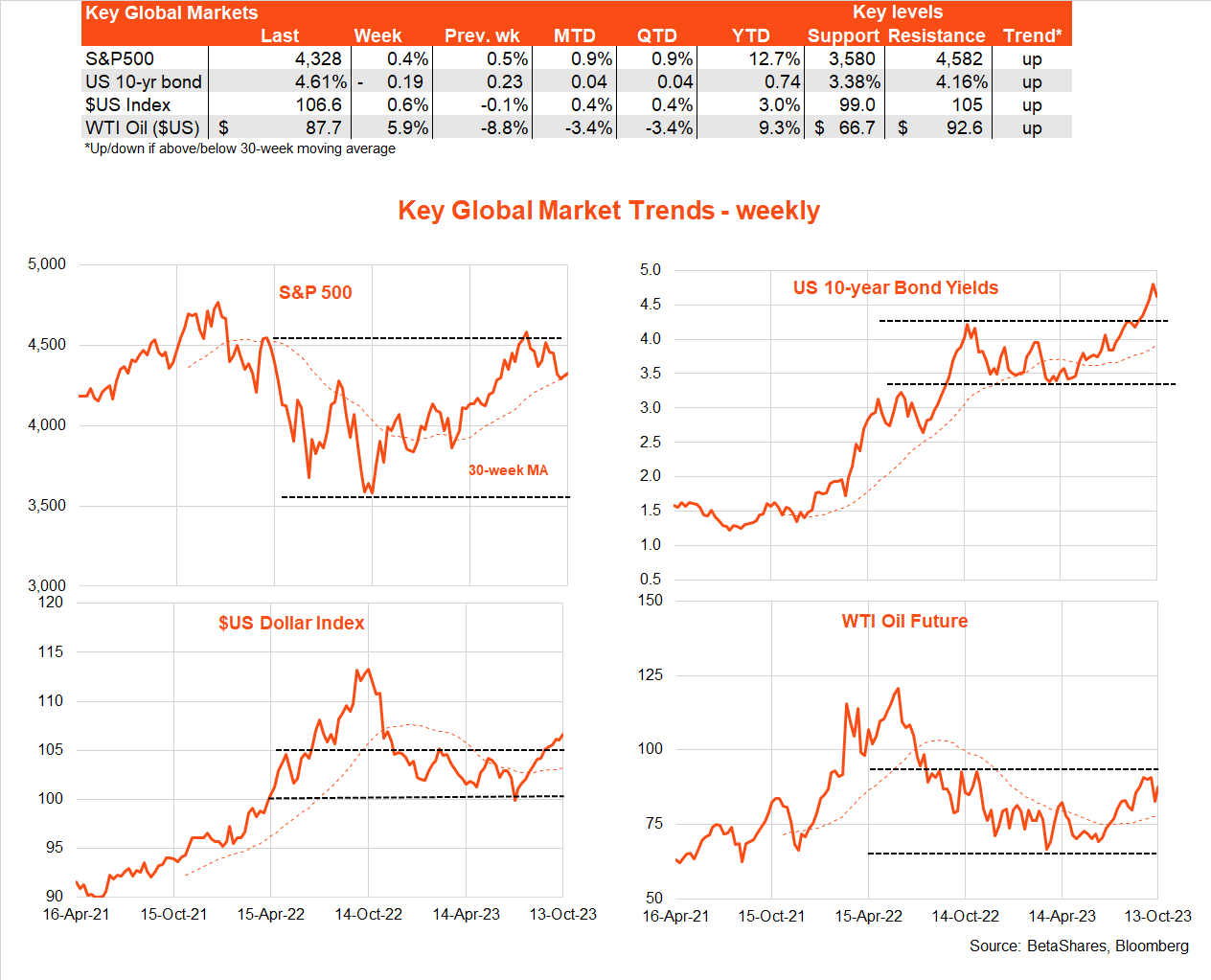

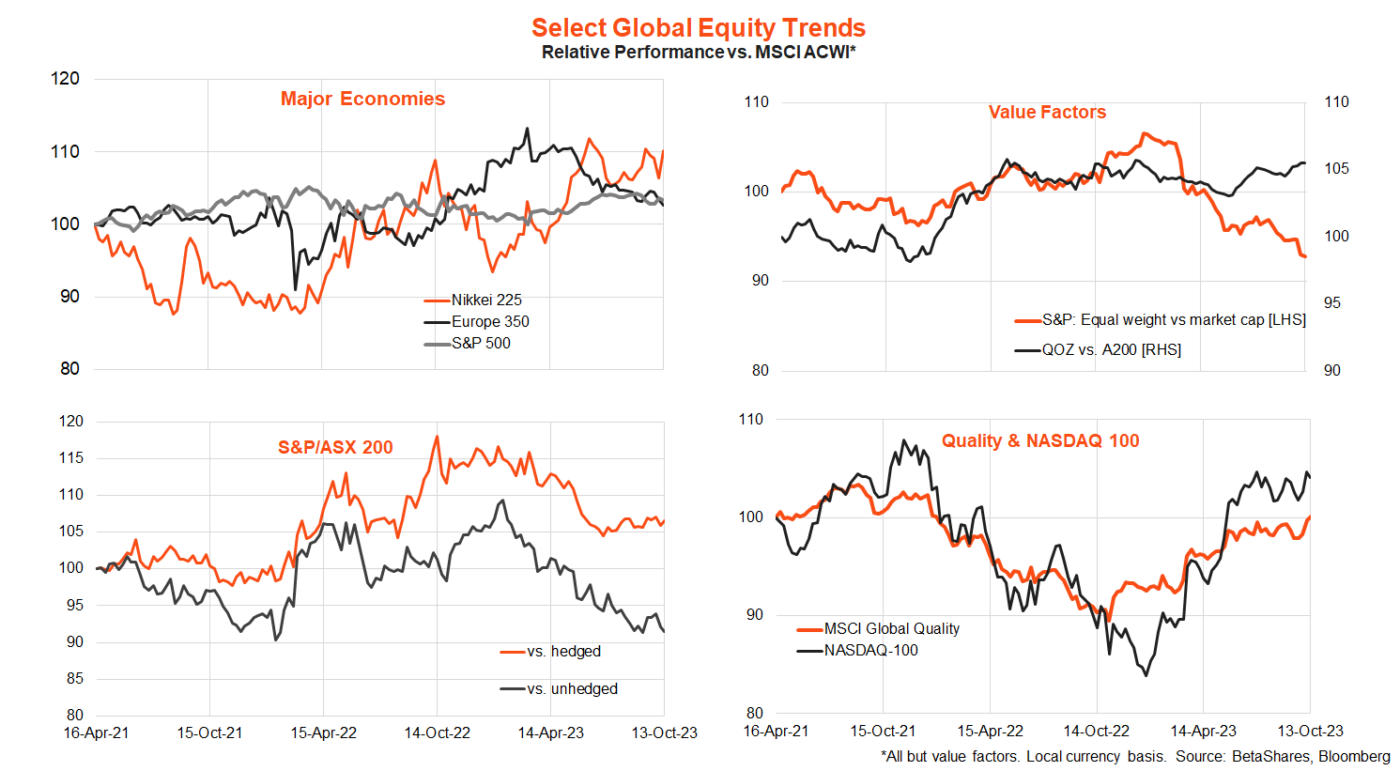

Global markets

US equities managed to squeeze out further small gains last week despite the lift in Middle East tensions and oil prices, thanks to a fall back in bond yields on the back of more dovish Fed commentary.

In terms of key economic data, both US producer and consumer headline prices were a touch higher than expected – thanks to the rise in oil prices – though both results seemed to be well absorbed by the market. Importantly, the 0.3% rise in core consumer prices was no worse than feared.

But perhaps of most interest in the US last week was a chorus of Fed speakers playing down the risk of another rate hike – instead suggesting a ‘high for longer’ policy outlook and noting the recent rise in bond yields was helping tighten financial conditions. Market pricing now suggests only a 10% chance of a November Fed rate hike, down from 30% a month ago.

US stocks did slip on Friday, however, with a drop in US consumer sentiment due to higher oil price-induced inflation fears. Fear of escalating Middle East tensions – with Israel preparing for a ground offensive into Gaza and other Middle East countries openly supporting Hamas – also saw oil prices spike on Friday after stabilising somewhat through the week.

Apart from developments in the Middle East, the key global event this week will likely be a Thursday speech by Fed chair Powell – who may well reiterate the more dovish themes of Fed speakers seen last week. If so, provided oil prices don’t rise much further (and Saudi Arabia provided some soothing comments last week) there’s a good chance the 4.8% high in US 10-year bond yields last week may have been the peak for this cycle.

In other economic news, US September retail sales are expected to rise 0.3% after a 0.6% gain in August – suggesting a continued gradual slowing in consumer spending.

Wednesday (Asia time) also sees the monthly Chinese ‘data dump’ on retail spending, industrial production and fixed-asset investment – along with Q3 GDP. Although quarterly GDP growth is expected to accelerate modestly to 1.0% from 0.8% in Q2, China’s overall economic outlook is expected to remain subdued – not helped by the ongoing property sector shakeout.

Note also this week marks a ramping up in the Q3 US earnings reporting season, with major financial companies such as Goldman Sachs, Netflix and Telsa reporting. At this early stage, a higher-than-average number of companies are beating earnings estimates, which is not too surprising given the economy’s economic resilience to date.

