Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.51% to 6925.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

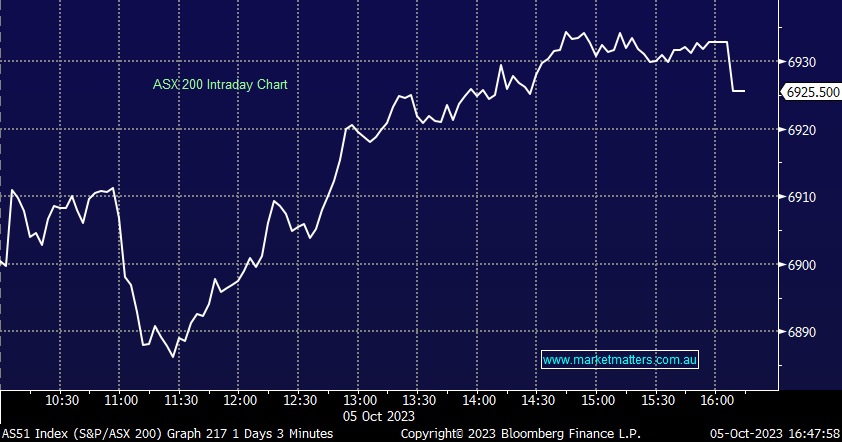

Some respite across the ASX today with the market bouncing from the bottom of its trading range despite a fairly brutal night across material and energy stocks, both sectors lagged today but the slack was more than taken up by interest rate sensitive names, property stocks enjoyed the pullback in US bond yields which flowed through to our own bond market today while Tech rebounded nicely from an aggressive 3-week, 13% pullback that has improved the risk/reward materially in the number of the large cap names.

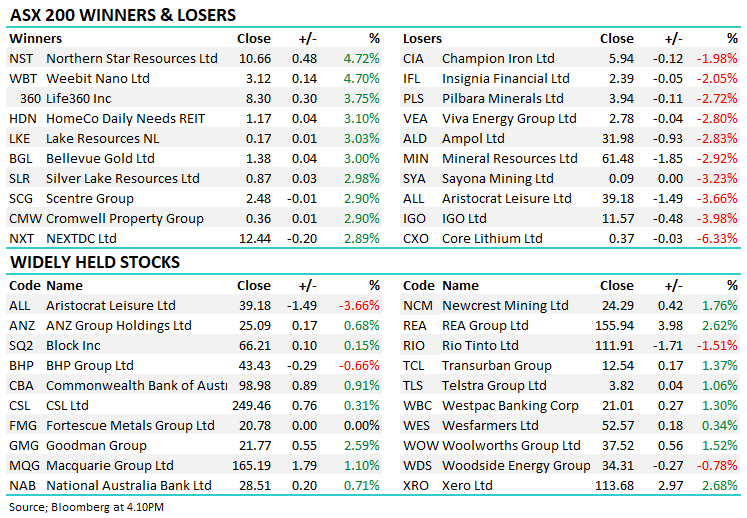

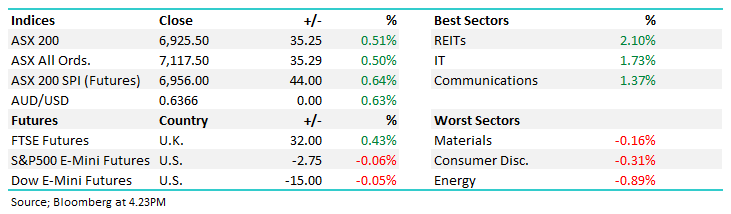

- The ASX 200 finished up +35pts/ +0.51% to 6925.

- Property (+2.10%), IT (+1.73%) and Communications (+1.37%) led the line.

