Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.35% to 7026.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

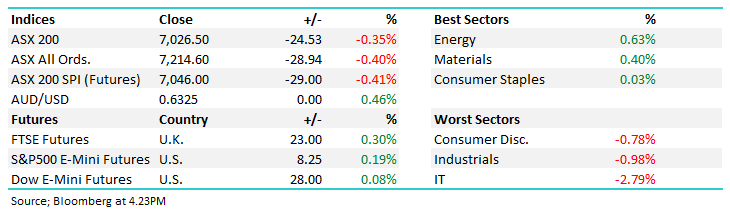

A lacklustre session locally with a smorgasbord of uncertainty playing into investor minds, a -0.35% fall was okay considering the news flow.

Energy and material stocks were reasonably well supported, although considering what Oil & Gold prices did overseas, no one got carried away, while technology tracked their overseas counterparts lower.

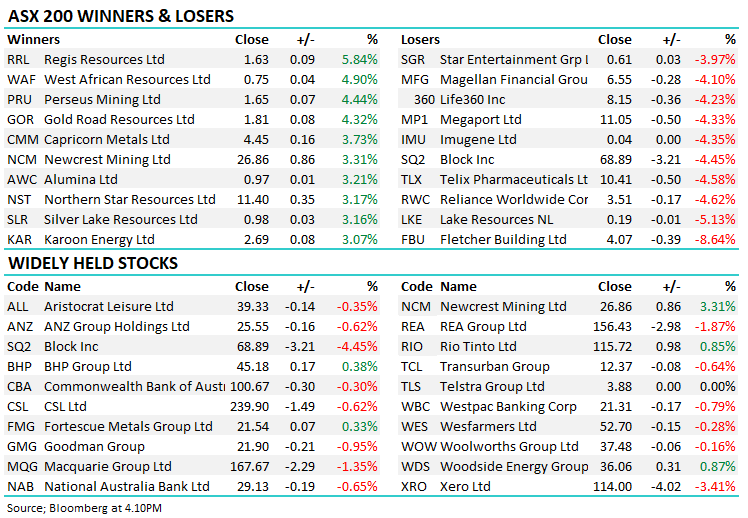

- The ASX 200 finished down -24pts/ -0.35% to 7026

- The Energy sector was best on ground (+0.63%) while Materials (+0.40%) and Staples (+0.03%) outperformed.

- IT (-2.79%), Industrials (-0.98%) and Consumer Discretionary (-0.78%) underperformed the broader strength.

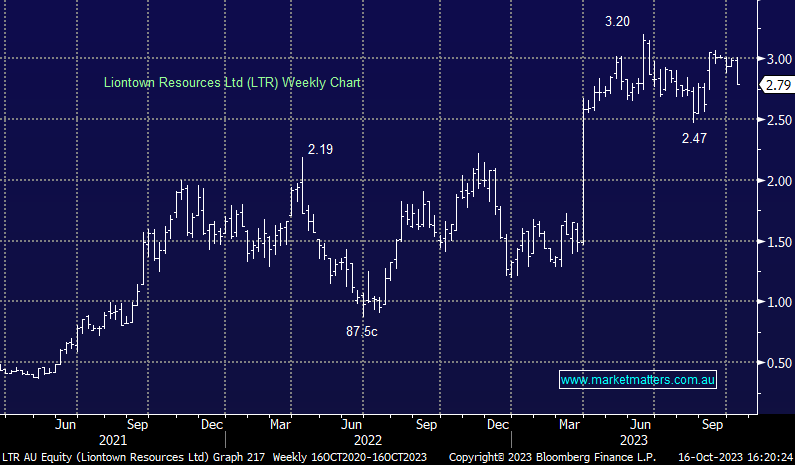

- Liontown Resources Ltd (ASX: LTR) in a halt after Albemarle walked away from its $3/sh takeover offer, they are now looking down the barrel of an equity/debt raise.