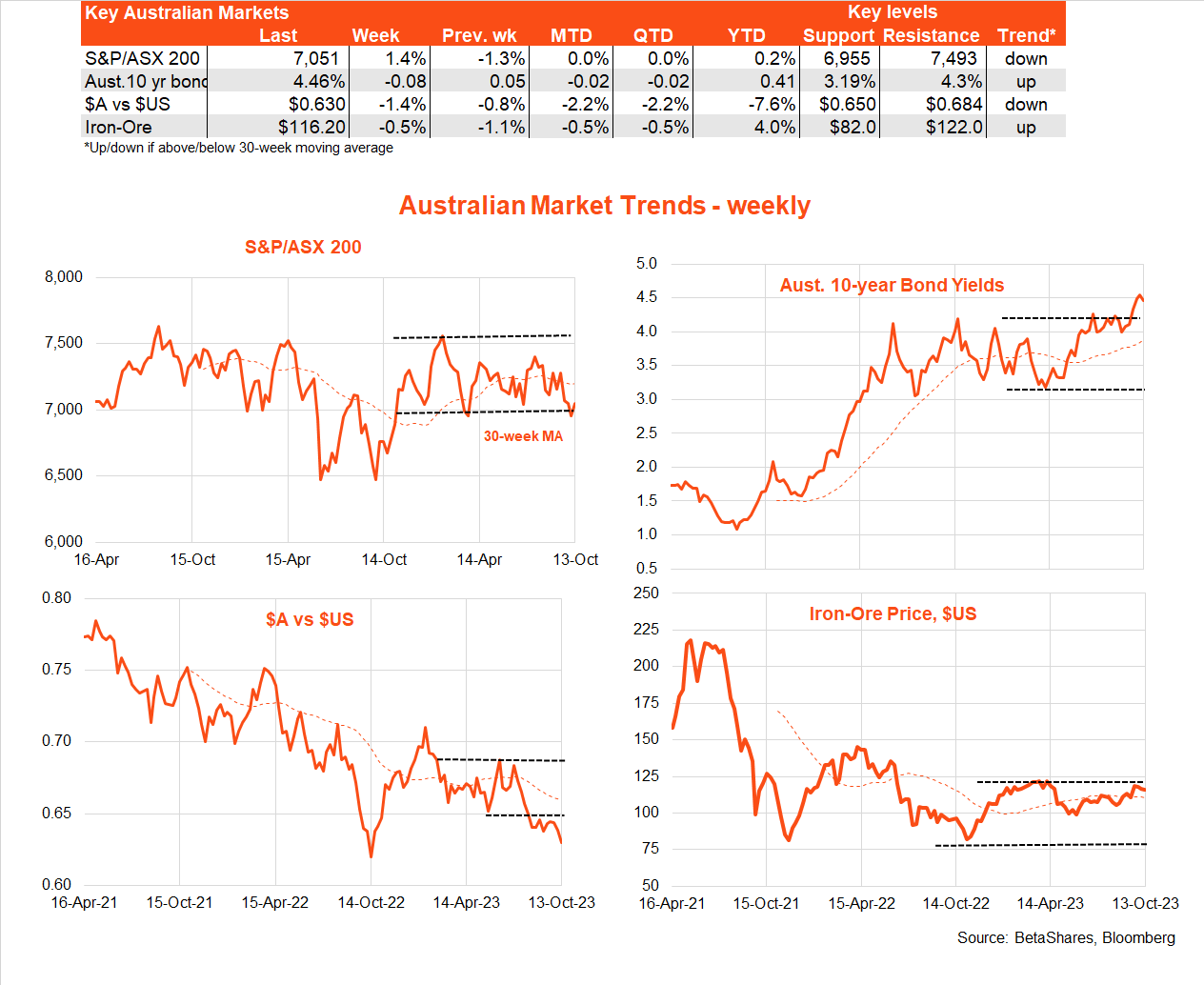

Australian market

Local equities bounced back a little last week but will likely be dragged down this morning by the US sell-off on Friday. Bond yields also pulled back, though remain high, with the $A remaining under downward pressure – not helped by flight to safety moves into the already strong $US last week.

In terms of major highlights last week, consumer sentiment bounced back a little and appears to be at least stabilising at low levels, while the NAB measure of business conditions eased, though remains around long-run average levels. Encouragingly, the NAB survey revealed a notable decline in both wage and price pressures.

Also leaning dovish, a speech by RBA Assistant Governor Kent suggested longer than usual lags in the transmission of monetary policy this cycle due to the COVID-related surge in fixed-rate home loans. These lags suggest more economic slowing from the rate hikes already in place is still to come, and an accordingly more cautious approach towards lifting rates further. My base case remains that the RBA is done raising rates, though the strong rebound in house prices in recent months is a clear risk to that view.

The local highlight this week will be Thursday’s September employment report, with a further solid 20k gain in employment expected, which should keep the unemployment rate steady at 3.7%.

Have a great week!