1. Home is where the stress is…

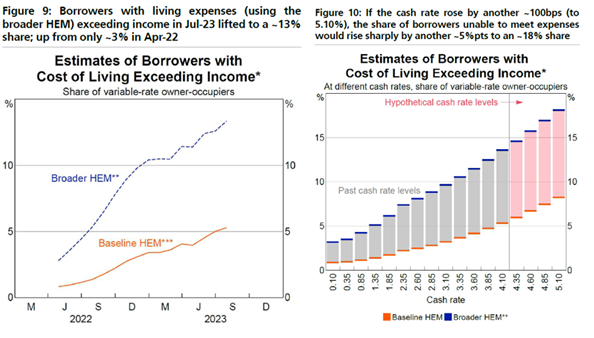

Aussie borrowers with living expenses exceeding income hit 13% in July 2023, up from just 3% in April 2022 for those on variable rates.

The RBA estimates 18% of fixed mortgage rate holders have seen their essential expenses and mortgage payments exceed their income.

Around one third of variable rate mortgage holders have sufficient buffers in their offset account to cover minimum mortgage repayments and essentials for at least one year.

Source: UBS (October 2023)

2. Sandals slide…

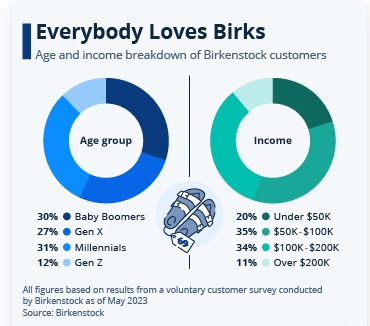

Birkenstock, yes those shoes, listed this week. Unsurprisingly to some, after pricing the IPO at the high end of the indicated range for a $10 billion valuation, the shares struggled in their trading debut.

The German sandal maker’s debut was the worst opening for a listing of $1 billion or more in New York in over 2 years according to Bloomberg. Out of more than 300 US IPOs of that size in the past century, only 9 have fared worse, the last being Applovin Corp (NASDAQ: APP), which opened 12.5% below its IPO price in April 2021.

Despite a fairly even split of fans across age groups and income buckets, the sandals couldn’t attract fans on the stockmarket.

Source: Birkenstock, HolgerZ, Bloomberg (October 2023)

3. One tequila, two tequila…

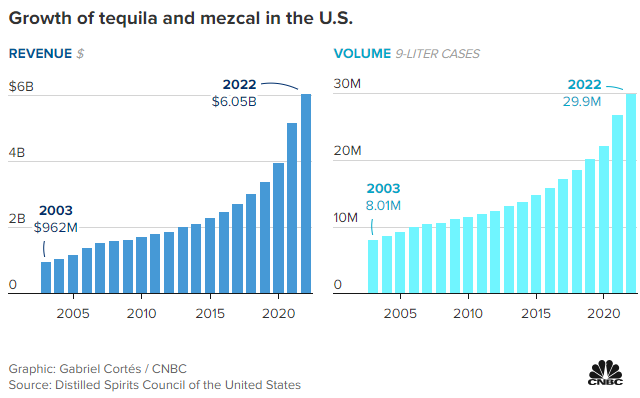

Tequila is shaping up as the new spirit of choice as we head into the Aussie summer.

Effective marketing, shifting demographics, and changing consumer trends have driven strong demand for tequila and mezcal in the US.

Consumers’ increasing willingness to spend more on higher-quality products across wine, spirits and beer has also benefited the spirit.

It comes as Kendall Jenner (of Kardashian heritage) launched her tequila brand into Australia this month. Despite the $100 price tag for 818 Tequila, consumer demand is expected to be strong.

Source: Distilled Spirits Council of the United States (October 2023)