Global markets

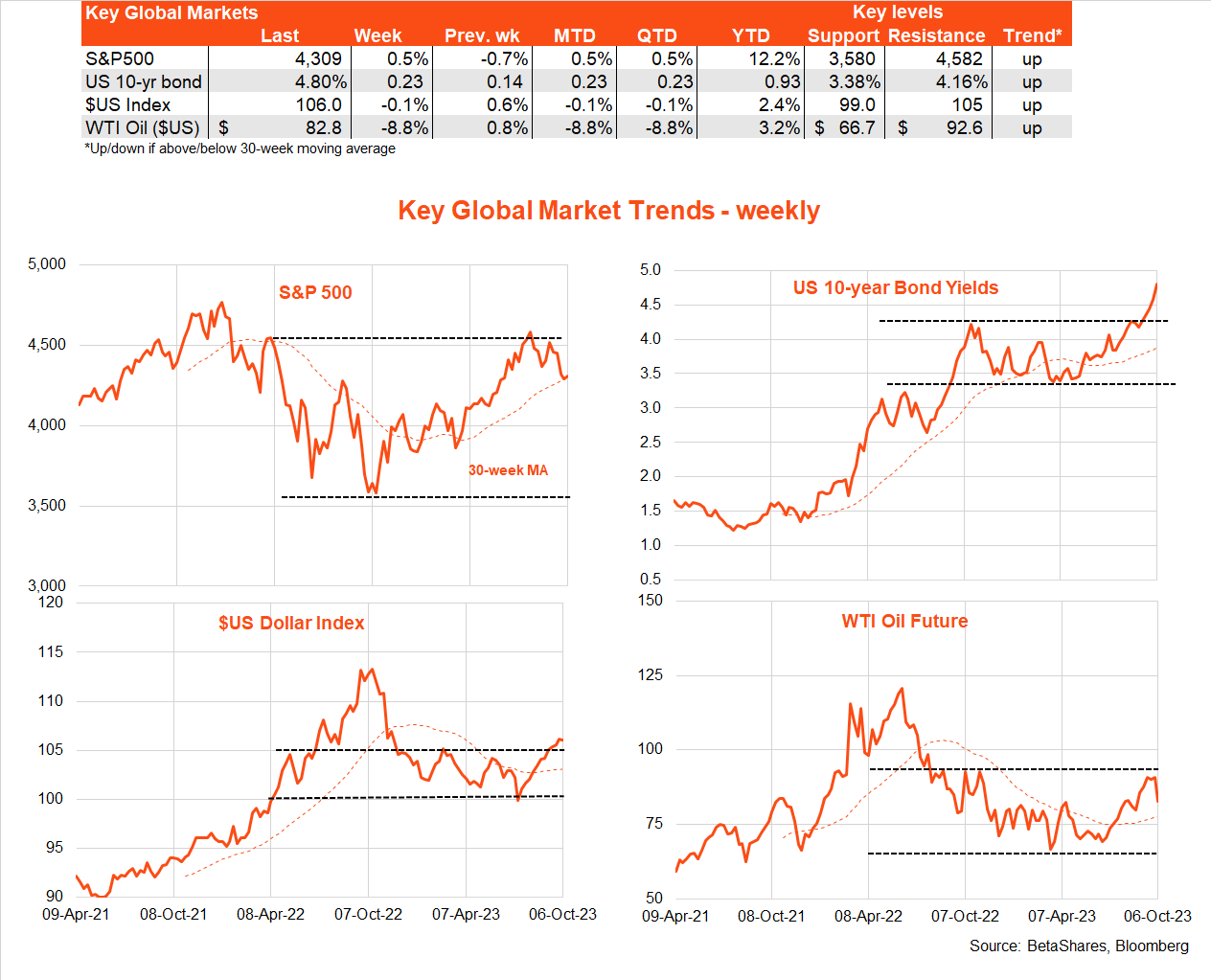

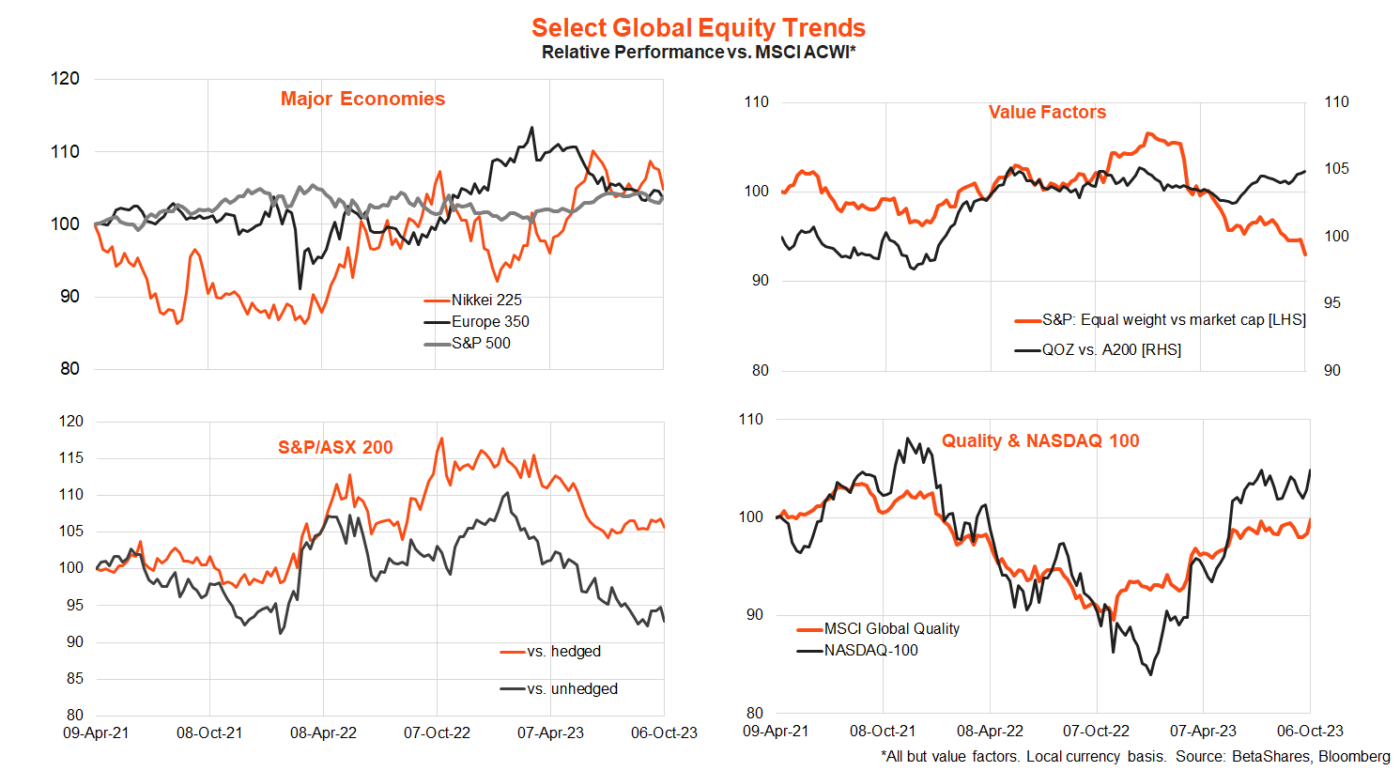

US equities managed to squeeze out small gains last week despite a further rise in bond yields, likely helped by a slump in oil prices and easing US wage inflation. Even the Nasdaq-100 (INDEXNASDAQ: NDX) bounced back 1.8%.

Whether this is merely consolidation remains to be seen, with Hamas attacks on Israel over the weekend likely to now lead to nervousness over the oil price and inflation outlook, given the risk of tighter restrictions on Iranian exports.

In terms of key events last week, markets were initially spooked by a rebound in US job openings – the decline of which over recent months had given rise to hopes of an easing in excess labour demand without the need for a recession.