- Treasury Wine Estates Ltd (ASX: TWE) +1.31% edged higher after saying that trading conditions remained inline with expectations, while they left the door open to cash in on any changes to Chinese tariffs.

- Mineral Resources Ltd (ASX: MIN) -0.62% slipped lower despite laying out a very positive picture of what lies ahead at their AGM today.

- Fletcher Building Ltd (ASX: FBU) -8.64% was the worst-performing stock on the ASX 200 after coming out of a trading halt, rebutting claims made by Bgc Group Inc (NASDAQ: BGC) about the cause of plumbing failures.

- Magellan Global Fund (ASX: MGF) +4.17% rose after they announced their intention to convert the closed class units to open class units to bridge the gap with their NTA, similar to what FOR did last week.

- Magellan Financial Group Ltd (ASX: MFG) -4.1% fell on the news, opened up a closed-ended fund is good for investors but not so good for the fund manager.

- Qantas Airways Limited (ASX: QAN) –2.4% was down after loyalty chief executive Olivia Wirth resigned, she’s joining the Myer Holdings Ltd (ASX: MYR) board.

- Gold stocks were up but are showing signs of fatigue after a very strong few days – Evolution Mining Ltd (ASX: EVN) +1.46%, Newcrest Mining Ltd (ASX: NCM) +3.3% and Northern Star Resources Ltd (ASX: NST) +3.17%.

- Iron Ore was up 1.8% in Asia, supporting Fortescue Metals Group Ltd (ASX: FMG) +0.33%, BHP Group Ltd (ASX: BHP) +0.38% & Rio Tinto Ltd (ASX: RIO) +0.85%.

- Gold up US$60/oz on Friday before tracking back US$14/oz today, sitting at US$1918 at our close.

- Asian stocks were mostly down, Hong Kong off -0.73%, Japan fell -1.83%, while China dipped 0.48%

- US reporting season gathers momentum this week: Bank of America Corp (NYSE: BAC), Goldman Sachs Group Inc (NYSE: GS), Morgan Stanley (NYSE: MS), Tesla Inc (NASDAQ: TSLA), Netflix Inc (NASDAQ: NFLX) and a slew of regional banks are on the schedule.

