On the broking desk some years ago (it must have been a slow day), one of my colleagues asked the question,

“What’s the best way to lose $5,000 in the stock market?”

You might be interested in the many replies.

Here are some of the more sensible replies:

- Start with $10,000.

- Try to make $5,000 quickly.

- Trade Forex from the comfort of your own kitchen.

- Trade CFDs without understanding CFDs.

- Trade a lot.

- Trade with confidence.

- Trade intraday.

- Trade on ‘inside information’.

- Buy stocks that fall.

- Back your brother-in-law’s tip.

- Set and forget (emphasis on ‘forget’).

- Buy a stock that is up 20% on the day.

- Buy a stock that is down 20% on the day.

- Don’t take any losses.

- Don’t take any profits.

And finally, this old chestnut – Pay for a $5,000 course called “Learn How to Trade and Make Money Like a Pro!”. That’s the instant way to lose $5,000 in the stock market. Let’s focus on that for a minute.

There are a lot of ways to receive a share trading education these days, so many places to put in your credit card number and receive instant share market gratification. The bar for successful stock market teachers, it seems, is a lot lower than the bar for successful stock market traders, and for the uninitiated, it is a minefield of heroes and charlatans.

So to guide you on your way, I have put together a list of things you might like to consider before forking out for ‘guaranteed trading success’

- Trading success cannot be ‘delivered’, packaged, achieved with a credit card, or achieved in quick time. You may think you are buying a solution, but you are not. You are buying an introduction to a lot of work.

- Without ‘purpose’, you will not last as a trader. It is like joining a gym. You’ll likely try it for a month and stop. Enter the trading marathon without enthusiasm, interest, passion, and a purpose, and you will join the many ranks of people who have wasted their money and time. You need intention, and that means having a very specific goal to inspire you. Without a goal, can you truly make trading shares a part of your life?

- You need risk capital. To make that clear. You need capital you can risk. Come to the trading game out of financial necessity, with capital you can’t afford to risk, and your ‘loss aversion’ will doom you to failure. Trading longevity favours the rich. They are the only ones that will last long enough to learn.

- Most people come into trading with a ‘get rich quick’ expectation. It’s a guaranteed way to get poor quick. Trading methods are most often about exploiting a small small edge over a long long period of time. That takes maturity, discipline, structure, and patience. Do you have that?

- Some courses have a hidden agenda. Selling you a software package, selling you a data feed, up-selling you to another product, snagging you as a customer of their trading platform. This alter purpose is why there are so many ‘free’ seminars. Because they’re a forum for hot leads, and that’s how they see you.

- The more you pay does not mean the more you get. There is no standard pricing for trading education. The better the marketing, the higher the price. The bigger the reputation, the profile, the number of goals they kicked, the bigger the price. But most prices are dictated by the size of the balls of the people selling it to you, not the product. Check what you get.

- The more people you put in a room, the longer it takes. Many courses take an extraordinarily long time to cover basic principles, principles that could be read in a book in half the time. Avoid the ‘Classroom’. Someone will hold you up with the “I can’t get my PC to turn on”, “I can’t get the software to load”, or “How do I make the arrows green”. You don’t need to involve yourself with the other nuff nuffs.

- There is a huge difference between ‘Learning to Trade’ and ‘Technical analysis’. Many courses sell technical analysis, which is not necessarily what you need as an introduction. You need to learn to trade. It’s very different.

Finally here are a few simple questions before you sign up to anything

- What am I buying? What’s the experience? Is it mentoring with a human, or am I just buying 20 PDFs as a book dressed up as a course?

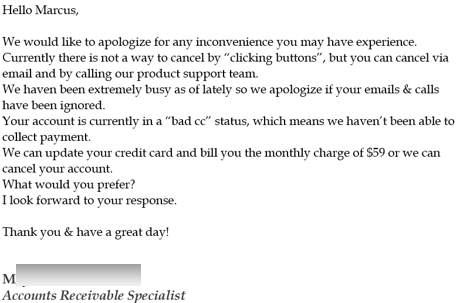

- Can I find the “cancel your subscription” button? Some very well-known educators don’t have one. Check first. They say you can cancel, but can you? If you can’t cancel on the website on a click, and have to send an email or ring a US Toll Free number to cancel, don’t sign up. The ability to cancel is a reflection of integrity. And the lack of it, a reflection of the lack of it. Here is an email I got from one very well-known software provider – I had to cancel my credit card to stop them charging me. They never replied to calls or emails cancelling – but the moment the credit card was cancelled they lit up:

- What will I get? Anything physical, anything valuable, anything personal, anything more than words?

- What is their motive? To get me trading and paying fees on their platform, to get me as a subscriber, to get my money, or to actually educate me?

- Who are the people behind it? I need names and faces and addresses in Australia. Not an unlicensed faceless entity with an address I can’t find.

- Could I read it in a book? If so, read the book. You don’t have to pay to have someone read the book for you.

- Am I really interested? Do I really have the time? Do I have any passion? Or am I just trying to solve my immediate financial ambitions in the laziest way possible, by spending money on my credit card?

But, the question you really need to ask yourself is this:

“Do I really want to be stuck in front of a screen trading shares all day, every day?”

Because if you want to succeed at it, that’s what it will take. Some people love the stock market. But they are few and far between, you only hear about the winners, and most of you will only ever visit the activity, find out its too much work, too painful, too costly, too damaging to your relationship, and you move on.

It’s a niche sport. But when the last organ to pump blood is your brain, it does fill a lot of hours.