Stock is a certificate of ownership issued by a corporation. To raise capital, the company issues a certificate of ownership to each shareholder. In return, the company pays dividends and bonuses to shareholders.

Each share represents a basic unit of ownership in a company. As the number of shares increases, there may be additional voting rights to determine the company’s performance, often referred to as a “majority shareholder.”

The essence of a share, then, is to raise money to do business; you invest in a company, and the company gives you shares as a return.

Here is an example:

You hear that the owner of a successful restaurant wants to open a new store, but he needs to raise some funding to open the new restaurant. You hear this and think, “This is your chance.” It costs $5 million to open a new store. You’re willing to invest $500,000.

The owner says the new restaurant is worth $10 a share, so you have 50,000 shares of the store. To facilitate the later dividend, the restaurant owner has given you a “XYZ holds 50 thousand shares of the certificate.” In this case, the stock is proof.

If the new business generates $10 million a year, the stock price is $10 a share; after five years, if you generate $50 million a year and someone wants to invest, you may have to pay $50 for a share. Then, if you sell it for $50, you get five times your capital.

Buying stocks is not a game of chance, you need to learn to pick good companies to make a good profit.

So what do you choose?

With thousands of stocks in the Australian, US and Hong Kong stock markets, it can be difficult for a beginner to make a selection.

There is a practical stock classification method that can help you quickly improve the efficiency of stock selection. Stocks are classified into four types based on returns and risks, namely blue crisps, cyclical stocks, growth stocks and concept stocks

01 Blue Chip stocks

Blue chip stocks are stocks issued by well-known companies with stable profits. They are characterised by high prices and dividends and generally have a high market value.

As a rule, they are the shares of a quality company that occupies a leading position in an industry. Since these companies have a mature and stable business model, they can provide shareholders with substantial profits; therefore, blue chip stocks are very popular in stock investments.

Simply put, blue chips tend to have larger market caps and are often at the top of the industry.

Here’s an example:

Let me give you an example of Microsoft.

At the data level:

- With a total market capitalisation of $1.96 trillion, Microsoft is a member of the “trillion club” with high thresholds. (The statistical period is as of February 2023)

