank ~$1.1b AUD, subject to adjustments, flagging M&A and potential capital returns for shareholders upon settlement.

Computershare Ltd (ASX: CPU)

Broker Moves

- Mader Group Ltd (ASX: MAD) Rated New Buy at Unified Capital; PT A$7.36

- Johns Lyng Group Ltd (ASX: JLG) Rated New Hold at Jefferies; PT A$6.50

- Atlas Arteria Group (ASX: ALX) Cut to Hold at Morgans Financial Limited

- Idp Education Ltd (ASX: IEL) Rated New Underperform at Jefferies; PT A$18

Major Movers Today