Despite the monthly rebound, however, the broader trend still appears downward.

Similarly, markets were initially spooked by Friday’s much larger-than-expected US employment gain of 336k in September, though then took some comfort from the fact the unemployment rate managed to hold steady at 3.8% and annual wage growth eased further from 4.3% to 4.2%.

All this suggests that despite ongoing solid US employment demand, rising labour supply is helping to contain labour cost pressures.

Oil prices slumped 8.8% last week reflecting Russia’s announcement that it would lift its self-imposed partial ban on oil exports, along with more general market concerns that higher prices may start to slow demand.

In the week ahead, initial attention will naturally focus on the oil market – with at least a knee-jerk upward move in prices likely. Otherwise, a key focus will be the US September CPI report on Thursday (US time), with flatter oil prices likely to produce a smaller 0.3% gain in headline prices after August’s 0.6% spike.

Core inflation is expected to rise by a reasonably modest 0.3% again. If achieved, these results should not overly rile the bond market further as they would be consistent with the Fed leaving rates on hold at the November policy meeting.

Note also this week marks the start of the Q3 US earnings reporting season. Given the resilient economic outlook, overall reports are likely to remain encouraging, which could give Wall Street some reason to cheer even in the face of high bond yields. After a flat 2023, markets continue to expect solid US earnings growth of just over 10% in both 2024 and 2025.

Minutes to the latest Fed policy meeting are released on Wednesday (US time), along with September producer prices.