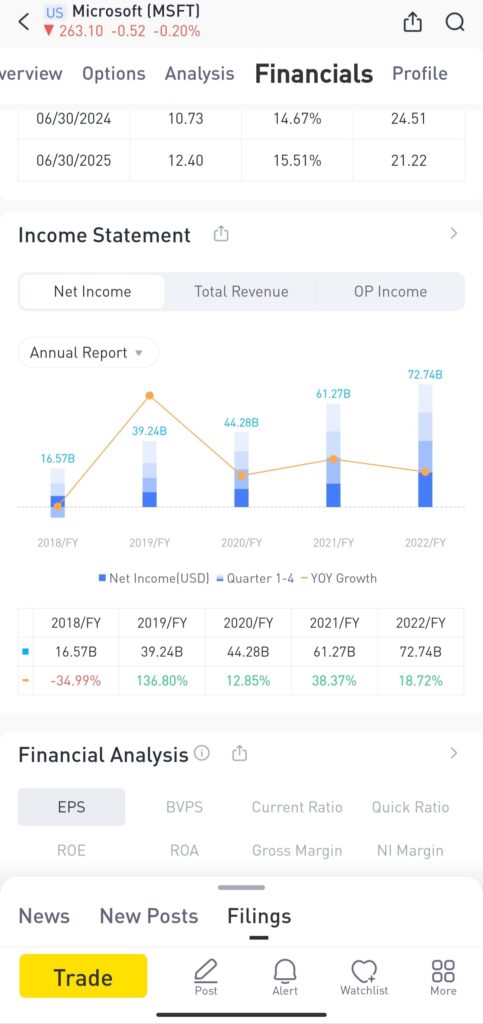

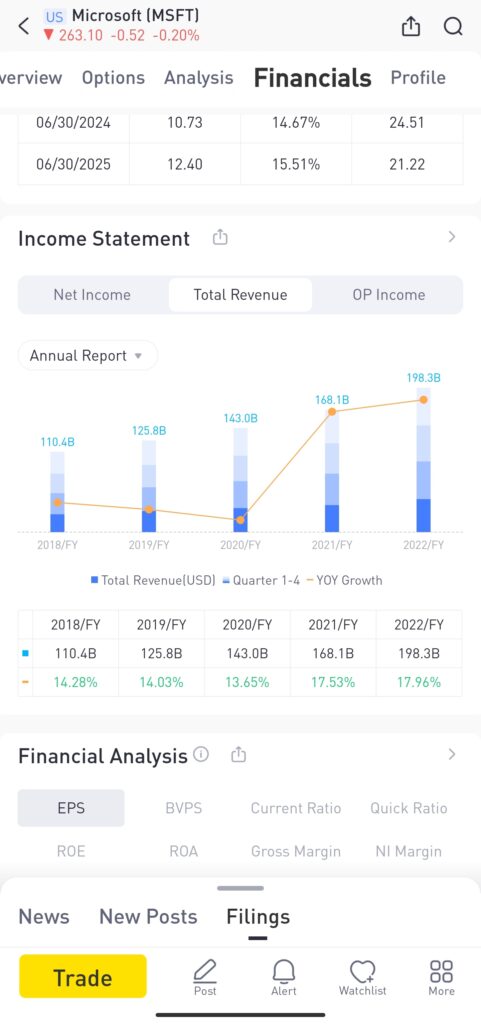

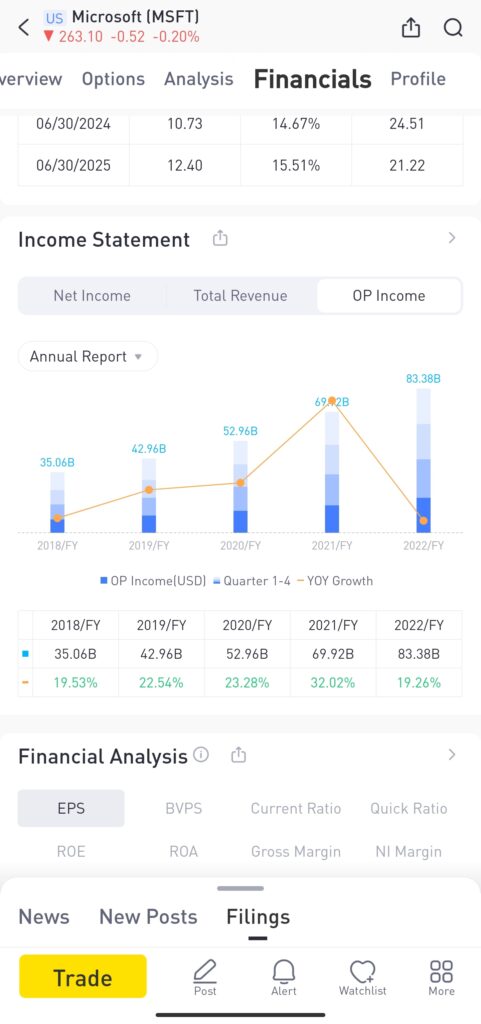

- In terms of profit, Microsoft’s net income, total revenue and operating profit have steadily increased year after year from 2018 to 2022 . In short, profits are very stable.

Put all this together and Microsoft is deemed as a blue-chip stock.

02 Cycle stocks Cycle stocks

such as commodities, real estate, steel and coal, and defense stocks are cyclical stocks whose price movements are significantly affected by the economic cycle.

In other words, the ups and downs of such stocks are closely linked to the business cycle, i.e. cyclical stocks often rise when the economy is doing well; when the economy is doing badly, cyclical stocks often crash.

Simply put, cyclical stocks are strongly correlated with the economic cycle.

Here is an example:

The boy Jack lives in a city that is relatively backward. In order to improve the standard of living of the inhabitants, the mayor wants to vigorously promote the economy and accelerate urbanisation.

The economy of the city has been boosted by tourism. Jack and the others had more money and wanted to move into a bigger, better house, so the real estate business did well. Also, because of its good environment, the city attracts many tourists who buy houses and settle down. Therefore, many real estate companies went public, and the companies’ stocks went up for many years.

However, the ongoing pandemic caused the city’s economy to shrink, factories were closed, workers lost their jobs, and people had very little money.

Therefore, making it very difficult to sell real estate at this time, a large number of companies have suffered losses, and the decline of real estate-related stocks is also obvious. When the economy is bad, real estate-related stocks also fall, which is a typical cyclical stock concept.

03 Growth stocks

Growth stocks are companies that issue shares on a small scale and whose business is thriving. The company is well managed, profitable, the products on the market have a strong competitiveness of the listed company shares.

The typical sales or profit growth rate of such companies is much higher than traditional industries for a few years, which can be 30%, 50% or even higher; always in the leading position in the industry, with a strong comprehensive, core competitiveness, such as an excellent management team.

Growth stocks exist in all industries, and growth stocks can become blue chips as the company develops. But growth stocks are very vulnerable to capital manipulation. In other words, if the profit numbers are good, such stocks skyrocket in price ; if the profit numbers are bad, they will fall drastically . Therefore, the overall volatility of growth stocks is relatively high.

Simply put, growth stocks are “potential stocks”; if you invest now, you will get a lot back in the future.

Here is an example:

Suppose you are a talent scout in the United States and your job is to find the right stars.

One day you suddenly find a nice guy. After an exchange, you learn that this young man is also a third-rate actor. In recent years, he has played a lot of supporting roles. Although many scenes lasted only a few minutes, his acting skills were sharpened very well.

They have not yet decided to recommend this young man to a great director. After a certain period of continuous observation, you find that young people learn very quickly and have good character.

You then take advantage of that. Five years later, young people become A-list celebrities and star in big Hollywood movies, and you get paid for it.

From discovery to discovery, young people are growth stocks for talent scouts.

04 Concept stocks

Concept stocks are stocks that are based on a specific concept and are characterised by speculation on a theme, region or technology.

Such stocks often rise above the daily limit for no reason or for several days in a row, even if the company in question has no substantial products or services at all, but may also be hyped up by investors. But the vast majority of such investments are due to emotional trading, no substantial performance support, and hype.

Therefore, the concept of stock is mostly a kind of emotional speculation, the herd effect is obvious.

Here is an example:

In March 2021, the “first stock in the meta-universe” Roblox went public. The share price rose 54% on the first day of trading, resulting in a market capitalisation of more than $40 billion, a tenfold increase from the $4 billion valuation a year earlier.

As the hype subsided, the stock price of Roblox also experienced a sharp decline, causing many speculators to suffer heavy losses. Want to talk about a performance that could support the stock rally?

Not really, unless you assume that the future direction of the technology sector is the direction of the meta-universe. Add Meta, Nvidia, Microsoft, Tencent and other giants, and the metaverse theme is hot.

The stock price of concept stocks fluctuates dramatically, so investors must be cautious when choosing such stocks.

From these examples you should now have a more complete understanding of stocks.