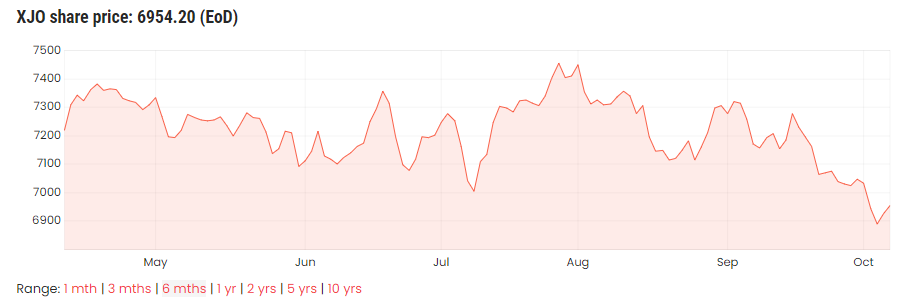

Rising bond yields, oil prices, and now heightened geopolitical tensions in the Middle East have seen equity markets pull back. The S&P/ASX 200 (INDEXASX: XJO) is effectively flat year-to-date, giving up gains of close to 8% seen in July.

Navigating the volatility

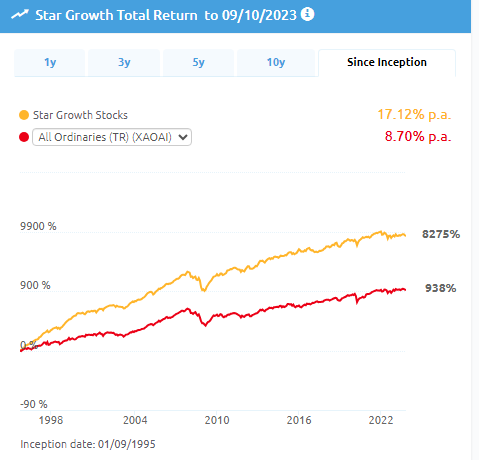

The team at Stock Doctor has always placed company fundamentals above macroeconomic factors when constructing our Star Growth and Income universe.

A sufficiently diversified portfolio of high-quality businesses with excellent Financial Health has been the secret to our long-term success, meaning we try not to get caught up with the day-to-day headlines and volatility that tends to concern the average investor.

Source: StockDoctor.com.au

Finding opportunities in a down market

Two companies the team at Stock Doctor has recently initiated coverage on, which we believe are offering attractive value at current prices are, gold miner Capricorn Metals Ltd (ASX: CMM) and mining software provider RPMGlobal Holdings Ltd (ASX: RUL).

The case for Capricorn Metals Ltd (ASX: CMM)

CMM is a mid-tier gold miner with operations based in Western Australia. The management team is highly regarded and has a history of value creation for shareholders in previous ventures, building 4 projects across different companies, including Equigold NL (ASX: EQI) and Regis Resources Ltd (ASX: RRL).

Regis Resources Ltd (ASX: RRL) share price

The team is looking to repeat success with its recent construction of the Karlawinda Gold Project and future development of Mt Gibson.

While the valuation may appear expensive relative to peers, we believe this is justified given the quality of the operations to date and the value created through execution in mine development.

Additionally, the firm has recently retired the vast majority of its gold hedge book, meaning it is one of the few Australian gold miners with a high realization of gold prices, resulting in higher margins per ounce sold. This will allow greater cash flows in the near term to fund new developments, and retire debt.

Why RPMGlobal Holdings Ltd (ASX: RUL) is underrated?

RPM Global is a company most small-cap investors are familiar with. It has traditionally been known as a consultant to the mining industry but has transitioned to software development and sales over the past decade.

RPMGlobal Holdings Ltd (ASX: RUL) share price

Nowadays, RUL has 9 out of the top 10 mining firms globally using its software and is one of the first providers to offer cloud-based solutions that interact with its financial reporting and modelling offerings.

The returns of the business have somewhat been obfuscated, however, as it is undergoing a transition from one-off license sales to a recurring software as a service (SaaS) subscription model.

Looking at the summarised financials on Stock Doctor, RUL appears to have meagre returns on equity and net profit margins.

We believe the next 12-24 months will see a significant uplift in these figures, as the company has a significant pipeline of business recorded via its Total Contract Value (TCV), which sits at ~$132 million. Theoretically, this revenue will require little additional cost to serve and may have underlying profit margins before interest and tax approaching 20-30%, against current group margins of ~5-10% pretax.

With over $30 million in net cash, and a buyback program underway, we feel this gem is still undervalued.

Source: StockDoctor.com.au