- Energy (-0.89%), Consumer Discretionary (-0.31%) and Materials (-0.16%) the weakest links

- Interesting to see Oil/Gas stocks bounce well from early weakness, they had pre-empted a pullback in the oil price and clearly attracted some buyers on the gap lower, Woodside Energy Group Ltd (ASX: WDS) finished down -0.78% however it was down 2.78% at its lows, while Santos Ltd (ASX: STO) fell a more benign -0.4%.

- Lithium Miners fell after JPMorgan Chase & Co (NYSE: JPM) downgraded on oversupply concerns – arguably, the horse has already bolted!

- They cut 2023-27 lithium price forecasts by about 10-40% saying the market will be oversupplied out to 2030

- Pilbara Minerals Ltd (ASX: PLS) -2.72%, Mineral Resources Ltd (ASX: MIN) -2.92% while IGO Ltd (ASX: IGO) -3.98% was hit hardest as they moved to a sell equivalent.

- Gold stocks were on the other side of the coin with Northern Star Resources Ltd (ASX: NST) +4.72% upgraded to a buy equivalent while Evolution Mining Ltd (ASX: EVN) +2.84% also bounced.

- Newcrest Mining Ltd (ASX: NCM) +1.76% announced a special dividend of US$1.10 as part of their deal with Newmont Corporation (NYSE: NEM) – this was expected with the stock trading ex on the 18th October, with the currency conversion happening same day. At current spot rates on AUD this equates to $A1.72

- Technology stocks had a better session after a tough period – Xero Limited (ASX: XRO) +2.68% and Altium Limited (ASX: ALU) +1.55% to finish at $42.60, the IT sector locally had pulled back more than 13%.

- Property stocks also enjoyed some bond yield relief, the Aussie 3-year off 9 bps today at 4.04%, Dexus (ASX: DXS) +2.52% & Goodman Group (ASX: GMG) +2.59%.

- PEXA Group Ltd (ASX: PXA) -1.8% is moving ahead with the acquisition of UK conveyancing technology company Smoove PLC (LON: SMV) for ~$42m, paid for from cash balances and existing debt, Smoov has ~7% of remortgage and 3% of the home sales market in the UK.

- Audinate Group Ltd (ASX: AD8) +0.98% successfully raised $20m through the SPP with some scale back for smaller investors. They now have an extra $70m in the bank to drive growth. The raise completed at $13, the stock closed today at $13.34.

- SRG Global Ltd (ASX: SRG) +4.96% secured a 10-year extension to their NZ Transpower contract, worth $NZ130m, adding to ~$55m of contracts already won since 1 July

- Iron Ore edged +0.76% higher in Asia, Fortescue Metals Group Ltd (ASX: FMG) was flat however its been incredibly resilient during this recent bout of market volatility.

- Gold benefitted from a lower $US, the dollar index back below 107 trading 106.54 at our close, spot Gold +$US5 to $US1827.

- Asian stocks were higher, Hong Kong up 0.56% & Japan put on 1.9%, while China came back online and edged up +0.10%

- US Futures are down ~0.10%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Alumina Limited (ASX: AWC) Raised to Buy at Citigroup Inc (NYSE: C); PT A$1.30

- Northern Star Raised to Overweight at JPMorgan; PT A$11.50

- Chalice Mining Ltd (ASX: CHN) Raised to Neutral at JPMorgan; PT A$2.30

- Arafura Rare Earths Ltd (ASX: ARU) Cut to Neutral at JPMorgan

- Sims Ltd (ASX: SGM) Raised to Neutral at JPMorgan; PT A$13

- Pilbara Minerals Cut to Neutral at JPMorgan; PT A$4.50

- Core Lithium Ltd (ASX: CXO) Cut to Underweight at JPMorgan

- IGO Cut to Underweight at JPMorgan; PT A$10.40

- Clinuvel Pharmaceuticals Limited (ASX: CUV) Rated New Buy at Bell Potter; PT A$24

- Aussie Broadband Ltd (ASX: ABB) Cut to Accumulate at Ord Minnett; PT A$4.15

Major Movers Today