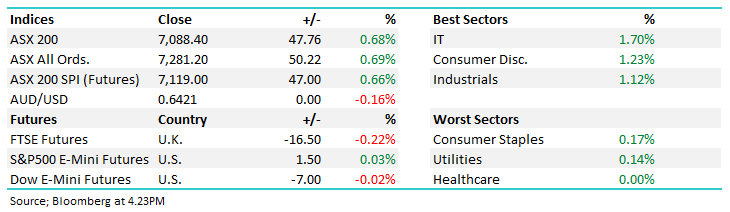

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.68% to 7088.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

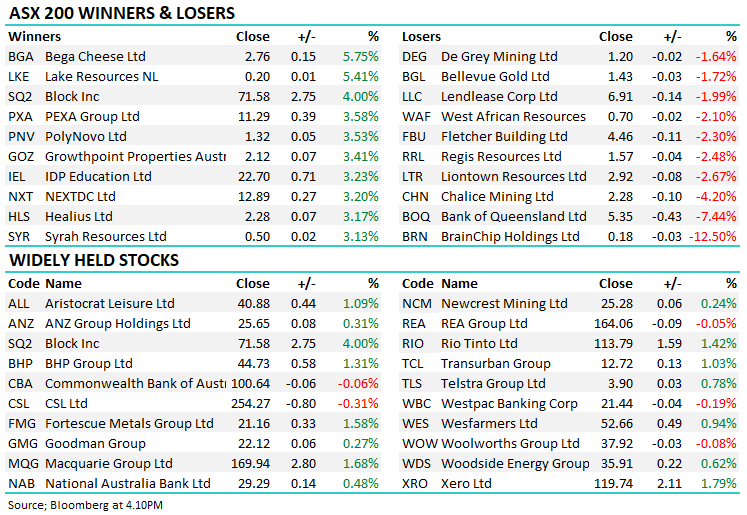

A positive session for the ASX, its fifth in a row with the market bouncing well from the bottom of its trading range as pressure on bond yields eased underpinning broad based buying across equities, 75% of the main board finished up on the session and no sector finishing down.

- The ASX 200 finished up +47pts/ +0.68% to 7088

- The Tech sector was best on ground (+1.70%) while Discretionary (+1.23%) and Industrials (+1.12%) were the only others to finish more than 1% higher.

- While no sector closed lower, Healthcare finished flat

- Bank of Queensland Ltd (ASX: BOQ) -7.44% traded lower on a miss at their FY23 results, more on this below.

- Domino’s Pizza Enterprises Ltd (ASX: DMP) +2.9% enjoyed a Citigroup Inc (NYSE: C) upgrade to buy, the broker saying it’s “encouraged” by changes in the company’s strategies over the last 6 months, the stock is still 32% below its January high.

- CSL Limited (ASX: CSL) -0.31% ticked lower despite reconfirming their previously stated FY23 guidance at their AGM today, with net profit to be $2.9-3bn in constant currency terms.

- Insurance Australia Group Ltd (ASX: IAG) +0.18% also reconfirmed guidance while they sighted a very benign claims experience year to date, let’s hope that continues!

- Telstra Group Ltd (ASX: TLS) +0.78% said they plan to buy Technology consultancy business Versent for $267.5m, this has been on the cards for a while.

- Aussie Broadband Ltd (ASX: ABB) -0.24% initially sold off on the news but recovered strongly to close at $4.10, lots happening in the Telco space with ABB looking to buy Symbio Holdings Ltd (ASX: SYM), which we covered this morning here.

- Commonwealth Bank of Australia (ASX: CBA) -0.06% down a touch, no new news coming from their AGM today.

- A mixed bag for gold stocks today, the precious metal was flat in Asian trade, ~$US1,860

- Iron Ore was up 0.85% in Asia, with the three major miners up around 1.5%

- Asian stocks were strong today, China +0.11%, Nikkei +0.67% & Hang Seng +1.65%

- US Futures are mostly flat, though Nasdaq futures are the strongest, +0.2%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Bank of Queensland Ltd (ASX: BOQ) $5.35

BOQ – 7.44%: Another poor result for BOQ with FY23 results around 4% below consensus in terms of underlying cash earnings ($450m), which was down 13% vs. FY22 and continues to highlight ongoing issues with this subscale franchise, albeit, this was not a surprise.

Margins remained under pressure (NIM 1.69%) which contracted a further 21bps on the half. The dividend of 21cps for the half took the FY23 dividend to 41cps, inline with expectations and represented a 71% payout of cash earnings for the half (60% for FY23).

While their strategy remains clear on driving digital transformation to improve competitiveness and per unit operating efficiency, this is easier said than done, particularly in an environment of heightened regulatory scrutiny.

BOQ looks very cheap on just 0.7x book and 9.1x earnings, but it’s cheap for a reason with more challenges to navigate.

Bank of Queensland Ltd (ASX: BOQ)

Calix Ltd (ASX: CXL) $2.95

CXL +10.07%: the second consecutive day of strong gains for Calix Ltd (ASX: CXL) has put a swift halt to the rout of the last ~2 months. The MD & CEO presented to the Bell Potter conference today with the notes from the presentation largely showing no new news, however, it did restore some confidence for the story.

Calix confirmed it’s balance sheet is in good order and “flexible.” The company also confirmed all key FY24 targets remain on track, the most important being the demonstration plant being developed at Pilbara Minerals Ltd’s (ASX: PLS) Pilgangoora Project.

The company’s transformative technology has a pipeline 76 projects in various stages of development, the key now is monetisation.

Calix Ltd (ASX: CXL)

Broker Moves

- Platinum Asset Management Ltd (ASX: PTM) Cut to Sell at Bell Potter

- Baby Bunting Group Ltd (ASX: BBN) Cut to Neutral at Citi; PT A$2

- Hub24 Ltd (ASX: HUB) Rated New Buy at Unified Capital; PT A$37.15

- Netwealth Group Ltd (ASX: NWL) Rated New Buy at Unified Capital; PT A$15.70

- Domino’s Pizza Enterprises Raised to Buy at Citi; PT A$58.60

- Praemium Ltd (ASX: PPS) Rated New Hold at Unified Capital

- Alumina Limited (ASX: AWC) Raised to Neutral at Goldman Sachs Group Inc (NYSE: GS); PT A$1.10

- Lynas Rare Earths Ltd (ASX: LYC) Raised to Buy at Goldman

- De Grey Mining Limited (ASX: DEG) Raised to Buy at Goldman; PT A$1.40

- Aussie Broadband Cut to Underweight at JPMorgan Chase & Co (NYSE: JPM); PT A$3.55

- Santos Ltd (ASX: STO) Raised to Overweight at JPMorgan; PT A$8.15

- Woodside Energy Group Ltd (ASX: WDS) Raised to Neutral at JPMorgan; PT A$35.50

- Aurizon Holdings Ltd (ASX: AZJ) Raised to Positive at Evans & Partners Global Flagship Fund (ASX: EGF); PT A$4

- MA Financial Group Ltd (ASX: MAF) Rated New Add at Morgans Financial Limited

Major Movers Today