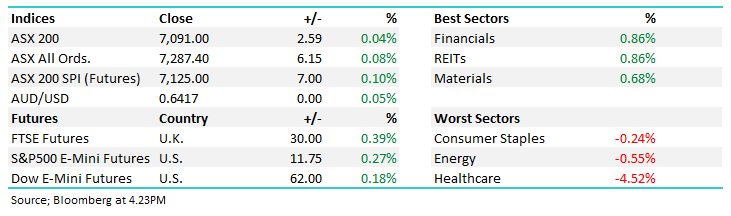

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.037% to 7091.00.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A quiet but (marginally) positive session played out in OZ Minerals Limited (ASX: OZL) today with the banks and miners supporting the broader index, while the Healthcare sector continues to struggle, news overnight knocking the sector again today. US CPI Inflation due for release tonight will be telling and could dictate market trends from here, just as bond yields are starting to cool.

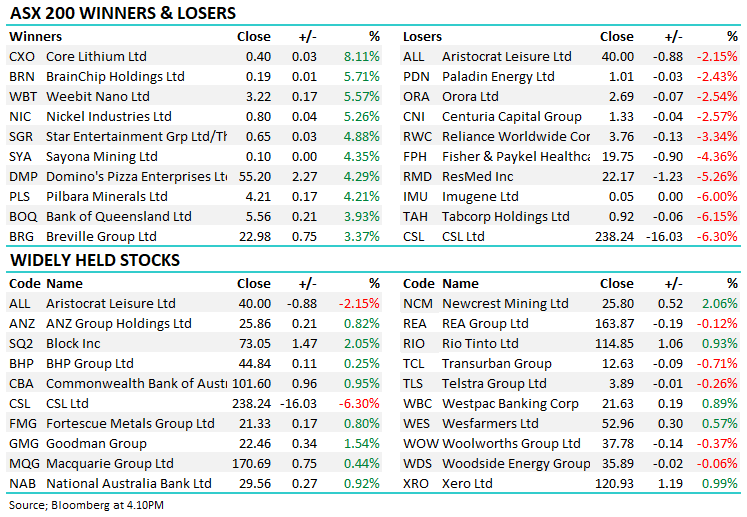

- The ASX 200 finished up +2pts/+0.04% at 7091.

- The Financials and Real Estate sectors shared the chocolates for best on ground (+0.86%) while Materials (+0.68%) & Tech (+0.58%) were close behind

- Healthcare (-4.52%) was by far the market laggard today, joined by Energy (-0.55%) and Staples (-0.24%)

- Monthly inflation expectations came in at 4.8% YoY, up from 4.6% but not surprising, the quarterly print is a lot more telling.

- Interesting move from Steve Johnson over at Forager Australian Shares Fund (ASX: FOR) +9.02%, writing to investors flagging an intention to revert back to an open-ended structure versus a Listed Investment Trust (LIT) which is closed-ended in an effort to bridge the persistent discount it trades at (~15%) relative to its Net Asset Value (NAV). This is rife in LICs and LITs and kudos to Steve for doing something about it – more managers should be doing this but alas, when you have locked in capital earning fees, many managers will find it hard to part with that, even though they should. Performance is another issue but at least this is a proactive move to the benefit of investors.

- Tabcorp Holdings Ltd (ASX: TAH) -6.15% was hit after saying revenue dropped ~6% in 1QFY24 due to the sale of Ebet Inc (NASDAQ: EBET) and lower contracted electronic gambling machines.

- Redbubble Ltd (ASX: RBL) +30.43% ripped after their quarterly showed positive underlying cash flow – self-funding a business, what a novel idea!

- CSL Limited (ASX: CSL) -6.3% was sold down after Novo Nordisk A/S (CPH: NOVO-B) announced encouraging efficacy results on the use of GLP-1’s on kidney disease, which could be a potential negative for CSL’s Vifor business.

- BlueScope Steel Limited (ASX: BSL) -1.95% fell on a downgrade from Morgan Stanley (NYSE: MS)

- Lithium stocks had another good day, rising from their hiatus, Pilbara Minerals Ltd (ASX: PLS) +4.21%, IGO ltd (ASX: IGO) +0.79% and at the smaller end of town, Global Lithium Resources Ltd (ASX: GL1) +6.67%

- Iron Ore was up smalls in Asia, sitting at $US112.75

- Gold edged higher trading at US$1878 at our close.

- Asian stocks fared far better than our market. Hang Seng (+2%) the star, Nikkei (+1.69%) and China (+0.78%) also doing well at our close though

- US Futures are up around +0.25%

- CPI inflation data out tonight in the US, with core SPI for Sep expected to be 0.3% taking the YoY run rate to 3.6%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

CSL Limited (ASX: CSL) $238.24

CSL -6.3%: the GLP-1 troubles that have plagued Resmed CDI (ASX: RMD) over the last month have also put pressure on the biopharma company, sending the stock to 4-year lows today. Novo Nordisk is currently trialling their GLP-1 drug on chronic kidney disease (CKD) and Type 2 Diabetes (T2D) with a 5-year study expected to be completed late next year.

The trial has been halted early given the outstanding results already meeting efficacy outcome requirements, with the data now expected to be published a year early.

Around 8% of CSL’s earnings may be impacted by the study, stemming from the Vifor business’s nephrology and dialysis (kidney disease treatment).

- More pain in the healthcare sector as a result of GLP-1, we do not plan on increasing exposure here

CSL Limited (ASX: CSL)

Broker Moves

- Insurance Australia Group Ltd (ASX: IAG) Raised to Add at Morgans Financial Limited

- Motio Ltd (ASX: MXO) Rated New Buy at Veritas Securities

- Bluescope Cut to Underweight at Morgan Stanley; PT A$18

- Bank of Queensland Ltd (ASX: BOQ) Cut to Neutral at Jarden Securities

- Webjet Limited (ASX: WEB) Raised to Buy at Goldman Sachs Group Inc (NYSE: GS); PT A$8.30

- Breville Group Ltd (ASX: BRG) Raised to Buy at Goldman; PT A$24.50

- Scentre Group (ASX: SCG) Rated New Outperform at Daiwa; PT A$2.77

- Seek Ltd (ASX: SEK) Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$27

- Perenti Ltd (ASX: PRN) Reinstated Buy at Moelis & Co (NYSE: MC); PT A$1.35

Major Movers Today