Australian market

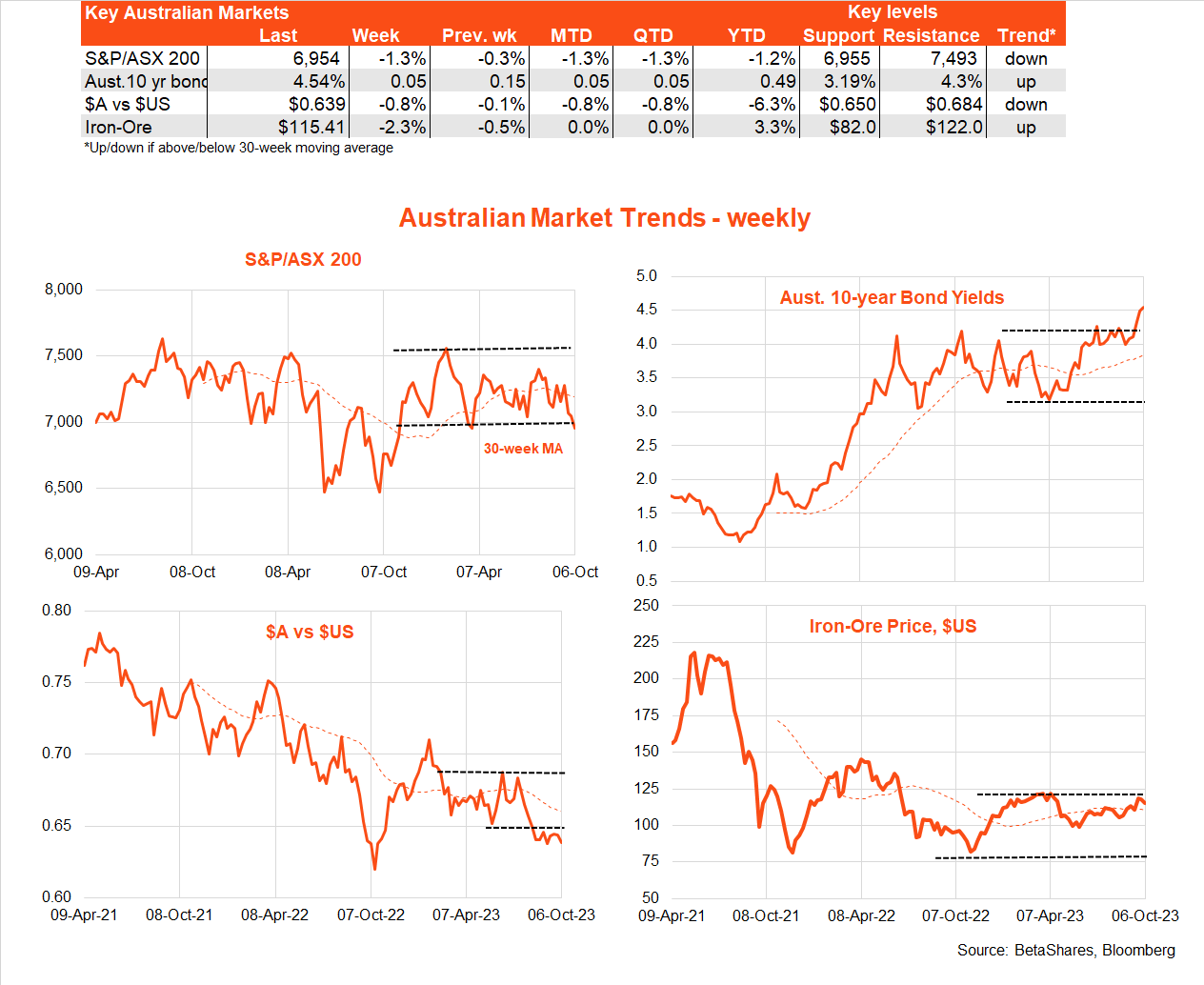

Local equities declined further last week, though are yet to benefit from Friday’s solid rebound in the US market.

Renewed Middle East tensions on the weekend, however, may hold back today’s market bounce. Bond yields rose further and the $A sank, as the US ‘no landing’ scenario remained the overriding global narrative.

In terms of major highlights last week, the RBA (under new Governor Michele Bullock) left interest rates on hold for the fourth month in a row, though the accompanying statement retained a modest tightening bias.

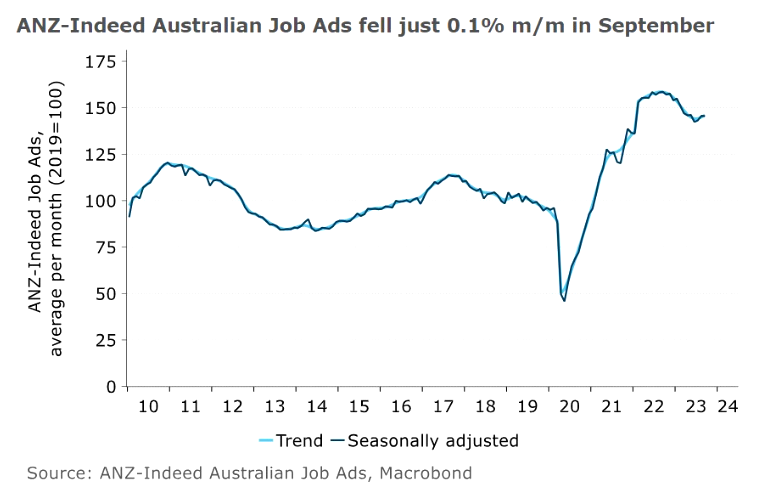

That said, pressure may well be building for another rate increase, with growing signs of economic resilience. ANZ Group Holdings Ltd (ASX: ANZ) job ads were flat in September after rising 1.9% in August – a tentative sign of stabilisation at a still high level following earlier declines from last’s year peak.

Of more RBA concern, national house prices continued to charge ahead, with Core Logic reporting a further 0.8% gain in September. House prices are now a whisker away from their record highs achieved early last year.

Against this backdrop, key local events this week include the Westpac Banking Corp (ASX: WBC) and National Australia Bank Ltd. (ASX: NAB) surveys of consumer and business sentiment respectively.

Business sentiment is likely to hold at a robust level, while it would not surprise if still subdued consumer sentiment finally rebounded somewhat given steady official interest rates in recent months, easing inflation, higher house prices and reduced fear of recession.

Have a great week!