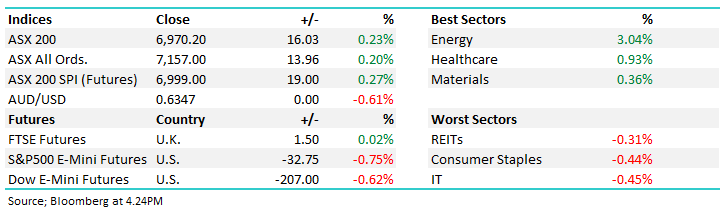

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.23% to 6970.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX was higher today (+16pts), though it finished up less than SPI Futures (+58pts) had implied on Saturday morning, the atrocious attacks by Hamas within Israel over the weekend that left hundreds dead has created another level of complexity, leading to higher Oil & Gold prices across Asia today, while we all hope and pray for a quick resolution, it appears unlikely.

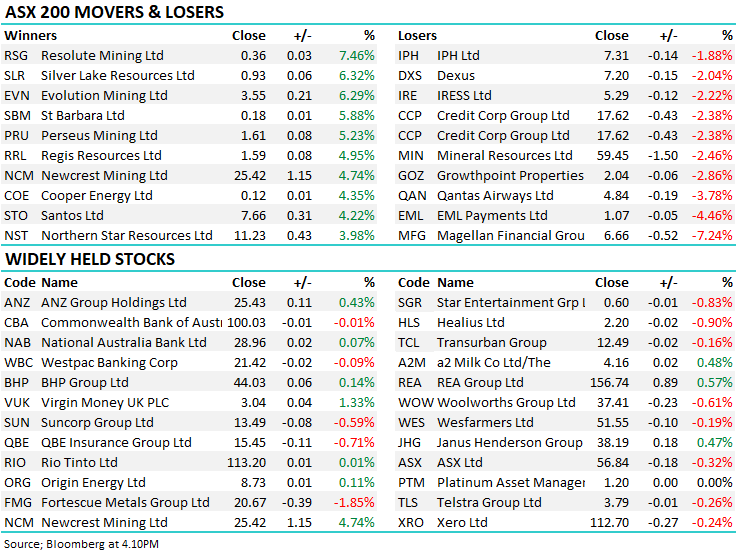

- The ASX 200 finished up +16pts/+0.23% at 6970.

- The Energy sector was best on ground (+3.04%) while Healthcare (+0.93%) & Materials (+0.36%) outpaced the markets gain.

- IT (-0.45%) and Staples (-0.44%) the weakest links while Property also fell (-0.30%).

- Oil and gold stocks were in focus today with Crude Oil +3.58% higher in Asian trade while Gold traded up to $US1850/oz

- Evolution Mining Ltd (ASX: EVN) +6.29% the standout while Northern Star Resources Ltd (ASX: NST) +3.98% and Silver Lake Resources Ltd (ASX: SLR) +6.32% also chimed in, but the whole sector was bought. We own the 3 names mentioned and with an overweight stance to Gold in our growth portfolio.

- Woodside Energy Group Ltd (ASX: WDS) +3.07%, Santos Ltd (ASX: STO) +4.22% and Beach Energy Ltd (ASX: BPT) +3.33% all higher, with WDS also enjoying an upgrade to buy equivalent from RBC.

- Magellan Financial Group Ltd (ASX: MFG) -7.24% down again, although the selling was more anaemic today vs Friday’s aggressive move. Certainly still more sellers than buyers, and we remain on the fence for now, void of the confidence to add to our position but equally, we don’t want to be shaken out at current levels. Currently, we’re down ~17% in the growth portfolio on a 4% position which has hit returns by ~70bps while the Income Portfolio is down 12% and we’re nursing a 48bps MFG hangover there.

- Guzman y Gomez (GYG) in the news flagging a potential IPO – we own Chipotle Mexican Grill, Inc. (NYSE: CMG) in our International Equities Portfolio which is more than 10x the size of Guzzy but a very similar sort of business – good comparable.

- Qantas Airways Limited (ASX: QAN) -3.78% traded to new yearly lows closing at $4.84 today, we see no reason to be there however, this is a call about the significant future capex rather than the media headlines.

- We weighed back into Altium Limited (ASX: ALU) last week for Growth, believing the risk/reward now stacks up for this high-quality software business.

- Iron Ore was down 2.7% in Asia following the Golden Week festivities.

- Gold edged higher trading at US$1850 at our close.

- Asian stocks were mixed, Hong Kong up 1%, Japan flat while China fell -0.81%

- US Futures are all down circa -0.70%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Steadfast Group Ltd (ASX: SDF) Raised to Overweight at Jarden Securities; PT A$6

- Amcor CDI (ASX: AMC) GDRs Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$14.50

- Beach Energy Cut to Sector Perform at Royal Bank of Canada (TSE: RY); PT A$1.70

- Viva Energy Group Ltd (ASX: VEA) Raised to Outperform at RBC; PT A$3.40

- Woodside Energy Raised to Outperform at RBC; PT A$38

- CSR Limited (ASX: CSR) Raised to Buy at Goldman Sachs Group Inc (NYSE: GS); PT A$6.45

- Bank of Queensland Ltd (ASX: BOQ) Cut to Sell at Citigroup Inc (NYSE: C); PT A$5

Major Movers Today