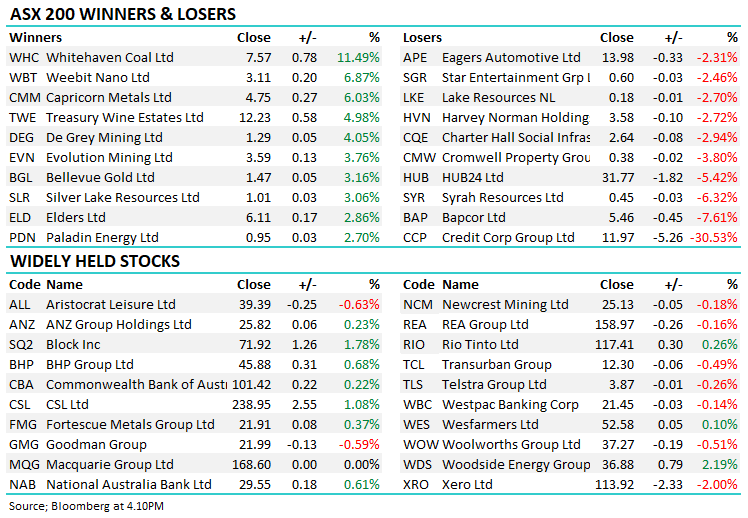

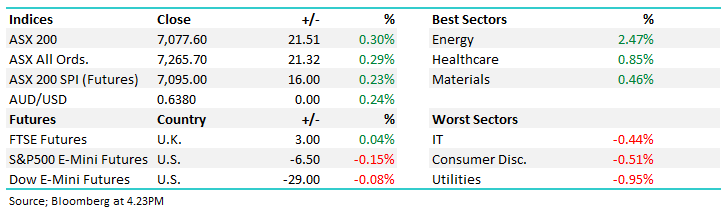

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.30% to 7077.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A choppy but overall positive session at the index level, although there was a lot happening under the hood, with some hits and a few big misses to get across today.

- The ASX 200 share price finished up +21pts/ +0.30% to 7077

- The Energy sector was best on ground (+2.47%) while Healthcare (+0.85%) and Materials (+0.46%) also did well.

- Utilities (-0.95%), Consumer Discretionary (-0.51%) and IT (-0.44%) underperformed.

- China data was mostly stronger than expected, headlined by 3Q GDP at 5.2% YoY vs. forecasts of 5.0% – other stats were robust including retail sales.

- Whitehaven Coal Ltd (ASX: WHC) +11.49% traded higher after announcing the acquisition of BMA’s QLD met coal assets for a sensible price and attractive payment terms – more on this below.

- Treasury Wine Estates Ltd (ASX: TWE) +4.98% had an interesting session, ripping higher at 3.11 pm this afternoon after China’s top diplomat in Australia said a resolution to punitive wine tariffs could be clear within weeks. The news bots were quick on this one if you look at the intra-day chart.

- Cettire Ltd (ASX: CTT) -3.42% fell despite delivering a strong 1Q trading update this morning, growth really ramping up here at the top line, although earnings not keeping pace + some potential overhang from the CEO.

- Evolution Mining Ltd (ASX: EVN) +3.76% said 1Q production was a touch lower but all on track for full-year run rates and cost guidance maintained. We continue to like EVN.

- BHP Group Ltd (ASX: BHP) +0.68% sang from the same song sheet which is to be expected so early in the year, one high note was around the increase in Copper production which is set to become a bigger part of the Big Australian over the coming years.

- Credit Corp Group Limited (ASX: CCP) -30.53% was whacked on a poor update, softer earnings and a write-down on the value of their debt ledgers. A clear avoid.

- Iron Ore was flat in Asia, the major miners edged higher.

- Gold was positive during our time zone, +$US16 higher at $US1940

- Asian stocks were mixed, Hong Kong down -0.10%, Japan flat while China fell -0.61% as better growth reduces the amount of likely stimulus.