- US Futures are up mildly.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

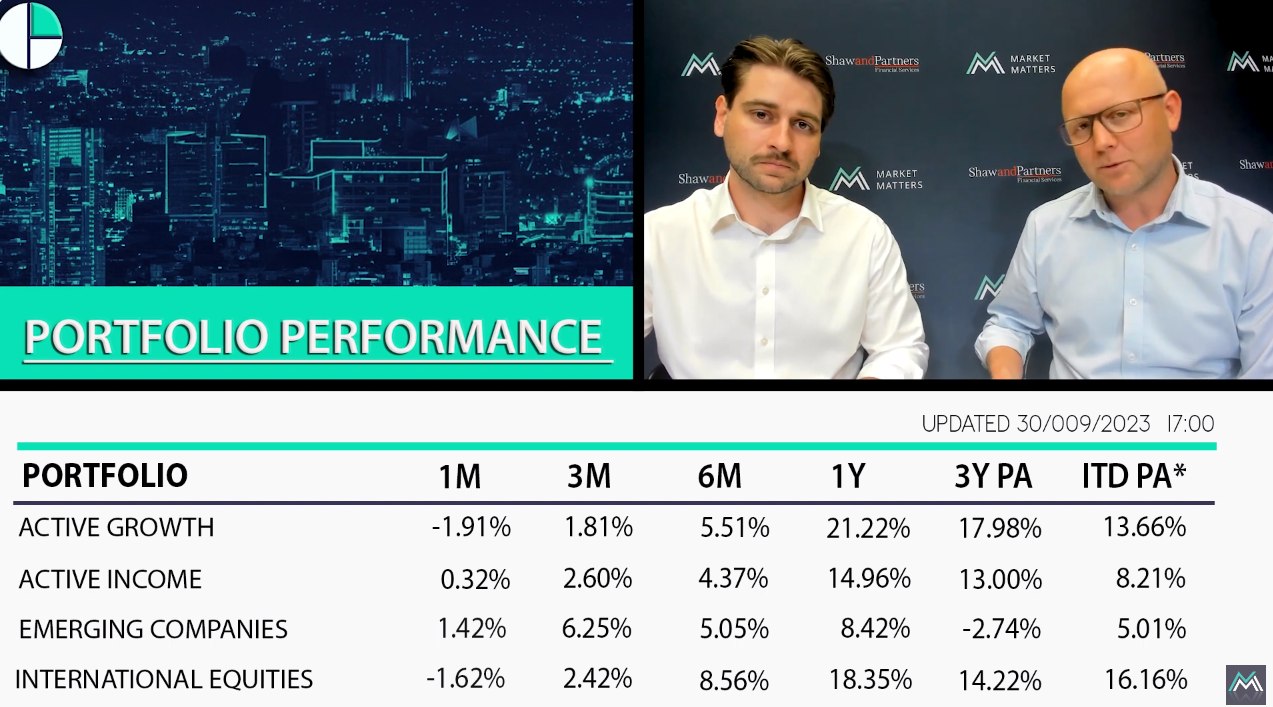

Market Matters Video Update

In our video update for September, Portfolio Managers James Gerrish & Harry Watt discuss current portfolio positioning and performance for the Market Matters published (website) portfolios, available at www.marketmatters.com.au

Liontown Resources Ltd (ASX: LTR) $2.79

LTR Halted: now seems to be in a bit of a pickle after Albemarle Corporation (NYSE: ALB) walked away from a proposed $3/sh takeover bid due to ‘complexities’ that seem to revolve around Gina Rineheart’s recent move to buy 19.9% of the stock, throwing a potential spanner in the works for Albemarle.

The issue now is around funding its Kathleen Valley Lithium project and the numbers are not small, they need about $1bn to reach first production (tipped for mid next year), and it now seems, given the extended trading halt, they’re in discussions with potential debt (and equity providers) to fund, what is now a rather large hole, although an amount ~$500m would do for now.

This is a surprising move by Albemarle, they had made 3 other unsuccessful bids before $3 was backed in by the board – and now they’ve walked away.

More water to go under the bridge here but LTR are out today garnering support for a raise, and brokers have taken the sword to their recommendations.

- Goldmans and Citigroup Inc (NYSE: C) both now calling LTR a sell

Liontown Resources Ltd (ASX: LTR)

Fletcher Building Ltd (ASX: FBU) $4.07

FBU -8.64%: the dual-listed building products company traded for the first time since last Wednesday, spending the long weekend preparing a statement on faulty water pipes that have been causing issues.

The issue pertains to plumbing products manufactured by Fletcher Building’s Iplex which were installed between 2017 and 2022.

Homebuilder BCG installed the products in around 11,000 homes in WA over that period and has blamed Iplex for a faulty product causing the 10.9% failure rate in the state, however, Fletcher Building has pushed back, citing the 0.19% failure rate for installations on the east coast.

BGC has claimed the cost to fix the issue could be over $700m vs FBU predicting under $100m, both companies have conflicting beliefs on the outcome here.

FBU shares fell to 6-month lows on the update, a level that will prove good value if Iplex is not found to be the cause of the issue.

Fletcher Building Ltd (ASX: FBU)

Broker Moves

- Liontown Resources Cut to Sell at Citi; PT A$2.30

- Liontown Resources Cut to Sell at Goldman; PT A$1.85

- Paladin Energy Ltd (ASX: PDN) Rated New Sell at Citi; PT 90 Australian cents

- Boss Energy Ltd (ASX: BOE) Cut to Sell at Shaw and Partners; PT A$3.60

Major Movers Today