Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.42% to 7056.10.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX had a positive session, although finished ~40pts below the highs after the latest RBA minutes showed another rate hike is not off the table. The list of today’s winners is an eclectic bunch with one thing in common, most have had a horrible last 12-months, perhaps some bargain hunting might be about to emerge,

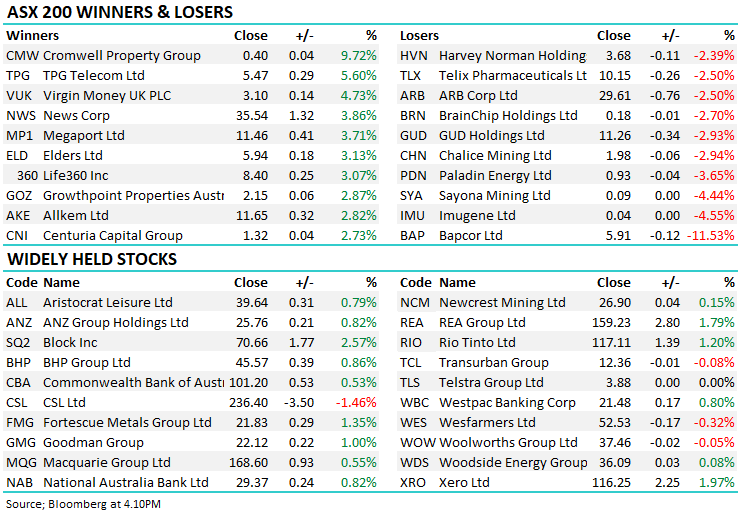

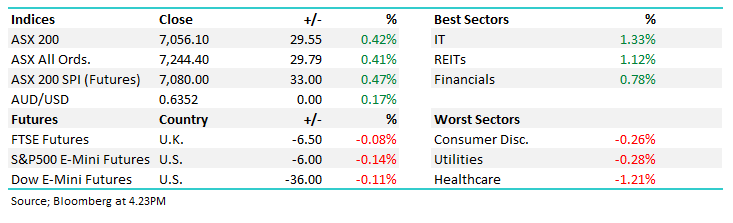

- The ASX 200 finished up +29pts/ +0.42% to 7056

- The IT sector was best on ground (+1.33%) while Property (+1.12%) and Financials (+0.78%) also did well.

- Healthcare (-1.21%), Utilities (-0.28%) and Consumer Discretionary (-0.26%) underperformed.

- Australian bond yields moved higher, the 3-year up 13bps to 4.08% following overseas moves + the RBA minutes kept the door firmly ajar for further rate hikes, bond traders have now fully priced in another 0.25% increase by August next year.

- Bapcor Ltd (ASX: BAP) -11.53% had a tough day after providing an update at their AGM, saying that 1Q24 trading has been tough amid deteriorating retail conditions – more on this in tomorrow’s Portfolio Positioning Report

- Hub24 Ltd (ASX: HUB) +1.42% was up, but finished a long way from early highs after reporting a strong start to FY24 with net inflows of $2.8bn for the quarter, up 34.7% on the previous quarter and broadly in line with PCP. They also announced a number of developments which were a net positive, we think, but those who bought the breakout today will be disappointed.

- TPG Telecom Ltd (ASX: TPG) +5.6% rallied on an AFR report saying that Vocus Group Ltd (ASX: VOC) was seeking about $6bn in debt financing, to be used for takeover and Vocus debt refinancing – TPG in the crosshairs!

- Magellan Financial Group Ltd (ASX: MFG) +0.92% is in the news as activist investor Sandon Capital Investments Ltd (ASX: SNC) pushes for change – we met with the team at Sandon last week and agree with their approach, and will be supportive of their calls for MFG to concentrate on getting their existing business right, before trying to grow again.

- Rio Tinto Ltd (ASX: RIO) +1.2% rallied on strength in Iron Ore prices + stronger than expected copper production for the 3Q.

- Gold stocks cooled today after a good run, Northern Star Resources Ltd (ASX: NST) -1.05% and Evolution Mining Ltd (ASX: EVN) -0.57%.

- Uranium stocks have also pulled back in the last few sessions, taking a breather after a very solid run, Paladin Energy Ltd (ASX: PDN) -3.65% to 92.5c having hit $1.14 late in September.

- The stable of WAM Capital Limited (ASX: WAM) LICs traded ex-dividend today.

- Iron Ore was up 2.7% in Asia, Fortescue Metals Group Ltd (ASX: FMG) +1.35% & BHP Group Ltd (ASX: BHP) +0.86%, although both were a long way below highs.

- Gold was down $US4 in Asia at $US1916

- Asian stocks were mostly higher, Hong Kong up +0.70% & Japan put on +0.9%, while China added +0.11%

- US Futures are mildly lower.

- US stocks we own in our International Equities Portfolio reporting this week include: Blackstone Inc (NYSE: BX) and Freeport-McMoRan Inc (NYSE: FCX)

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index – Weekly Chart

Broker Moves

- AVADA Group Ltd (ASX: AVD) Rated New Buy at Unified Capital

- Red 5 Limited (ASX: RED) Cut to Hold at Canaccord Genuity Group Inc (TSE: CF); PT 32 Australian cents