- US Futures are mildly lower.

- US stocks we own in our International Equities Portfolio reporting this week include: Blackstone Inc (NYSE: BX) & Freeport-McMoRan Inc (NYSE: FCX)

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Whitehaven Coal Ltd (ASX: WHC) $7.57

WHC +11.49%: Announced the purchase of the Daunia & Blackwater met coal mines in QLD from BHP Mitsubishi Alliance (BMA) with some important points to make on this large, and very strategic acquisition, which we think will prove a good one:

They didn’t overpay with a sticker price of $US3.2bn a touch below what some expected, importantly, this incorporates an upfront component of $2.1bn + deferred payments over 3 years. On spot prices, they paid 1.8x EV / FY2024F EBITDA i.e. very cheap, noting this could increase if met coal prices remain strong with some potential sweeteners for BMA.

They can pay this from cash and a $900m bridging loan, which will either be converted into longer-term debt funding or they may sell down a minority stake to customers.

These are met coal mines used in steel making, not thermal coal used in power generation as the bulk of WHC production is currently. This transforms WHC into a primarily met coal company, generating ~70% of sales from a product that has a long future.

Also worth noting, is that the shift towards met coal will deliver financial market benefits i.e. a greater degree of funding optionality and an increase in the number of funds that could own WHC (thermal coal is the one being snubbed from an ESG perspective), a company with 70% in met coal should be enough to overcome some mandate restrictions.

Steel is required for urbanisation, but importantly, steel is also required to build infrastructure for the energy transition, with very little new supply on the horizon (unlike Iron Ore which will have a greater supply response).

There were lots of market-friendly terms being used in today’s announcement, compelling and transformational, and materially earnings accretive, all things that we like to see. A solid update from WHC, buying a good asset at a sensible price.

Whitehaven Coal Ltd (ASX: WHC)

Cettire Ltd (ASX: CTT) $2.54

CTT -3.42%: a strong 1Q update from the e-commerce luxury goods retailer wasn’t enough to impress the market with Cettire falling to 7-week lows.

Revenue was up 98% to $167.4m in the quarter with active customers up 69% showing the company has had little trouble capturing new customers and growing the percentage of the luxury goods market that trades online. EBITDA was up 58% to $8.7m, though perhaps not as impressive as other metrics would imply.

The upside is that the company is profitable and now in a great position to self-fund growth. Cettire’s Founder & CEO Dean Mints owns more than a third of the shares on issue and has a history of selling down a block after quarterly updates and results, perhaps another block is around the corner?

Cettire Ltd (ASX: CTT)

Credit Corp Group Limited (ASX: CCP) $11.97

CCP -30.53%: the debt collector fell to 3-year lows today after taking a knife to asset values and guidance.

The company said collection conditions had continued to deteriorate after flagging the higher delinquencies at results in August.

As a consequence, the company has reduced the value of their US Purchased Debt Ledger (PDL) assets by $45m, or -14% given the company now expects lower returns over the medium term. In the immediate future though, Credit Corp has downgraded NPAT (before the impairment) by 10.5%, or $10m to $80-90m in FY23.

We struggle to see how Credit Corp will get back on track in the near term given how expensive PDL’s are against a backdrop of weaker collections – something needs to give!

Credit Corp Group Limited (ASX: CCP)

Broker Moves

- Hub24 Ltd (ASX: HUB) Cut to Market-Weight at Wilsons; PT A$33.66

- Janison Education Group Ltd (ASX: JAN) Cut to Market-Weight at Wilsons

- Rio Tinto Ltd (ASX: RIO) Raised to Outperform at CLSA; PT A$126.50

- Xero Limited (ASX: XRO) Cut to Sector Perform at RBC; PT A$125

- Propel Funeral Partners Ltd (ASX: PFP) Rated New Positive at Evans & Partners Global Flagship Fund (ASX: EGF); PT A$4.64

Major Movers Today